In the fast-paced world of global real estate investment, timing is everything. Whether you’re seizing a new opportunity, refinancing a maturing loan, or unlocking the value of existing assets, having access to capital fast can make or break a deal. That’s where bridge loans come in.

At America Mortgages, our team specializes in providing U.S. bridge financing for non-resident investors with speed, clarity, and flexibility.

U.S. Bridge Loan Market Overview

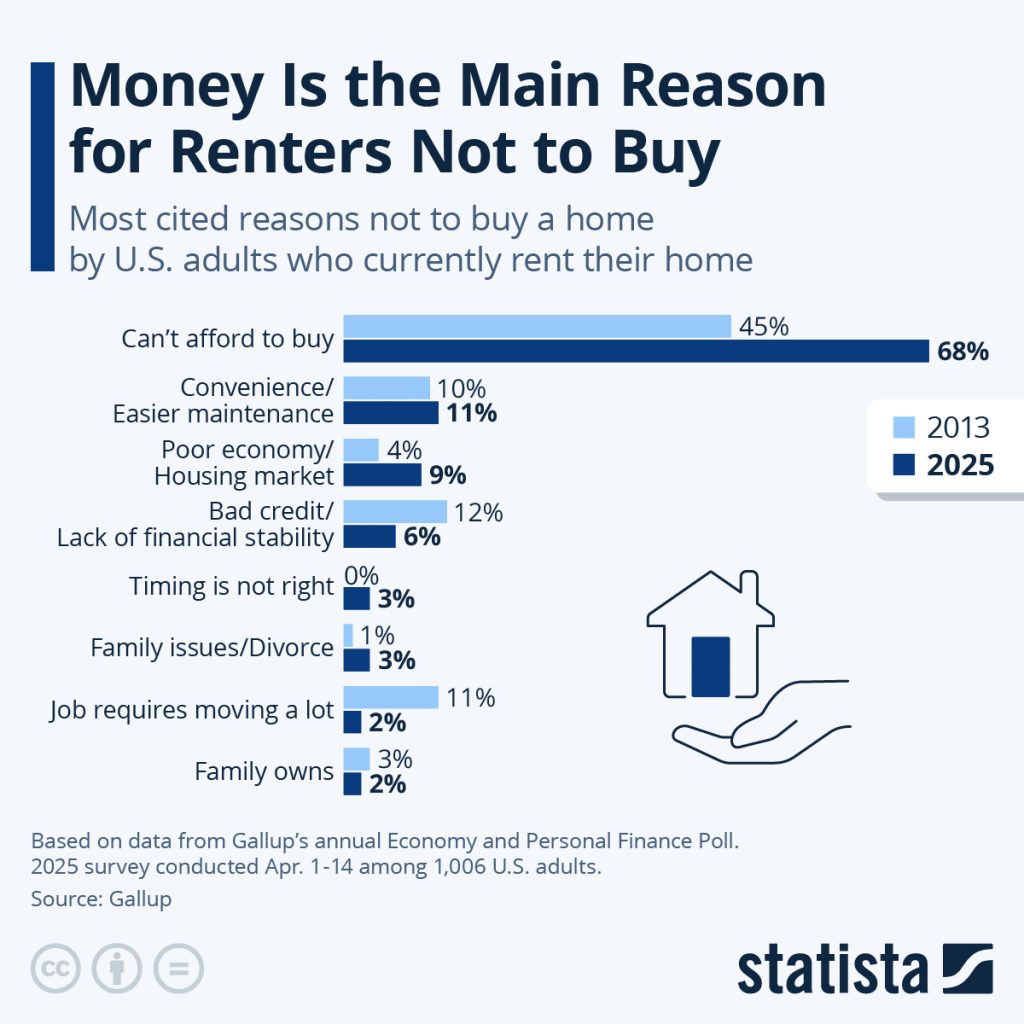

According to a recent report by the American Association of Private Lenders (AAPL), private lenders completed 3,736 bridge loan transactions totalling nearly $2 billion in originations. This highlights the strong demand for short-term financing solutions in the U.S. real estate market, particularly among investors who need fast, flexible access to capital.

What makes America Mortgages different, besides its international access through its parent company, Global Mortgage Group—a Singapore-based HNW real estate financing firm—is its expertise in dealing with non-resident real estate investors. This expertise, along with unique funding sources, sets us apart from most, if not all, asset-backed loan originators.

What Is a Bridge Loan?

