The Federal Reserve raised rates 11 times in 2022 and 2023 but are now hitting pause. The decision comes as inflation has risen. The Fed is holding steady, waiting for inflation to ease closer to the target before making any changes.

The Federal Reserve’s decisions have a significant impact on the housing market. When they adjust interest rates, it directly influences mortgage rates. At the same time, the recent hikes in interest rates were aimed at cooling down the economy after the COVID-19 pandemic.

While higher rates can pose initial challenges for homebuyers, it’s worth noting that mortgage rates have seen a slight decrease from their peak of 8% last fall. As of May 1, the average 30-year rate was 7.39%, according to a survey by Bankrate. This downward trend indicates a positive shift in the market, providing some relief for buyers and sellers alike.

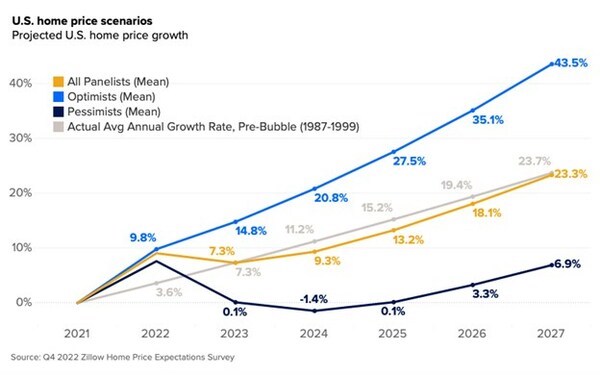

The current market conditions present numerous opportunities. Despite the slowdown in home sales, prices remain stable, with the nationwide median existing-home price almost reaching $400,000 in March.

Savvy investors will understand that purchasing U.S. real estate now means avoiding the buying frenzy and escalating property prices that often accompany decreased interest rates. Additionally, if the Fed decides to reduce rates, you can always refinance later.

Savvy Real Estate Investors Use This Program

Most savvy real estate investors will take advantage of interest-only loans. Interest-only loans increase cash flow and cash-on-cash returns. The first impact that an interest-only period can have on a real estate deal is that it can increase cash flow on the project and cash-on-cash returns as a result.

- Improved Cash Flow: Interest-only loans result in lower initial repayments, which can free up cash flow for other investments, property upgrades, or unforeseen expenses.

- Tax Efficiency: For investment properties, loan interest can often be claimed as a tax deduction. This means the larger interest payments in an interest-only loan may provide significant tax advantages.

- Strategic Investing: With the flexibility of lower initial repayments, savvy investors may be able to diversify their portfolio or strategically invest in higher yield opportunities.

America Mortgages has one of the best interest-only mortgage options in the market! Think about this – a FIXED 10-year interest-only product that converts to a 30-year fixed at the end of 10-years with no adjustment in rate. The only difference is that the loan now becomes a principal and interest payment. This loan is available to all clients regardless of their age. You have the certainty of knowing exactly what your mortgage payments are for 40-years. If interest rates go down, refinance into another 10-year program. It’s that simple.

At America Mortgages, we recognize the complexities of the U.S. housing market. That’s why we’re here to provide expert guidance. Whether you’re a foreign national investor or a U.S. expat, our team can assist you in finding the right mortgage for your needs. Offering up to 75% LTV in all 50 U.S. states for Foreign Nationals and 80% for U.S. expats, America Mortgages is your trusted source for dependable, flexible, market-rate U.S. mortgage loans.

For any questions or personalized assistance, our committed team at America Mortgages is here to support you along your real estate investment journey. Reach out to us at [email protected]. If you’d like to schedule a no-obligation meeting with one of our U.S. loan officers to explore your U.S. mortgage options, use our 24/7 calendar link. Don’t wait; take the next step towards owning your investment home in the U.S. by contacting us today!