Ex-post

The worsening energy crisis in Europe has taken the front page of most media channels this week as the Nord Stream 2 pipeline, a 1,200 km natural gas pipeline from Russia to Germany, remains close, which is driving the Euro to a 20-year low vs. USD. The BBC reports that the annual energy bill for a typical UK household is £1,971. From 1 October, however, that’s due to rise 80% – to £3,549!!! Can you imagine paying USD4,000 a month for electricity?! The new incoming PM, Ms. Truss, will certainly be making this a top priority. We really hope for a mild winter in Europe for everyone’s interest.

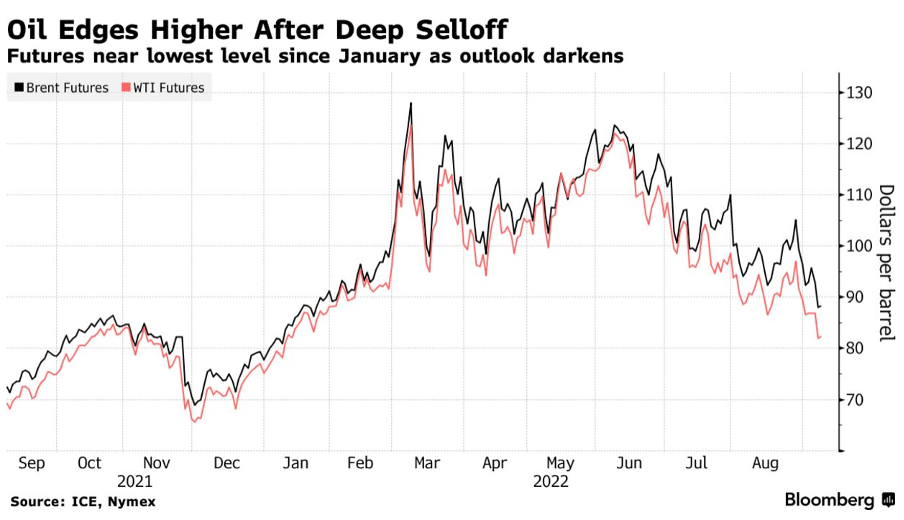

Meanwhile, the Yen is now close to a mind-boggling ¥145 vs. USD, a 24-year low! Oil at $82 is a very critical level and, technically speaking, could break lower, which could give some breathing room to the economy. Seeing Oil go from $120 a barrel in May 2022 to $85 now shows how volatile the world is and also how quickly demand can fall for the most popular commodities.

In the US, Nonfarm payrolls were +315,000 in August (seasonally slow) vs. +526,000 in September, slightly lower than expected but a big month-on-month decline. Meanwhile, unemployment is at +3.7%, slightly higher than expected. The tight labour market while companies are announcing hiring freezes is peculiar. Could this be a recession where employment is less affected? ISM Manufacturing for August was 52.8, unchanged from July – not the decline I was hoping for to give us a little breathing room.