A bridge loan is a short-term financing solution designed to bridge the gap between an immediate funding need and long-term financing or liquidity. In real estate, it’s commonly used to:

- Free up equity in existing properties

- Fund urgent purchases or business needs

- Refinance maturing loans

- Acquire property before securing permanent financing

Bridge loans are typically secured by the borrower’s U.S. property and can often be arranged faster than traditional mortgage products.

Case Study: $22M U.S. Bridge Loan Funded in 5 Days

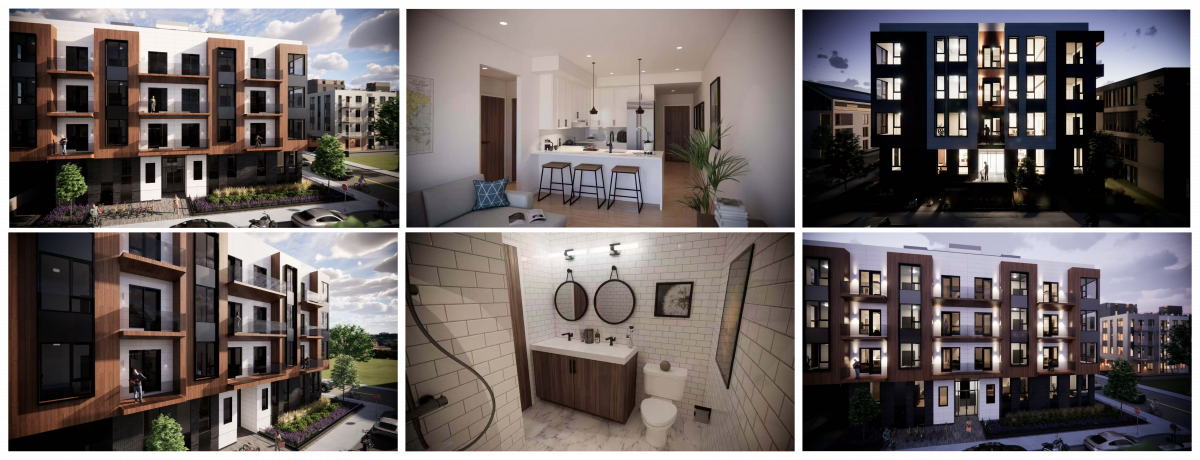

In a recent example, America Mortgages closed two asset-backed U.S. bridging loans totalling $22 million for an Australian investor in Sydney. The properties in San Diego, California, were originally purchased over a decade ago as a long-term investment.

With property values having more than doubled, the investor saw a time-sensitive business opportunity and needed to unlock equity quickly.

“Our team, noting the urgency and short timeline of this closing, coordinated the escrow, title, appraisal, insurance, and funding all within 5 business days,” said Robert Chadwick, CEO of America Mortgages.

This transaction not only highlights the efficiency of our lending team but also our deep understanding of the unique needs of international property owners.

Read the full press release here.

The AM Bridge+ Loan Program

The America Mortgages Bridge+ Loan Program provides quick access to capital with competitive rates and streamlined processing, tailored specifically for the needs of international real estate investors.

Key Loan Features and Requirements:

- Income: No personal income required

- Credit: No U.S. credit required

- Eligible Loan Types: Purchase, refinance, cash-out refinance

- Term Lengths: 12–24 months

- Loan Amounts: US$300,000 to US$100 million ++

- Payment Options: Monthly, interest-only, or interest rolled up

- Loan-to-Value (LTV): Up to 75%

- Location: Available in all 50 U.S. states

- Underwriting: Based solely on property value

- Amortization: Interest-only servicing

- Closing Time: As fast as 5–14 days

Whether you’re unlocking liquidity from existing U.S. assets or seizing an investment opportunity, AM Bridge+ was designed to move with the speed and simplicity global investors demand.

Ready to Unlock the Value of Your U.S. Property?

Bridge financing can be an effective tool for unlocking liquidity when it matters most. If you’re a global investor with U.S. real estate holdings, the team at America Mortgages is ready to help you structure a deal that works for your timeline and goals.

Contact us today to learn more about our U.S. bridge loan programs for international clients.

Call us 24 hours a day, 7 days a week at +1 (845) 583-0830

Schedule a meeting with one of our loan officers through our calendar link.

📧 [email protected]

🌐 www.americamortgages.com

¿22 millones en 5 días? Por qué los inversionistas inteligentes están recurriendo a los préstamos puente en EE. UU.

