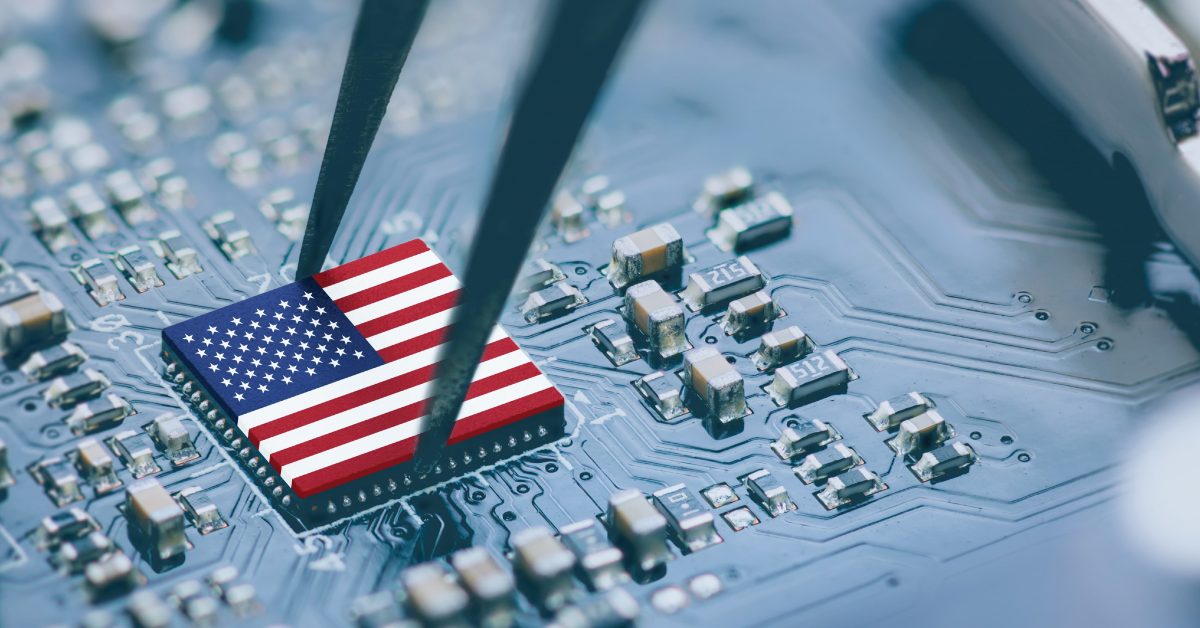

The CHIPS and Science Act is a U.S. federal law enacted in August 2022 to bolster the domestic semiconductor industry, enhance technological innovation, and strengthen national security by bringing manufacturing onshore.

Total funding, investment and spending is expected to be $500 billion.

More importantly, creating over 500,000 jobs over the next 5-10 years.

As a property investor, you want to own in areas where employment will be robust with high-wage renters. Learn which specific U.S. states will benefit the most.

THE HOUSING MARKET

The CHIPS and Science Act could have a significant positive impact on the U.S. housing market due to its focus on stimulating domestic semiconductor manufacturing and fostering economic growth.

Here’s how:

1. Increased Demand for Housing in Manufacturing Hubs

- Job Creation: The CHIPS Act is expected to create 500,000 high-paying jobs in semiconductor manufacturing, research, and related sectors. This influx of employment will drive housing demand in areas surrounding major chip production facilities, such as:

– Arizona (Phoenix)

– Texas (Austin, Taylor)

– New York (Clay, Albany)

– Ohio (New Albany)

– Oregon (Hillsboro) - Population Growth: Migration to these regions for employment opportunities will increase the need for housing, potentially driving up home prices and rents.

2. Boosted Construction Activity

- Residential Development: Increased demand for housing near semiconductor facilities could spur residential construction projects to accommodate the growing workforce.

- Infrastructure Expansion: Investments in roads, utilities, and public amenities to support these facilities may also enhance local real estate markets.

