Over the past few months, we surveyed over 1,000 of our clients and partners globally with the following question:

“What is the key consideration for owning an investment property in the U.S.?”

The top 3 answers were:

1. Education

2. Price and Affordability

3. Profit/Income Potential

In this report, we look at the top public and private schools in California, New York, Texas, and Florida, and we rank them by:

1. Highest SAT scores

2. Cities with the highest rental yield

3. Cities with the Lowest Home Price-to-income ratio

We then conclude our report with our team’s top 3 personal choices for US public schools, based on a combination of high SAT scores, the liveability of the city, rental income potential, as well as other personal and subjective aspects.

WHY IS EDUCATION IMPORTANT?

Job market growth is certainly a key driver for price appreciation and is normally driven by new business formation in the area. Still, popularity as a living destination is driven by things like safety, cost of living, ease of transportation, and of course, quality of education.

“Popularity as a living destination” drives demand, home value appreciation, and strong growth in rental income.

Education is an important factor for overseas property investors in determining where their next home purchase will be in the U.S. Most of the time, the objective of owning real estate to earn income almost always comes down to “could I live there one day”?

In Asia, for example, where owning property is ingrained in their culture, it’s common to purchase an investment property “in anticipation” of sending their child to college.

They could even live there during or after graduation, and the price appreciation could even pay for college if they sell the property.

Or if the child decides to get a job in the U.S., they can stay in the apartment as a post-graduation gift to build up their credit or even rent it out to earn income.

Many new immigrants or returning expats will choose to live in areas where there are good schools and a higher population of similar background families. High schools are a very important decision since it will determine their experience during the formative years between 14-18 years of age and potential college choices.

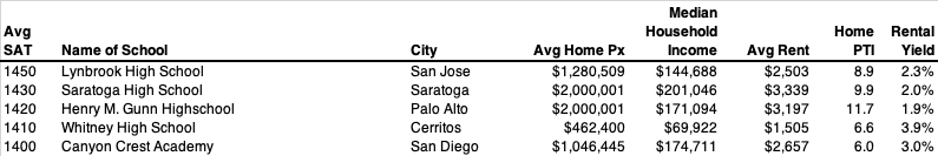

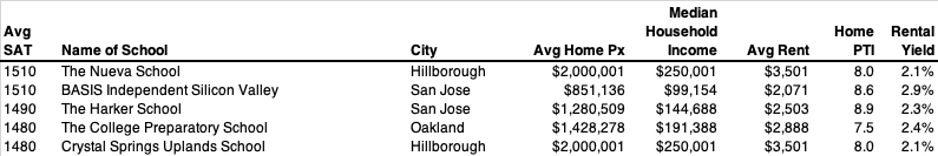

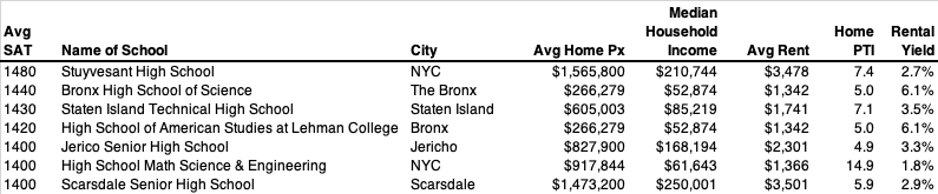

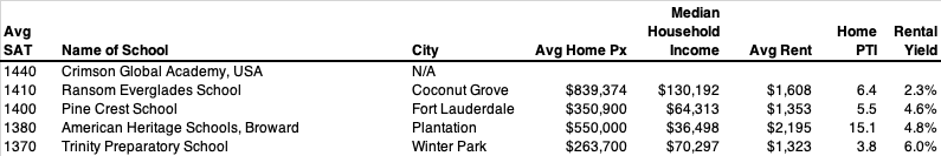

TOP 5 SAT SCORES

These rank the schools with the highest standardised test scores.