| US Rates | 30-year fixed 6.12% | 15-year fixed 5.32% |

| 30-year jumbo 5.10% | 5/1 ARM 5.95% |

Ex-ante

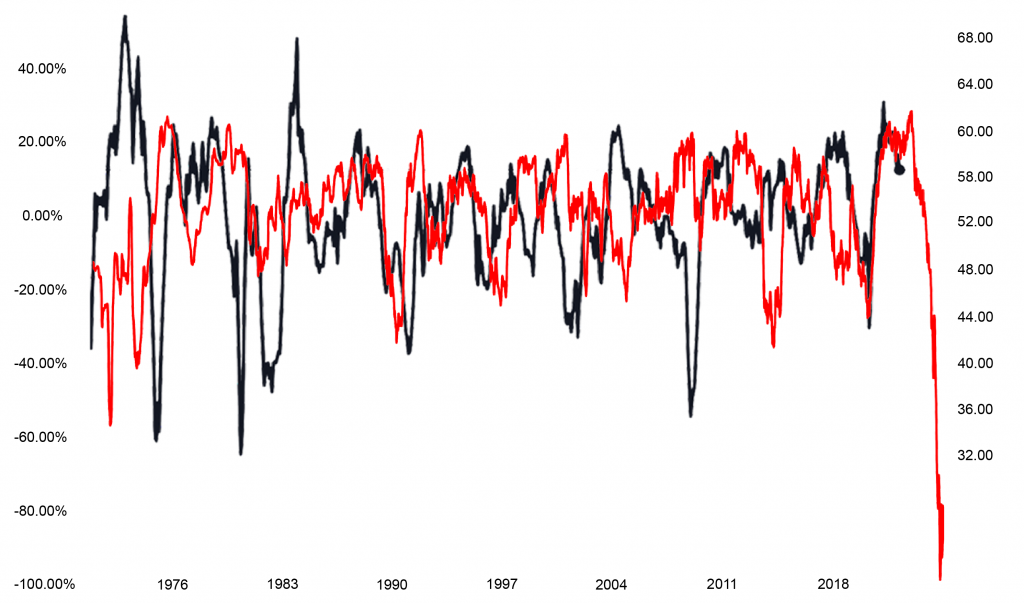

I’m really keeping an eye on oil prices…I have a sinking feeling that Oil is such a consensus overweight for most hedge funds (and institutions) that technical breakthrough support (say $80) will see a further decline in oil prices which is good news for everyone! European energy prices are now generally 15-20% of GDP, and someone has to pay for it – the public or private sector. If the public pays for it, it will have to run a fiscal deficit of 15-20% of GDP, so more debt on top of the already growing debt problem. The private sector gets tricky, especially for countries that have piled on loads of debt in a short period of time. One country that sticks out is Sweden, with over 150% of private debt to GDP. Nationally, Sweden’s debt service ratio is 27% (highest on record). It appears Sweden, France, and South Korea are the most interest-rate sensitive countries, relatively speaking, according to BIS data. Watch this space. The negative soundbites on the European banking sector are going to get louder and more frequent.

Buy now! Why now?

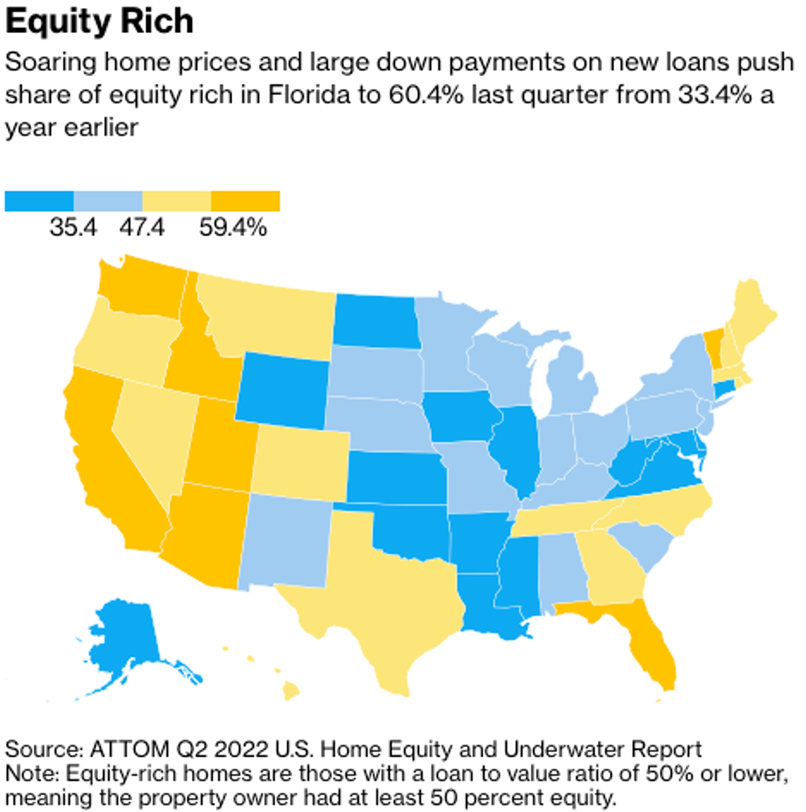

We are in a perverse cycle where rising rates are actually squeezing up rental yields. The marginal buyer cannot afford to own given rate rises, and the Millennials also cannot afford and must rent – AND, to add to that, there is a 3.8M housing shortage according to the Fed. If you read last week’s “Ex-post, Ex-ante,” places like New York are seeing double-digit percentage increases in rents, BUT 39% of residents are looking to move given the high cost of living. It won’t be long where we are in a world where rates are 7-8%, BUT rental yields could be 15-20% (some parts of Texas can net you low teens yield already).