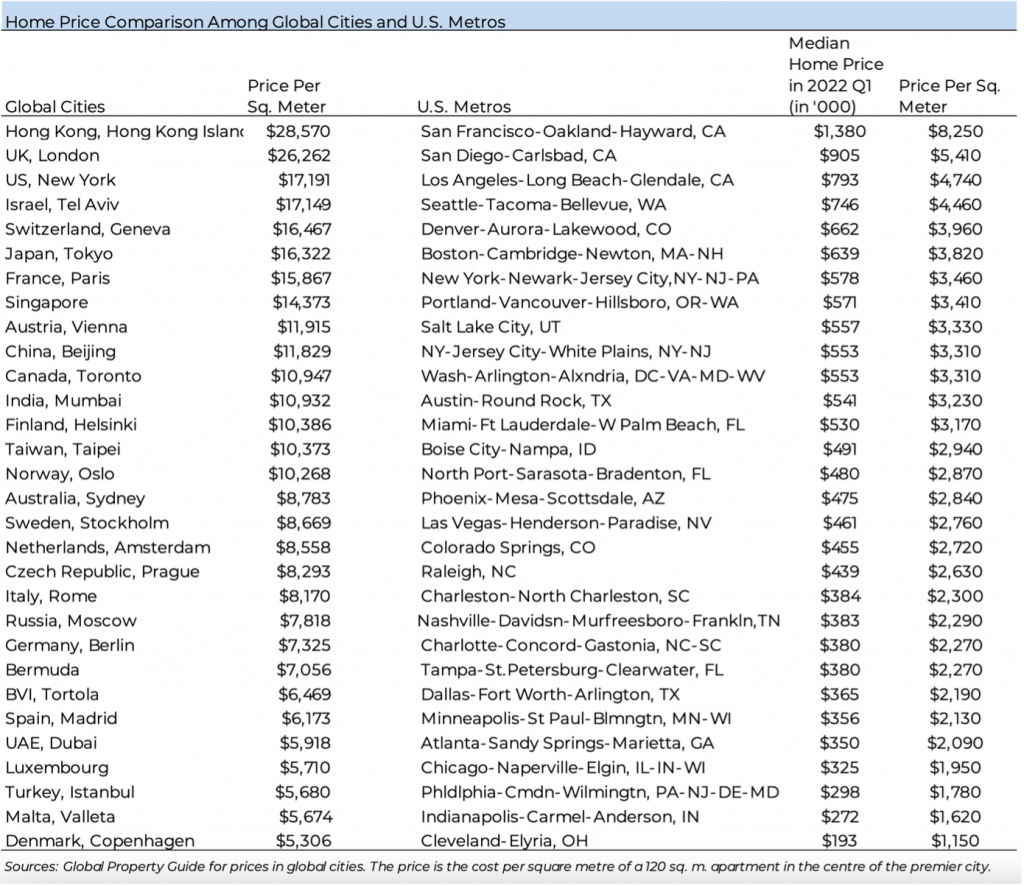

3. Rising Property Values

- Economic Growth: The influx of jobs and investments is likely to enhance local economies, increasing property values and attracting real estate investors to these regions.

- Regional Hot Spots: Cities and states benefiting from the CHIPS Act could experience accelerated growth in property values, creating new real estate hot spots.

4. Rental Market Growth

- Short-Term Demand: Many workers relocating for semiconductor jobs may initially rent before purchasing homes, boosting rental market activity.

- Corporate Housing: Companies building semiconductor facilities may also increase demand for temporary housing for contractors and employees.

5. Housing Affordability Challenges

- Pressure on Supply: A surge in demand without corresponding increases in housing supply could exacerbate affordability issues in regions with already tight housing markets.

- Gentrification Risks: Rapid economic growth could lead to higher housing costs, displacing lower-income residents in affected areas.

- This is a perfect scenario for investors and rents are bid-up in these areas.

6. Long-Term National Impacts

- Economic Stability: By strengthening the U.S. economy and ensuring supply chain resilience, the CHIPS Act may contribute to long-term stability in the national housing market.

STATES TO SEE THE BIGGEST IMPACT

1. Arizona

- Major Projects: Intel’s expansion in Chandler and Taiwan Semiconductor Manufacturing Co. (TSMC) in Phoenix.

- Investment: TSMC’s facility represents over $6.6 billion in funding, while Intel’s expansion accounts for $7.87 billion.

=> Jobs: Intel’s projects in Arizona are expected to create up to 30,000 jobs across multiple states, including Arizona, New Mexico, Ohio, and Oregon.

2. New York

- Major Projects: Micron Technology’s $100 billion commitment to a new chip factory in Clay, New York.

- Incentives: $5.5 billion in state tax credits and $825 million in federal funding for Albany NanoTech.

=> Jobs: Micron’s investment in Clay, New York, is projected to create approximately 20,000 jobs.

3. Ohio

- Major Projects: Intel’s semiconductor manufacturing expansion in New Albany.

- Investment: Billions are allocated to develop a state-of-the-art chip production facility.

=> Jobs: Intel’s expansion in Ohio is part of a broader initiative expected to generate up to 30,000 jobs across multiple states.