California Public Schools

California Private Schools

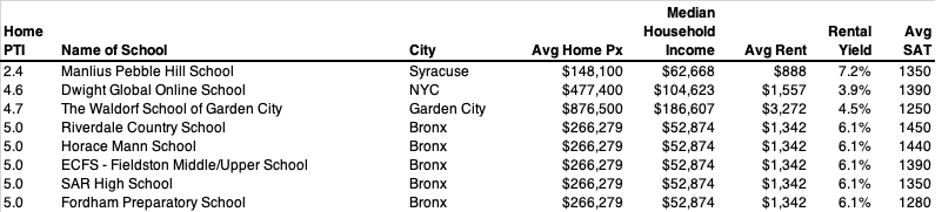

New York Public Schools

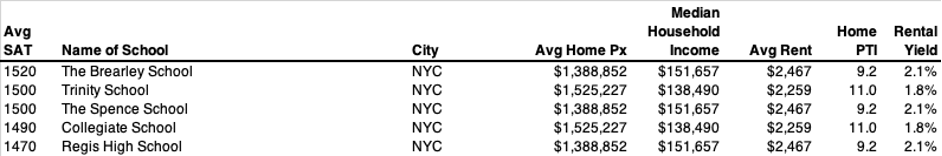

New York Private Schools

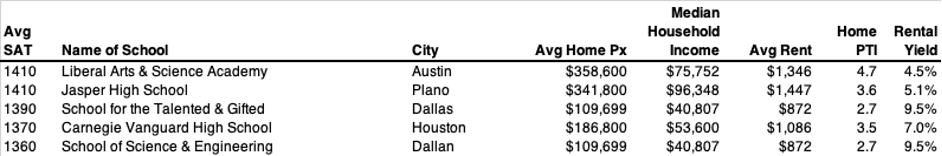

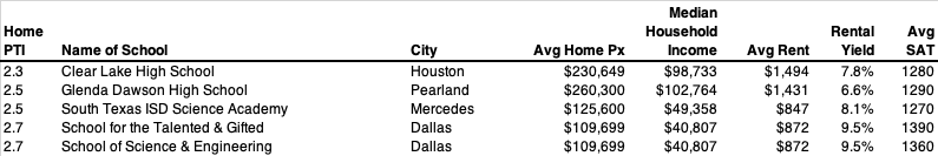

Texas Public Schools

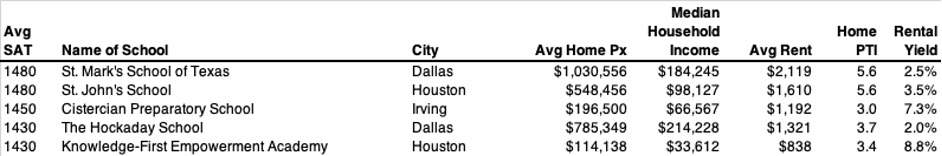

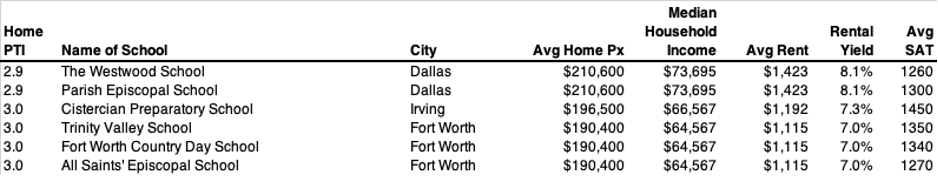

Texas Private Schools

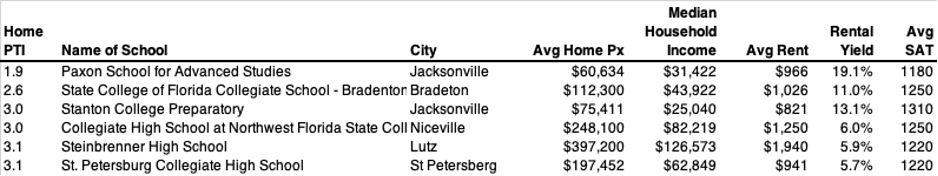

Florida Public Schools

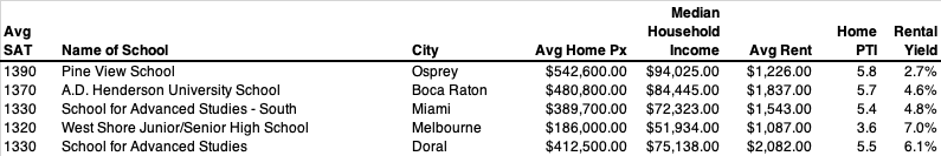

Florida Private Schools