En el acelerado mundo de la inversión inmobiliaria global, el tiempo lo es todo. Ya sea que estés aprovechando una nueva oportunidad, refinanciando un préstamo próximo a vencerse o desbloqueando el valor de activos existentes, tener acceso rápido al capital puede ser la diferencia entre cerrar o perder un negocio. Ahí es donde entran los préstamos puente.

En America Mortgages, nuestro equipo se especializa en ofrecer financiamiento puente en EE. UU. para inversionistas no residentes, con rapidez, claridad y flexibilidad.

Panorama del mercado de préstamos puente en EE. UU.

Según un informe reciente de la American Association of Private Lenders (AAPL), los prestamistas privados completaron 3,736 transacciones de préstamos puente, por un total de casi $2 mil millones en originaciones. Esto resalta la fuerte demanda de soluciones de financiamiento a corto plazo en el mercado inmobiliario estadounidense, especialmente entre inversionistas que necesitan acceso rápido y flexible al capital.

¿Qué hace diferente a America Mortgages?

Además de su alcance internacional a través de su empresa matriz, Global Mortgage Group —una firma de financiamiento inmobiliario para personas de alto patrimonio con sede en Singapur—, America Mortgages se distingue por su experiencia en trabajar con inversionistas inmobiliarios no residentes. Esta especialización, junto con fuentes únicas de financiamiento, nos diferencia de la mayoría, si no de todos, los originadores de préstamos respaldados por activos.

¿Qué es un préstamo puente?

Un préstamo puente es una solución de financiamiento a corto plazo diseñada para cubrir la brecha entre una necesidad inmediata de capital y el financiamiento o liquidez a largo plazo. En el ámbito inmobiliario, se utiliza comúnmente para:

- Liberar capital de propiedades existentes

- Financiar compras urgentes o necesidades comerciales

- Refinanciar préstamos que están por vencer

- Adquirir una propiedad antes de obtener financiamiento permanente

Los préstamos puente normalmente están respaldados por la propiedad del prestatario en EE. UU. y, en muchos casos, pueden gestionarse más rápido que los productos hipotecarios tradicionales.

Caso de estudio: préstamo puente de $22 millones en EE. UU. financiado en 5 días

En un ejemplo reciente, America Mortgages cerró dos préstamos puente respaldados por activos en EE. UU. por un total de $22 millones para un inversionista australiano con sede en Sídney. Las propiedades, ubicadas en San Diego, California, fueron adquiridas originalmente hace más de una década como inversión a largo plazo.

Con los valores de las propiedades más que duplicados, el inversionista identificó una oportunidad comercial urgente y necesitaba liberar capital rápidamente.

“Nuestro equipo, reconociendo la urgencia y el corto plazo para cerrar la operación, coordinó el fideicomiso, título, tasación, seguro y financiamiento en tan solo 5 días hábiles,” comentó Robert Chadwick, CEO de America Mortgages.

Esta operación no solo resalta la eficiencia de nuestro equipo de financiamiento, sino también nuestra profunda comprensión de las necesidades únicas de los propietarios internacionales de bienes raíces.

Lee el comunicado completo aquí.

Programa de préstamo AM Bridge+

El programa Bridge+ de America Mortgages ofrece acceso rápido al capital, con tasas competitivas y un proceso ágil, diseñado específicamente para atender las necesidades de los inversionistas inmobiliarios internacionales.

Características clave y requisitos del préstamo:

- Ingresos: No se requiere ingreso personal

- Crédito: No se requiere historial crediticio en EE. UU.

- Tipos de préstamo elegibles: Compra, refinanciamiento, refinanciamiento con retiro de capital

- Plazos: De 12 a 24 meses

- Montos de préstamo: Desde US$300,000 hasta más de US$100 millones

- Opciones de pago: Mensuales, solo intereses o intereses acumulados

- Relación préstamo-valor (LTV): Hasta el 75%

- Ubicación: Disponible en los 50 estados de EE. UU.

- Evaluación: Basada únicamente en el valor de la propiedad

- Amortización: Solo pago de intereses

- Tiempo de cierre: Tan rápido como en 5 a 14 días

Ya sea que estés desbloqueando liquidez de activos existentes en EE. UU. o aprovechando una nueva oportunidad de inversión, AM Bridge+ está diseñado para operar con la velocidad y simplicidad que los inversionistas globales necesitan.

¿Listo para desbloquear el valor de tu propiedad en EE. UU.?