4. Texas

- Major Projects: Samsung Electronics in Taylor and Texas Instruments across multiple locations.

- Investment: Samsung has committed $17 billion, Texas Instruments $30 billion.

=> Jobs: Approximately 10,000-15,000 direct jobs in semiconductor manufacturing and an estimated 6,500 construction jobs during the build-out phase.

5. Oregon

- Major Projects: Intel’s ongoing investment in Hillsboro as part of its U.S. manufacturing network.

=> Jobs: Intel’s activities in Oregon are included in the company’s expansion plans, which are expected to create up to 30,000 jobs.

6. Utah

- Major Projects: Texas Instruments’ semiconductor wafer plant.

- Investment: Part of Texas Instruments’ $1.6 billion allocation shared with Texas.

=> Jobs: Expected to create 500 to 800 direct jobs in manufacturing and engineering roles at the Lehi plant.

THE UPSHOT

The CHIPS Act aims to:

- Reduce U.S. reliance on foreign semiconductor manufacturing.

- Create high-paying jobs across the country.

- Boost local economies in states with large manufacturing investments.

The CHIPS Act will likely stimulate regional housing markets near semiconductor manufacturing hubs through job creation and population growth.

We are happy to introduce you to realtors and property managers in these areas. If there’s further interest, we’re happy to explore expanding these services.

These states, due to existing infrastructure, workforce capabilities, and favorable policies, are emerging as leaders in the domestic semiconductor resurgence.

America Mortgages is ready to help you navigate these exciting opportunities. Whether you’re an investor targeting high-demand markets or a homeowner exploring financing options, we provide tailored solutions to meet your needs.

For more information, there are several easy ways to contact us:

Visit www.AmericaMortgages.com

Speak with a U.S. loan specialist 24 hours a day, 7 days a week: +1 845-583-0830

Schedule a convenient time to speak to one of our U.S. loan specialists.

Compra propiedades donde la Ley CHIPS generará 500,000 empleos

La Ley CHIPS y Ciencia es una ley federal de los Estados Unidos promulgada en agosto de 2022 para fortalecer la industria nacional de semiconductores, fomentar la innovación tecnológica y reforzar la seguridad nacional mediante la fabricación en el país.

El financiamiento, la inversión y el gasto total se estiman en $500 mil millones.

Más importante aún, se espera la creación de más de 500,000 empleos durante los próximos 5 a 10 años.

Como inversor inmobiliario, querrás poseer propiedades en áreas donde el empleo sea sólido y los inquilinos tengan salarios altos. Descubre cuáles son los estados específicos de EE.UU. que más se beneficiarán.

EL MERCADO INMOBILIARIO

La Ley CHIPS y Ciencia podría tener un impacto positivo significativo en el mercado inmobiliario de EE.UU. gracias a su enfoque en estimular la fabricación nacional de semiconductores y fomentar el crecimiento económico.

Esto es lo que puedes esperar:

- Mayor demanda de vivienda en centros de manufactura

- Creación de empleos: Se espera que la Ley CHIPS cree 500,000 empleos bien remunerados en la fabricación de semiconductores, investigación y sectores relacionados. Este aumento en el empleo impulsará la demanda de vivienda en áreas cercanas a las principales instalaciones de producción de chips, como:

– Arizona (Phoenix)

– Texas (Austin, Taylor)

– Nueva York (Clay, Albany)

– Ohio (New Albany)

– Oregón (Hillsboro) - Crecimiento poblacional: La migración a estas regiones para aprovechar oportunidades laborales aumentará la necesidad de vivienda, lo que podría elevar los precios de las propiedades y las rentas.

- Aumento de la actividad de construcción

- Desarrollo residencial: El incremento en la demanda de vivienda cerca de las instalaciones de semiconductores podría estimular proyectos de construcción residencial para acomodar a la creciente fuerza laboral.

- Expansión de infraestructura: Las inversiones en carreteras, servicios públicos y comodidades públicas para apoyar estas instalaciones también pueden mejorar los mercados inmobiliarios locales.

- Incremento en el valor de las propiedades

- Crecimiento económico: La llegada de empleos e inversiones probablemente mejorará las economías locales, aumentando el valor de las propiedades y atrayendo a inversores inmobiliarios a estas regiones.

- Zonas calientes: Las ciudades y estados beneficiados por la Ley CHIPS podrían experimentar un crecimiento acelerado en el valor de las propiedades, creando nuevos puntos de interés inmobiliario.