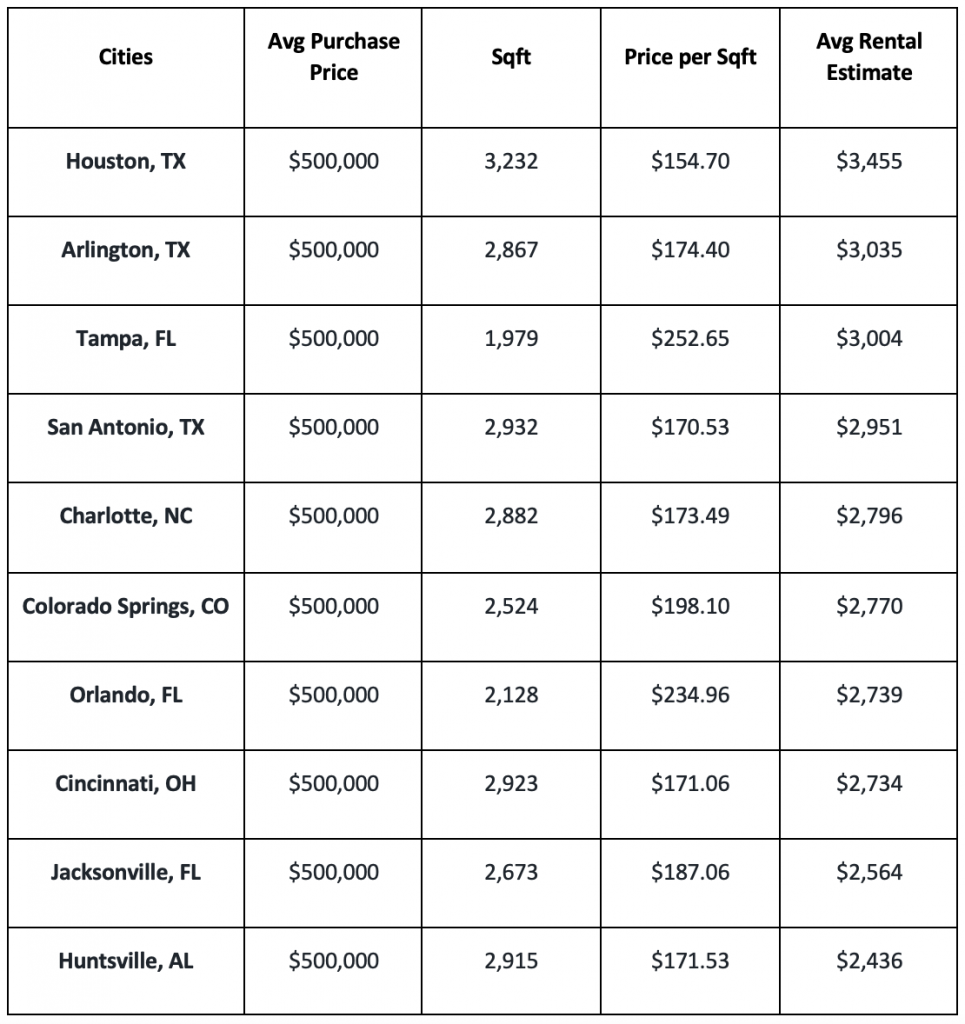

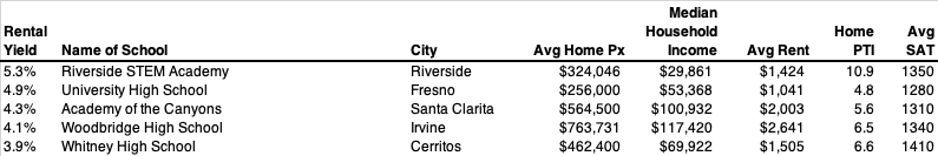

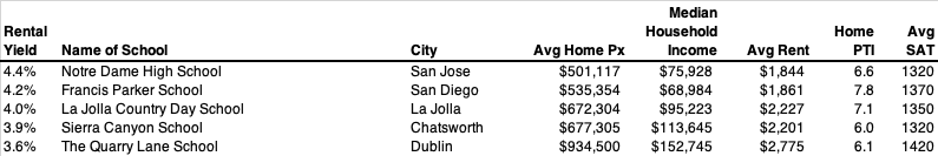

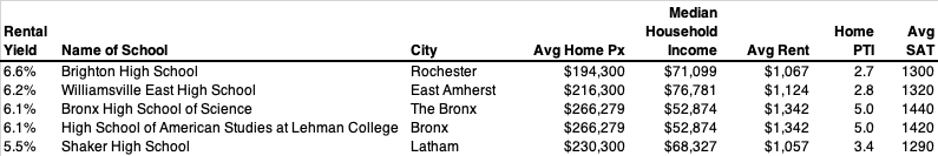

TOP 5 HIGHEST RENTAL YIELD

Here we take the Average Yearly Rental Income as a percentage of the Average Home Price in the city or neighbourhood the school is in. This shows us how much income the asset produces vs. its cost. This is a rough guide, but I can argue it is understated since home prices are declining while rents have been increasing across the country.