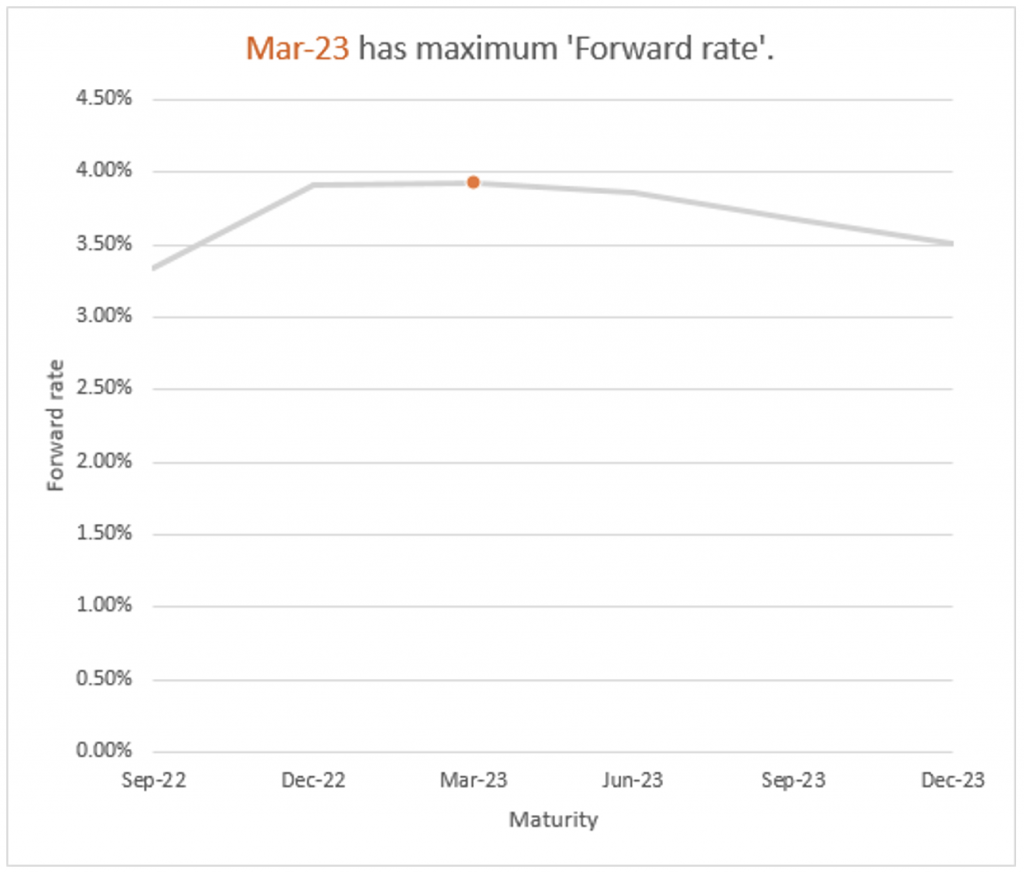

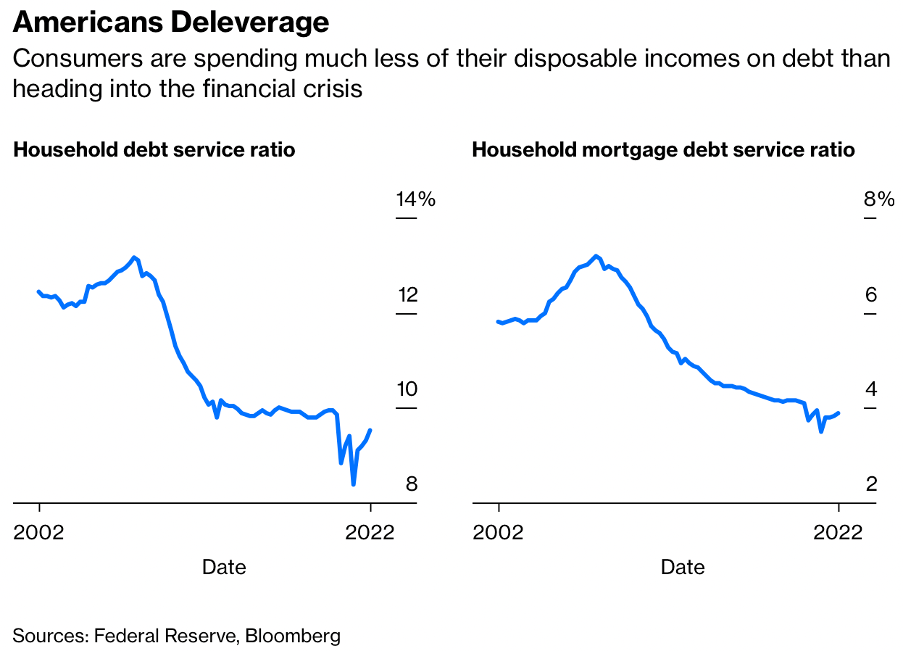

Look at this chart below from a Bloomberg article (7 September) US household debt service ratio has fallen from around 13% at the time of the last housing crisis to 10% now, according to the Fed. The amount households are spending to service their mortgage debt has been cut almost in half, from 7.18% in 2007 to a recent 3.89%!

LOANS OF THE WEEK!

1. Indonesia family uses bridge loan to purchase $5.4M Retail/Office to maximize cash flow

| Location: San Diego | Price: $5,400,000 |

| Property: Storefront Retail + Office | Loan Amount: $3,500,000 |

| Cap rate: 4.05% / 100% leased | Loan to value: 65% |

| Use: Investment | Rate: 8.5% |

| Loan: AM USA Bridge+ | Term: 3-year interest only |

– Client was offered a bank loan at 5.75% but given that it is cash-flow based he would not be able to cover the 1.25x cash flow coverage typically required and would be able to get around 40% LTV. Our knowledge was valuable. We knew that California is a tough market as it is with very low CAP rates but the added increase in interest rates is making it even harder to achieve higher loan amounts.

– Our solution: Use a bridge loan with higher leverage, interest-only payment to get into the property. Then position the tenants for renewal of their lease agreements and refinance when rates come back, allowing for more leverage to be supported by the cash flow. Good news is the client is using this strategy to purchase more yielding assets in the US. Loan managed by our Head of Sales, [email protected]

