Looking to access liquidity quickly and easily from your U.S. real estate? AM bridge loans can help! Bridge loans are short-term loans that help cover immediate financial needs until longer-term financing is secured. This is excellent for non-resident investors and U.S. expats who need quick access to liquidity.

What is a Bridge Loan?

Bridge loans provide fast approval and flexible repayment terms, allowing investors to act on opportunities quickly for a purchase or release equity from a property when “conventional” bank options are not available or are not practical. There are a variety of reasons sophisticated real estate investors use bridge funding – it can be used to purchase a new property while selling an existing property, fund renovations on a property before renting it out, or obtain almost immediate access to liquidity tied up in real estate for higher return investments.

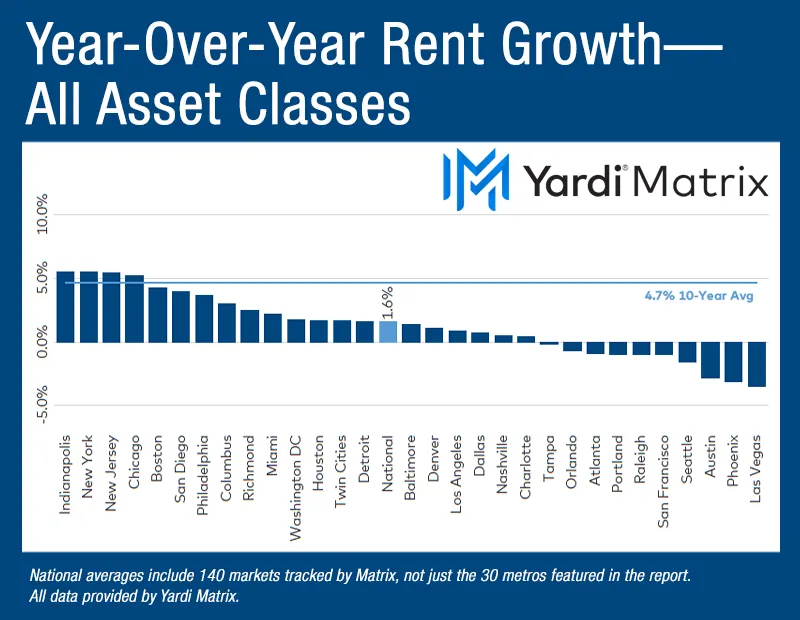

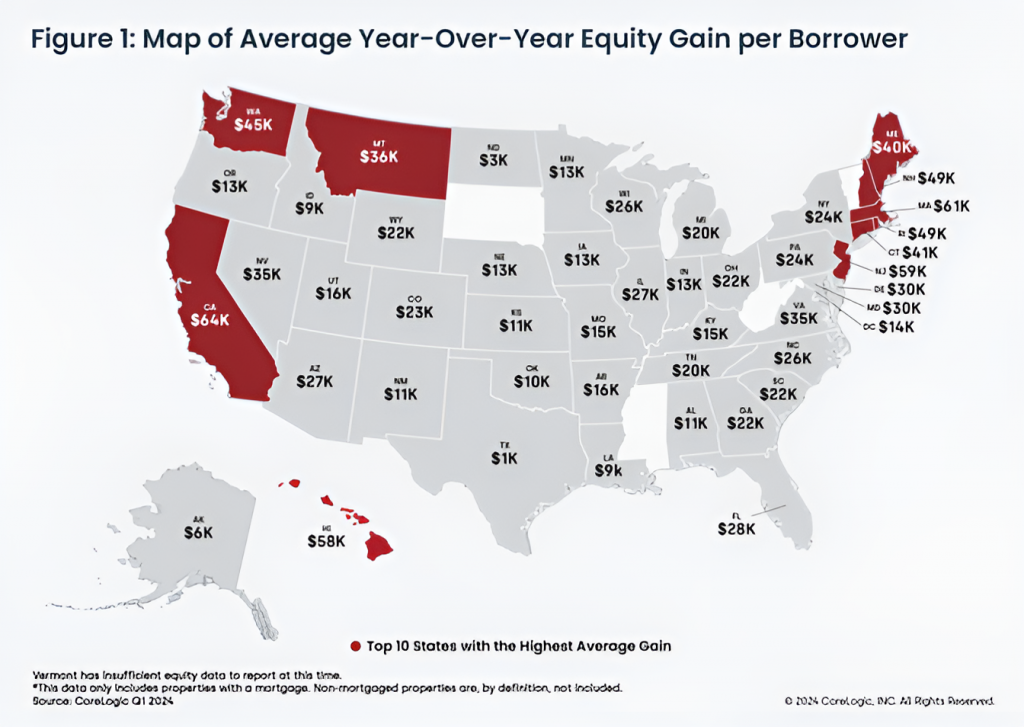

As reported by CoreLogic, in Q1 2024, the total home equity for U.S. mortgage holders exceeded $17 trillion, nearing the previous record set in 2023. The increase in home values and equity growth suggests many homeowners have significant potential capital. AM Bridge loans allow foreign nationals and U.S. expat investors to leverage their existing equity to finance short-term needs or seize investment opportunities.