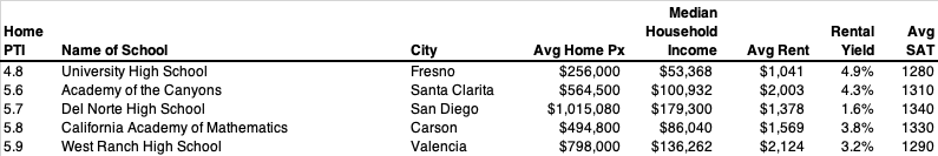

California Public School Cities

California Private School Cities

New York Public School Cities

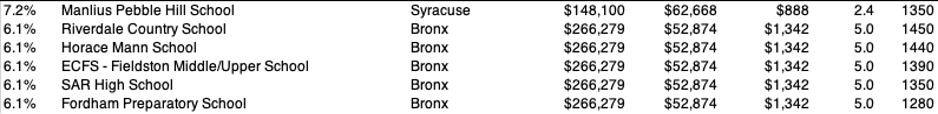

New York Private School Cities

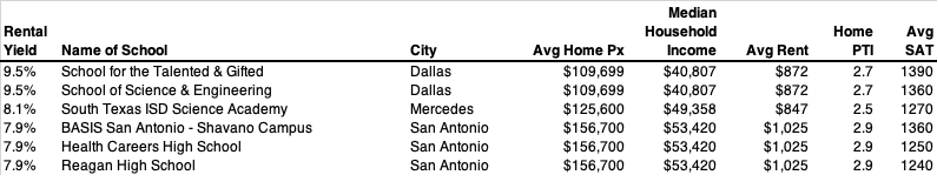

Texas Public School Cities

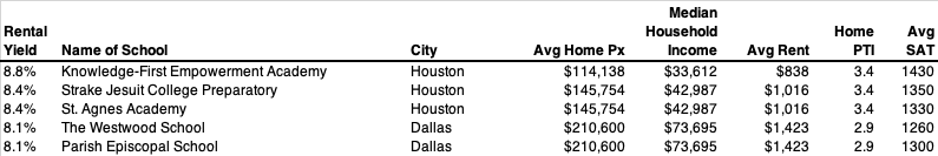

Texas Private School Cities

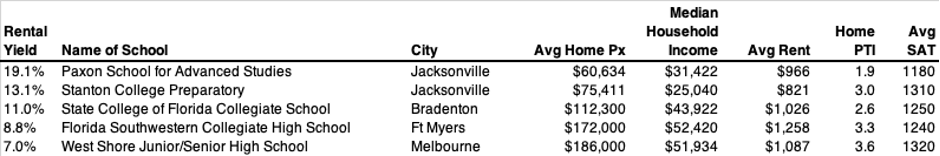

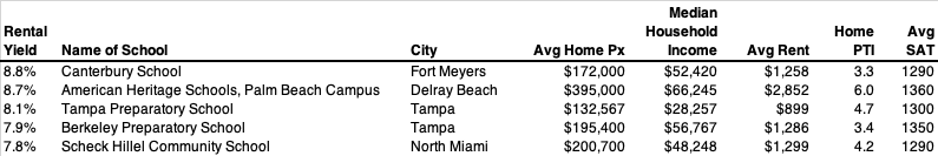

Florida Public School Cities

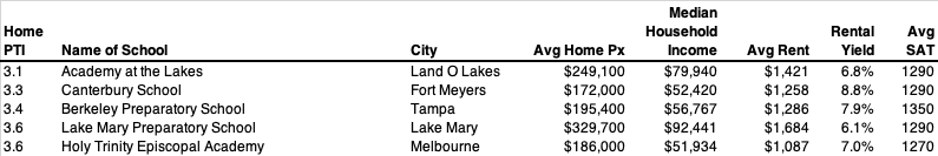

Florida Private School Cities

TOP 5 LOWEST HOME PX-TO-INCOME RATIO

This is similar to a P.E. ratio for stocks. It’s based on the Average Home Price compared to the Median Household Income in that particular city. The lower the price, the more affordable it is (IE better value), or in another way, the less the homes have increased vs. the income of that particular area. Nationally, the average is 4.7, but in popular destinations such as California or Hawaii, the ratios are 8.9 and 9.4, respectively.

