Ex-post

Biden cancels $10,000 in student debt – timing before the mid-term elections are interesting, but no one can deny that it is a big problem that is stifling growth in many ways. The main event was Federal Reserve chairman Powell’s speech at Jackson Hole, which was a reminder that inflation is being treated more seriously than we are expecting. Risk assets have been correcting ever since – yet bonds haven’t moved with the same intent indicating smart money had priced in the Fed’s response. While 10Y treasuries do not dictate mortgage rates, they 2 are correlated, and we expect some upward pressure on rates.

Ex-ante

Over the next week, we will be paying attention to the Case-Schiller index as a gauge year-on-year home prices, and the big one is August ISM manufacturing index, which consensus has at 51.8 (under 50 is a contraction). If this is lower than consensus, it may portend to be something more recessionary. As we highlighted in last week’s “Ex-ante, Ex-post,” there is historically a big contraction in manufacturing output when rates rise to a certain extent.

U.S. HOME PRICES

We reiterate the underlying fundamentals of housing are very supportive, with an abundant amount of equity and well-known shortage.

In an article written by the Fed, on 7 May 2021, “Housing Supply: A Growing Deficit”, The claim in 2018, the housing shortage was 2.5 million units, and now, more recently, in 2020, the U.S. has a housing shortage of 3.8 million units.

That is to say, 3.8 million units are needed to not only meet the demand from the growing number of households but also to maintain a target vacancy rate of 13%. Between 2018 and 2020, the housing stock deficit increased by approximately 52%

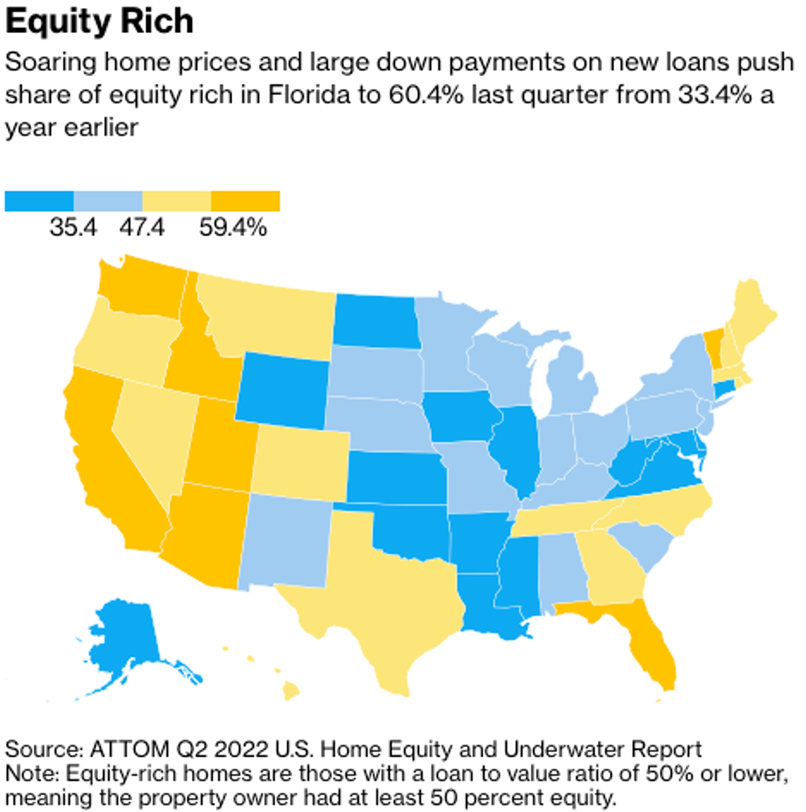

Elsewhere, In Bloomberg’s article published, 5 August 2022, “Almost Half of Mortgaged Homes in U.S. Now Considered Equity-Rich .”This would be the 9th straight quarterly rise, according to the article, fuelled by strong house valuations during the pandemic area. The article definition of Equity-Rich as owners having over 50% in home equity. Some of the highest equity-rich states are Florida, California, Washington, Utah, Idaho (surprising), and Vermont.

LOANS OF THE WEEK!

Singapore citizen purchases new development in Manhattan, New York

| Location: New York City | Price: $1,000,000 |

| Property: Condominium | Loan Amount: $600,000 |

| Use: Investment | Loan-to-Value: 60% |

| Loan: AM Foreign National+ | Rate: 6.875% |

| | Term: 30-year fixed |

Singapore client attended a presentation by an international realtor on a New York condo launch. America Mortgages was attending the event and helped the client discuss the financing options available.

Philippines businessman purchases home in Florida

| Location: Fort Lauderdale | Price: $650,000 |

| Property: Single Family Home | Loan Amount: $455,000 |

| Use: Investment | Loan-to-Value: 70% |

| Loan: AM Foreign National + | Rate: 6.875% |

| Term: 30-year fixed |

Referred by his local private bank, the client wanted to own a retirement home for the future (he’s only 58) but liked how rental rates have been rising in the area and also wanted more USD income.

Swedish National purchases home in Texas

| Location: Austin | Price: $9,500,000 |

| Property: Single Family Home | Loan Amount: $5,225,000 |

| Use: Investment | Loan-to-Value: 55% |

| Loan: AM HNW+ (Super Jumbo) | Rate: 7.25% |

| | Term: 5-year fixed, 30-year amortized |

Swedish client saw our ad on LinkedIn and reached out to discuss the financing options for a Texas property. He was surprised at how easy it was to qualify and close for direct U.S. lending option.

Interested in releasing equity? America Mortgages has a 97% approval rate for both U.S. Citizens & Foreign Nationals. As a company our only focus is providing market rate U.S. mortgage financing for foreign nationals and U.S. expats.

Schedule a call with us at [email protected] today!