How Can Bridge Loans Help?

Bridge loans can be a vital tool for non-resident U.S. investors and U.S. expat investors. Unlike conventional mortgage loans, bridge loans can be structured to the exact needs of the borrower. Often with high LTV, no monthly debt servicing, and quick closing times – often as short as one week. Bridge loans can provide the needed capital to:

- Facilitate Property Purchases: Investors can secure properties quickly without waiting for the sale of another asset.

- Avoid Foreclosure: Quick access to funds can prevent the loss of property due to foreclosure.

- Expand Business Ventures: Investors can use the equity from high-value properties to invest in other business opportunities.

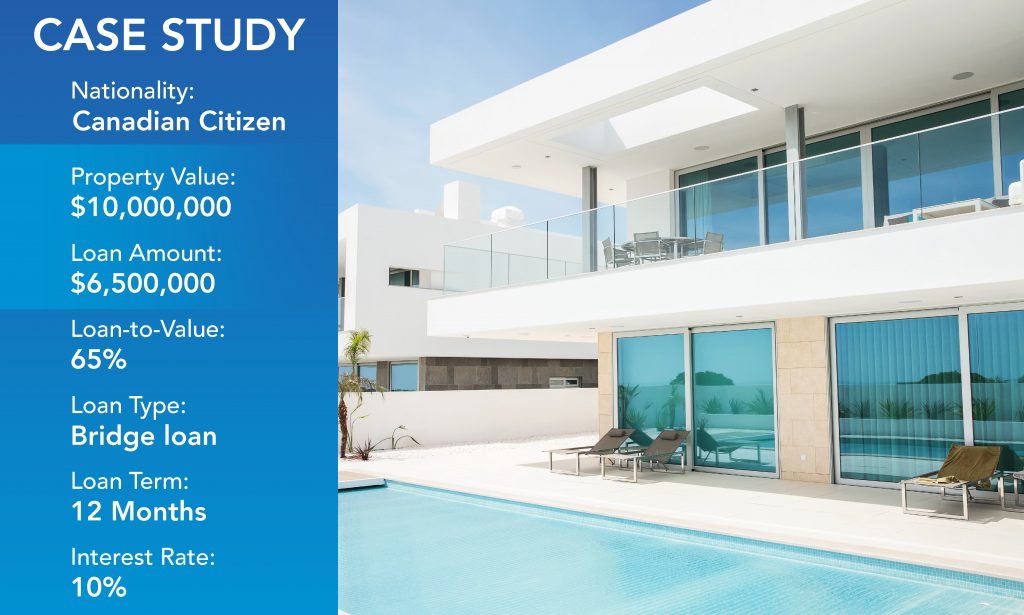

America Mortgages Case Studies:

Canadian Businessman Leverages $10M California Property to Expand Business

A Canadian businessman owned a $10 million property in California. To expand his business, he pulled out 65% of the LTV from his property, amounting to a $6.5 million loan. With an interest rate of 10% over a 12-month term, this bridge loan provided the necessary liquidity to invest in his business without selling the property.

