During our recent live webinar on “Investing in Undervalued Properties,” our expert hosts, Nobel Sky International’s Founder, Rauf Said (RS), and America Mortgages’ Vice President of U.S. Lending, Nick Worthing (NW), received a lot of questions from the participants. Unfortunately, there was limited time to address all inquiries during the session. For those who missed the opportunity to join the webinar, it is available here.

To address the questions, we arranged for both Rauf and Nick to set aside time to provide insightful answers.

Remarks have been edited for clarity and brevity.

Q: I own a few U.S. properties. Can you get a mortgage and buy several homes at once?

NW: Yes, we can do a portfolio loan, cross-collateralised by all properties; this would be one loan.

Q: What is Noble Sky’s and America Mortgage’s collaboration? Is it a partnership?

RS: America Mortgages will be Noble Sky’s go-to partner for our foreign clients to access U.S. mortgage financing options for their real estate investment opportunities.

Q: Should you look at the crime rate and demographics of people living in the area?

RS: Yes, they do play a part in your investment decision. However, it is important to approach every real estate investment independently to ensure that you take advantage of potential investments and make the right choice.

Q: Who owns the property between you buying from the wholesaler and it being fixed?

RS: The investor.

Q: Typically, how long do you hold the property for flipping?

RS: 9 months to 1 year.

Q: How many properties can you buy?

NW: As many as you have the money available for – the underwriting isn’t based on your income, so it will come down to how much you have available for the down payment and reserves.

Q: A question to Nick: Do we get a pre-approval not knowing what project we are getting into for fix-and-flip or fix-and-hold property?

NW: Yes, but the pre-approval only confirms you have the down payment available, as most of the underwriting will be completed when we have the appraisal for the property.

Q: How is Noble Sky making money? Commission?

RS:

1. Incorporation of business entity

2. Tax filing, bookkeeping

3. Proposal and research of suitable assets

4. Management of the assets for flip or rental

5. Renovation of your property

6. Performance of the flip profit and rental income sharing

Q: This is really good with leverage! I’m in Singapore now. How can I make an appointment?

RS: Please reach out to +65 9422 0100 or [email protected].

Q: What’s the loan interest rate for us as foreigners?

NW: It really depends on how you qualify and what loan program you choose. We have loan programs that qualify on foreign earned income and loan programs that qualify only on the rental income of the property. With most loans offering 30 year tenure and fixed interest only programs most are seeing better yields than when rates were 3%.

Q: How easy is it to flip a property in the current high interest & high borrowing cost environment for prospective buyers?