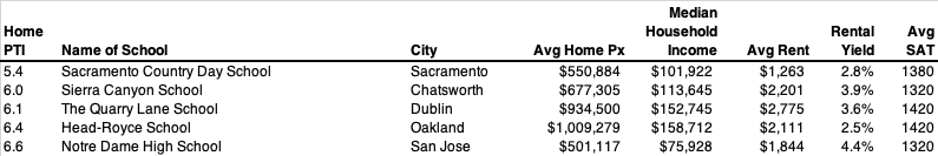

California Public School Cities

California Private School Cities

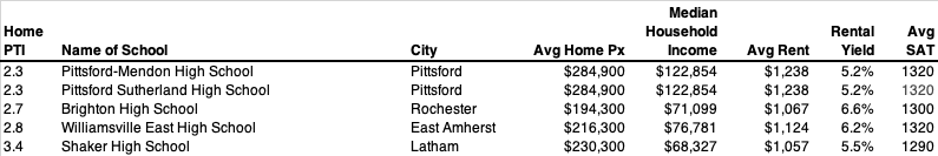

New York Public School Cities

New York Private School Cities

Texas Public School Cities

Texas Private School Cities

Florida Public School Cities

Florida Private School Cities

Conclusion

Looking at absolute test scores, New York and California have cities with the highest SAT scores for both public and private schools. However, these states will also have a higher home price-to-income ratio since they are fairly well-known destinations for overseas buyers – Palo Alto, Manhattan, San Francisco, etc.

In this report, we want to highlight the value option. Cities where you are able to purchase a home that is not only affordable on an absolute basis but relative to its Median Household Income of that city.

In this case, Texas and Florida are better options. In Florida, good areas to invest in include big metropolitan cities like Jacksonville and Bradenton, which boast surprisingly high rental yields ranging from 11% to 19%, respectively!

In Texas, rental yields are lower than Florida but still much significantly higher than California and New York and most importantly, higher than cost of financing. Largely populated cities like Houston and Dallas have the highest rental yields of 7.8 % and 9.5%. If you are only considering areas with good school districts, I recommend choosing areas that are closer to private institutions. You will be guaranteed a similar standard of education as New York and California public schools while earning a comparable income from investment.

OUR TOP CHOICES FOR PUBLIC SCHOOLS IN THE U.S.

This of course are personal choices. The truth is all of these schools are amazing and cities which they are located in all very liveable. If you want to be introduced to our realtor partner in these specific cities to learn more as well as property options available, please email us at: [email protected]

1. Canyon Crest Academy, San Diego, California

Canyon Crest Academy is a prestigious public high school in San Diego, California. This is my number one choice as it ticks all the boxes. The area is diverse, affordable, and has high educational standards, as the school is ranked second state-wide (1400 SAT, 31 ACT). As a California native who’s seen it all, I would also name San Diego as the most beautiful area in the state. In San Diego, you can enjoy stunning beaches, perfect weather, and amazing food, all whilst attending a top school. Additionally, if you are someone who considers college as part of your moving decision – for yourselves or for your kids – California is also a great place to live because of its proximity to top universities. Schools like UCLA, UCSD, UC Berkeley, and Stanford are only a drive away, which makes it easier and more accessible for families and their children.

2. School for Advanced Studies Homestead, Miami, Florida.

School for Advanced Studies Homestead, in Coral Gables, Miami, is a top 10 public high school in Florida. Located southwest of downtown Miami, Coral Gables is well known for its exclusive private estates, shopping districts, and upscale suburban lifestyle. After visiting the area last summer, I was stunned by its beauty and liveliness. Coral Gables is young, fun, and perfect for raising a family. I was surprised to find that the neighbourhood was less expensive than I thought. The average price of a home in Coral Gables is $235,800, with an average rent of $1,303. In this area, the rental yield is also higher at 6.6%, which increases your potential rental income.

Investing in an area like this would also be beneficial long term as it is only a short drive away from the University of Miami, one of the top 3 colleges in Florida. If your child is considering attending a college within state borders, Coral Gables is a great option.

3. Bronx High School of Science, Bronx, New York

If you’re looking for an affordable house in New York City, be sure to take a look at the Bronx. Not only is the borough home to massive parks, diverse neighbourhoods, and great eats, but it also has the lowest average home price of any borough, hovering at $266K as of October 2022.

What’s more, the Bronx has the highest-rated schools in the city. Bronx High School of Science is ranked number one amongst public high schools in New York (1400 SAT, 33 ACT). Investing in a home in the Bronx will also secure you a stable cash flow compared to other districts, as the rental yield in the area is 5%, 2% higher than the state average. On a more fun note, the Bronx is also the essence of the culture in New York. It is the home of hip-hop, jazz, and Yankee Stadium. You will surely get to enjoy the New York vibe when living in the Bronx.