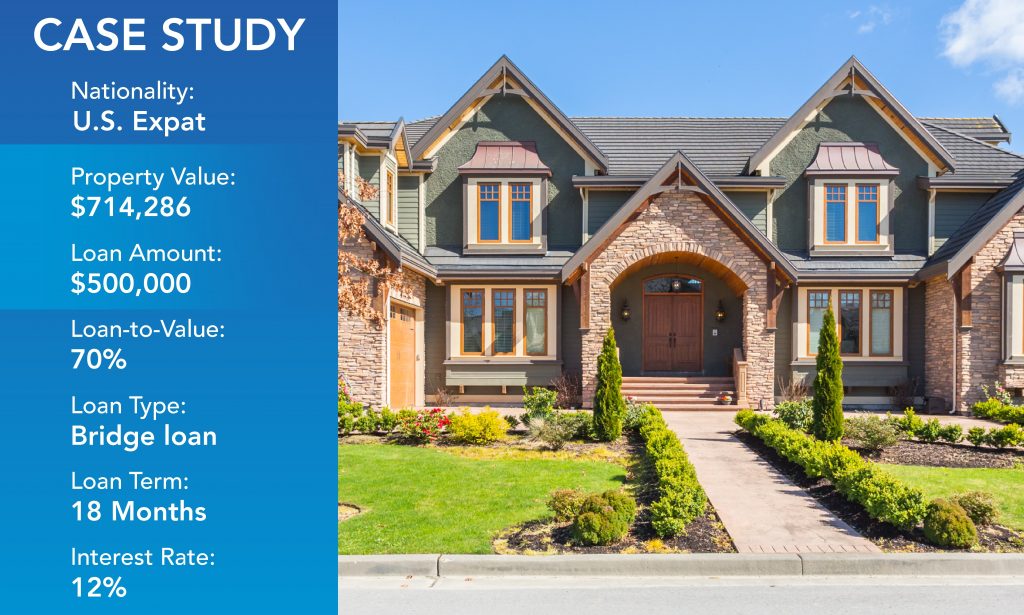

Bridge Loan Helps U.S. Expat Avoid Foreclosure

Facing foreclosure, a U.S. expat property owner sought help from America Mortgages. We helped to secure a $500,000 bridge loan at a 70% LTV and 12% interest over 18 months. This quick access to funds eased his financial strain, preventing foreclosure and protecting his investment by paying off the existing lender and structuring the loan so that he did not have to make monthly payments for 6 months. This allowed the client to relax, reset, and focus on getting back on track.

What is Needed to Qualify?

Equity: Qualifying for a bridge loan is primarily based on the existing equity in the owned property. Bridge loans will typically allow for up to 70% of the current value of the existing property. If there is an existing mortgage, it will need to be paid off through the transaction.

Income: Normally, there are no income requirements for these types of loans. However, the borrower should be able to either service the monthly payments or have sufficient equity to “roll up” or pay any interest payments due upfront out of the loan proceeds.

Credit: No U.S. credit is required

- Eligible Loan Types: Purchase, refinance, and cash-out refinance

- Term Lengths: 12-24 months

- No U.S. Credit Required

- Loan Amounts: US$100,000 to US$100m

- Payment Options: Monthly, interest-only, interest rolled up, no prepayment penalty

- Purchase Loan-to-Value (LTV): Up to 75%

- Refinance Loan-to-Value (LTV): Up to 70%

- Cash-out Refinance Loan-to-Value (LTV): Up to 65%

- Property Types: Single-family, multi-family (5+ units), duplexes, triplexes, quadplexes, condominiums, townhomes, commercial, industrial

America Mortgages offers bridge loans designed to bridge that gap for non-resident U.S. investors and U.S. expats. Our fast approvals and flexible terms empower investors to access liquidity quickly, whether buying, renovating, or avoiding foreclosure. With substantial home equity available, our bridge loans help leverage existing assets for short-term needs and investments. Trust America Mortgages to support your U.S. real estate goals with tailored solutions that ensure confidence and success.

Schedule a meeting with one of our loan officers using our 24/7 calendar link. Contact us today at [email protected] to start your investment journey!