- Crecimiento del mercado de alquileres

- Demanda a corto plazo: Muchos trabajadores que se trasladen para empleos en semiconductores podrían inicialmente alquilar antes de comprar viviendas, impulsando la actividad del mercado de alquileres.

- Alojamientos corporativos: Las empresas que construyen instalaciones de semiconductores también pueden aumentar la demanda de alojamientos temporales para contratistas y empleados.

- Desafíos de asequibilidad de vivienda

- Presión en la oferta: Un aumento en la demanda sin incrementos correspondientes en la oferta de vivienda podría agravar los problemas de asequibilidad en regiones con mercados inmobiliarios ya ajustados.

- Riesgos de gentrificación: El rápido crecimiento económico podría llevar a costos de vivienda más altos, desplazando a residentes de ingresos bajos en las áreas afectadas.

Este es un escenario perfecto para los inversores, ya que las rentas tienden a aumentar en estas áreas.

- Impactos nacionales a largo plazo

- Estabilidad económica: Al fortalecer la economía de EE.UU. y garantizar la resiliencia de la cadena de suministro, la Ley CHIPS podría contribuir a la estabilidad a largo plazo del mercado inmobiliario nacional.

ESTADOS CON MAYOR IMPACTO

- Arizona

- Proyectos principales: Expansión de Intel en Chandler y Taiwan Semiconductor Manufacturing Co. (TSMC) en Phoenix.

- Inversión: La instalación de TSMC representa más de $6.6 mil millones en financiamiento, mientras que la expansión de Intel equivale a $7.87 mil millones.

- => Empleos: Los proyectos de Intel en Arizona se espera que generen hasta 30,000 empleos en varios estados, incluidos Arizona, Nuevo México, Ohio y Oregón.

- Nueva York

- Proyectos principales: Compromiso de $100 mil millones de Micron Technology para una nueva fábrica de chips en Clay, Nueva York.

- Incentivos: $5.5 mil millones en créditos fiscales estatales y $825 millones en financiamiento federal para Albany NanoTech.

- => Empleos: La inversión de Micron en Clay, Nueva York, se proyecta que cree aproximadamente 20,000 empleos.

- Ohio

- Proyectos principales: Expansión de la fabricación de semiconductores de Intel en New Albany.

- Inversión: Miles de millones se destinarán al desarrollo de una instalación de producción de chips de última generación.

- => Empleos: La expansión de Intel en Ohio es parte de una iniciativa más amplia que se espera genere hasta 30,000 empleos en varios estados.

- Texas

- Proyectos principales: Samsung Electronics en Taylor y Texas Instruments en múltiples ubicaciones.

- Inversión: Samsung se ha comprometido con $17 mil millones, mientras que Texas Instruments con $30 mil millones.

- => Empleos: Aproximadamente 10,000-15,000 empleos directos en la fabricación de semiconductores y unos 6,500 empleos de construcción durante la fase de desarrollo.

- Oregón

- Proyectos principales: Inversiones continuas de Intel en Hillsboro como parte de su red de fabricación en EE.UU.

- => Empleos: Las actividades de Intel en Oregón están incluidas en los planes de expansión de la compañía, que se espera que creen hasta 30,000 empleos.

- Utah

- Proyectos principales: Planta de obleas semiconductoras de Texas Instruments.

- Inversión: Parte de los $1.6 mil millones destinados por Texas Instruments, compartidos con Texas.

- => Empleos: Se espera la creación de entre 500 y 800 empleos directos en manufactura y roles de ingeniería en la planta de Lehi.

CONCLUSIÓN

La Ley CHIPS tiene como objetivos:

- Reducir la dependencia de los Estados Unidos en la fabricación de semiconductores extranjeros.

- Crear empleos bien remunerados en todo el país.

- Impulsar las economías locales en los estados con grandes inversiones en manufactura.

Es probable que la Ley CHIPS estimule los mercados de vivienda regionales cercanos a los centros de fabricación de semiconductores gracias a la creación de empleos y el crecimiento poblacional.

Estamos encantados de presentarte a agentes inmobiliarios y administradores de propiedades en estas áreas. Si hay mayor interés, estamos dispuestos a explorar la ampliación de estos servicios.

Estos estados, gracias a su infraestructura existente, capacidades de fuerza laboral y políticas favorables, están emergiendo como líderes en el resurgimiento del sector de semiconductores domésticos.

America Mortgages está listo para ayudarte a navegar estas emocionantes oportunidades. Ya sea que seas un inversor enfocado en mercados de alta demanda o un propietario explorando opciones de financiamiento, ofrecemos soluciones personalizadas para satisfacer tus necesidades.