2. Canada tech entrepreneur buys $1.25M condo in Miami

| Location: Miami | Price: $1,250,000 |

| Property: Condo | Loan Amount: $875,000 |

| Use: Investment | Loan to value: 70% |

| Loan: AM Foreign National+ | Rate: 6.875% |

| Term: 30-year fixed |

– Client wanted to start building rental portfolio in the US to earn income and to begin developing a credit footprint for future family and business opportunities. Given the nature of his business, he was not able to find bank financing in Canada and we were able to find a mortgage which used his Canada credit and income to qualify. Funded in 43 days with the help of our Canada-based loan officer, [email protected]

3. UK family buys $850K Boston condo in son’s name to develop credit

| Location: Boston | Price: $850,000 |

| Property: Condo | Loan Amount: $595,000 |

| Use: Investment | Loan to value: 70% |

| Loan: AM Foreign National+ | Rate: 6.875% |

| Term: 30-year fixed |

– Client bought condo in son’s name to rent out while his son attends boarding school on the East Coast. The intention is for him to stay in the condo upon graduation from university in 4-5 years or continue to rent out to bolster his income while starting out on his career, meanwhile developing US credit for himself. Our UK-based loan officer provided a hassle-free experience throughout their mortgage journey, [email protected]

Schedule a call with us at [email protected] to find out more!