El financiamiento puente puede ser una herramienta eficaz para liberar liquidez justo cuando más se necesita. Si eres un inversionista global con propiedades en Estados Unidos, el equipo de America Mortgages está listo para ayudarte a estructurar una solución adaptada a tus tiempos y objetivos.

Contáctanos hoy para conocer más sobre nuestros programas de préstamos puente en EE. UU. para clientes internacionales.

📞 Llámanos las 24 horas, los 7 días de la semana: +1 (845) 583-0830

📅 Agenda una reunión con uno de nuestros asesores a través de nuestro calendario

📧 Escríbenos a: [email protected]

🌐 Visítanos en: www.americamortgages.com

5天融资2200万美元?聪明的投资者为何纷纷选择美国桥梁贷款

在快节奏的全球房地产投资世界中,时机就是一切。 无论您是抓住新的投资机会、为到期贷款进行再融资,还是释放现有资产的价值,能否快速获取资金往往决定了一笔交易的成败。这正是桥梁贷款发挥作用的地方。

在 America Mortgages(美国抵押贷款公司),我们的团队专注于为非美国居民投资者提供快捷、透明且灵活的美国桥梁融资服务。

美国桥梁贷款市场概况

根据**美国私人贷款人协会(AAPL)**发布的最新报告,截至2024年8月,私人贷款机构完成了 3,736笔桥梁贷款交易,总放款金额接近20亿美元。这表明美国房地产市场对短期融资解决方案的强劲需求,尤其是在需要快速、灵活获取资金的投资者群体中。

America Mortgages 的独特之处

America Mortgages 除了拥有其母公司 Global Mortgage Group(总部位于新加坡的高净值房地产融资公司) 提供的国际融资渠道外,还具备深厚的专业经验,专门服务非美国居民的房地产投资者。这种专业能力,加上独特的资金来源,使我们在资产支持贷款领域脱颖而出。

什么是桥梁贷款?

桥梁贷款是一种短期融资工具,旨在填补资金需求与长期融资或流动性之间的空档。在房地产领域中,它通常用于:

- 释放现有物业的可用净值

- 为紧急购置或业务资金需求提供资金

- 为即将到期的贷款进行再融资

- 在获得长期融资前先行购置房产

桥梁贷款通常以借款人在美国的房地产作为抵押,并且相比传统按揭产品更快速安排完成。

案例分析:2200万美元的美国桥梁贷款,5天内完成放款

在最近的一个案例中,America Mortgages 为一位来自悉尼的澳大利亚投资者成功完成了两笔总额为 2200万美元 的资产支持型桥梁贷款。该投资者在十多年前购买了位于加州圣地亚哥的房产,作为长期投资。

随着房产价值翻倍,该投资者发现了一个时间敏感的商业机会,并希望尽快释放资产净值。

“我们的团队意识到交易的紧迫性与时间限制,仅用5个工作日就协调完成了托管、产权、估价、保险及资金发放,”America Mortgages 首席执行官 Robert Chadwick 表示。

此交易不仅展示了我们贷款团队的高效执行力,也体现了我们对国际房地产投资者独特需求的深刻理解。

点击此处查看完整新闻稿。

AM Bridge+ 桥梁贷款计划

America Mortgages Bridge+ 贷款计划 提供快速的资金获取、具竞争力的利率和高效的审批流程,专为国际房地产投资者量身定制。

贷款要点与资格条件:

- 收入要求: 无需提供个人收入

- 信用要求: 无需美国信用记录

- 可贷款类型: 购买、再融资、套现再融资

- 贷款期限: 12–24个月

- 贷款金额: 美金 300,000 至 1亿以上

- 还款选项: 按月付息、只付利息或利息累积支付

- 贷款成数(LTV): 最高可达75%

- 适用范围: 覆盖全美50个州

- 审核标准: 完全基于房产价值

- 还款方式: 只付利息

- 放款速度: 快至5–14天内完成

无论您是希望释放美国现有资产的流动性,还是抓住新的投资机会,AM Bridge+ 都是为国际投资者打造的高效、简便融资工具。

准备好释放您美国房产的潜在价值了吗?

桥梁融资可以成为在关键时刻释放资金的有效工具。如果您是一位拥有美国房地产的全球投资者,America Mortgages 团队随时准备协助您制定适合您时间表和目标的融资方案。

欢迎立即联系我们,了解更多关于我们为国际客户提供的美国桥梁贷款产品。

📞 全天候服务热线:+1 (845) 583-0830

📅 通过我们的预约链接安排与贷款专员会面

📧 邮箱:[email protected]

🌐 官网:www.americamortgages.com