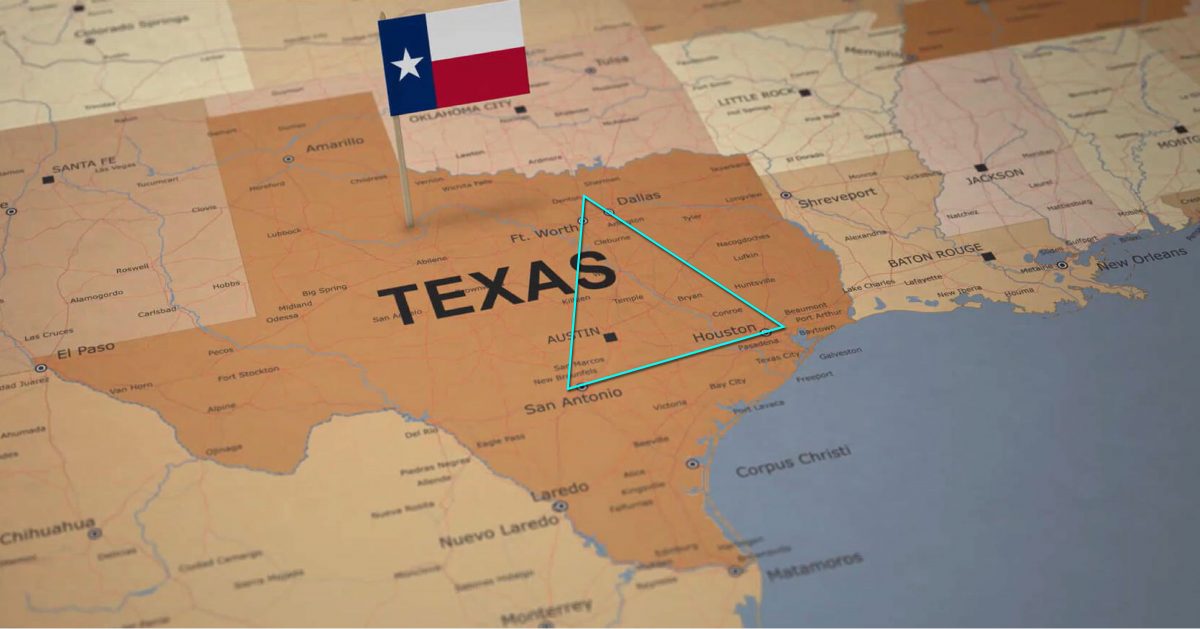

RS: Buying in the right area with the right fundamentals and demographics is key. Ensure you don’t buy an overly expensive property, so your pool of ready buyers will be greater.

Q: Is the income yield from long-term rentals better than Airbnb’s?

RS: The portfolio in Noble Sky shows that Airbnb’s short-term rental income yield is higher than long-term rental income. We will monitor the market if the data changes.

Q: What’s the average occupancy rate for your Airbnb properties?

RS: Minimally, 90% occupancy.

Q: What’s the maximum loan-to-value and minimum loan amount?

NW:Theminimum loan amount is $150,000. The max LTV is 75% for purchase, and 70% cash-out refinance.

Q: Do you offer non-recourse loans?

NW: Yes, but only on larger (over 2M) loans require recourse.

Q: Who has the final decision on when to sell? What happens if I want to keep the property for 24 months, but Rauf intends to sell after 9 months?

RS: You, as the owner, have the ultimate decision. Noble Sky advises you on the best exit strategy based on our experience. If you choose to pivot from flip to rental, then our rental sharing of the income will apply.

Q: Any strategies to devalue a property to revalue it later? Would you recommend it?

RS: Yes, we may “haggle” with the seller during the purchase based on the inspection report. We recommend doing it, but it is important to do it professionally.

Q: In profit share, do you consider the borrowing cost?

RS: No. We have a tier-sharing structure that is based on only the amount of cash you commit.

Q: If the property is so run down, why are locals not buying it easily? Also, what are the chances of getting a high flip price?

RS: The locals form the largest concentration of people buying these properties. High flip prices will depend on how you remodel your property and if the area supports a high price. Research before buying any property is highly important to ensure you buy right in the first place.

Q: What is the cost to create and maintain a U.S. entity to hold the property?

RS: The cost to create a U.S. entity is US$997. The monthly cost to maintain your entity with bookkeeping, tax returns filing, and annual returns is US$97 per month. We also throw in research of prospective assets every 2 weeks as a bonus.

Q: Rauf, How do you see the accelerating decline of real estate prices in the U.S.? While construction costs are fairly high. Is flipping getting very risky?

RS: Flip will be risky on the higher-priced properties (above $350k). When property prices decline, there will be more fear in the market. That is the best time for you as informed investors to enter. Not just when the market is on an uptrend. As a gauge, always ensure you buy even lower than the market median.

America Mortgages specialises in providing real estate financing to foreign nationals and U.S. expats. Our expertise in addressing their specific financial and documentation requirements simplifies the mortgage application process. We offer customised lending solutions.

Speak with a U.S. mortgage expert now by scheduling a call at www.calendly.com/u-s-mortgages. Start your journey today!

For more details, visit us at www.americamortgages.com or email us at [email protected].

Looking for international mortgage loans globally, including the U.K., Australia, Canada, France, Portugal, Spain, Italy, Singapore, Hong Kong, Japan, Thailand, Philippines, Dubai, and other locations? Visit our parent company Global Mortgage Group (GMG), at www.gmg.asia.