Para más información, hay varias formas fáciles de contactarnos:

- Visita www.AmericaMortgages.com

- Habla con un especialista en préstamos de EE.UU. las 24 horas, los 7 días de la semana: +1 845-583-0830

- Programa una hora conveniente para hablar con uno de nuestros especialistas en préstamos de EE.UU

在《CHIPS法案》将新增50万个工作岗位的地区购买房产

CHIPS与科学法案》是美国于2022年8月颁布的一项联邦法律,旨在通过将制造业带回国内来加强国内半导体行业、促进技术创新以及增强国家安全。

总资金、投资和支出预计将达到5000亿美元。

更重要的是,这项法案预计将在未来5到10年内创造超过50万个就业机会。

作为房地产投资者,您需要关注就业强劲且租户收入较高的地区。了解哪些美国州将从中受益最大。

房地产市场

《CHIPS与科学法案》通过其专注于刺激国内半导体制造和促进经济增长的举措,可能对美国房地产市场产生显著的积极影响。

以下是具体影响:

- 制造业中心的住房需求增加

- 就业创造:《CHIPS法案》预计将在半导体制造、研究及相关行业创造50万个高薪职位。这种就业增长将推动主要芯片生产设施周边地区的住房需求,例如:

– 亚利桑那州(凤凰城)

– 德克萨斯州(奥斯汀、泰勒)

– 纽约州(克莱、奥尔巴尼)

– 俄亥俄州(新奥尔巴尼)

– 俄勒冈州(希尔斯伯勒) - **人口增长:**就业机会将吸引人们迁往这些地区,从而增加住房需求,并可能推高房价和租金。

- 建筑活动增加

- **住宅开发:**半导体设施附近对住房的需求增加可能会推动住宅建设项目,以满足不断增长的劳动力需求。

- **基础设施扩展:**为支持这些设施而进行的道路、公用事业和公共设施投资也可能改善当地房地产市场。

- 房产价值上升

- **经济增长:**就业和投资的增加可能会提升当地经济,推高房产价值,并吸引房地产投资者到这些地区。

- **热点地区:**受益于《CHIPS法案》的城市和州可能在房产价值方面实现快速增长,成为新的房地产热点。

- 租赁市场增长

- **短期需求:**许多为半导体工作搬迁的员工可能在购房前选择租房,从而推动租赁市场活动。

- **企业住房:**建设半导体设施的公司可能会增加对承包商和员工临时住房的需求。

- 住房负担能力的挑战

- **供应压力:**需求激增但住房供应未相应增加,可能加剧住房市场紧张地区的负担能力问题。

- **绅士化风险:**经济快速增长可能导致住房成本上升,将低收入居民排挤出受影响地区。

这是一个理想的投资者机会,这些地区的租金正在上涨。

- 长期的全国影响

- **经济稳定:**通过加强美国经济并确保供应链韧性,《CHIPS法案》可能为国家房地产市场的长期稳定做出贡献。

受影响最大的州

- 亚利桑那州

- **主要项目:**Intel在钱德勒的扩展和台积电(TSMC)在凤凰城的设施。

- **投资:**台积电的设施投资超过66亿美元,而Intel的扩展投资为78.7亿美元。

- **=> 就业:**Intel在亚利桑那州的项目预计将在多个州(包括亚利桑那州、新墨西哥州、俄亥俄州和俄勒冈州)创造多达3万个就业机会。

- 纽约州

- **主要项目:**美光科技承诺在纽约州克莱新建一座价值1000亿美元的芯片工厂。

- **激励措施:**州政府提供55亿美元税收优惠,联邦政府为奥尔巴尼NanoTech提供8.25亿美元资金支持。

- **=> 就业:**美光在纽约州克莱的投资预计将创造约2万个就业机会。

- 俄亥俄州

- **主要项目:**Intel在新奥尔巴尼扩展半导体制造设施。

- **投资:**投资数十亿美元开发最先进的芯片生产设施。

- **=> 就业:**Intel在俄亥俄州的扩展是更广泛计划的一部分,预计将在多个州创造多达3万个就业机会。

- 德克萨斯州

- **主要项目:**三星电子在泰勒的设施以及德州仪器在多个地点的项目。

- **投资:**三星承诺投资170亿美元,德州仪器承诺投资300亿美元。

- **=> 就业:**预计半导体制造领域直接创造1万到1.5万个就业机会,建设阶段预计创造6500个建筑岗位。

- 俄勒冈州

- **主要项目:**Intel在希尔斯伯勒的持续投资,作为其美国制造网络的一部分。

- **=> 就业:**Intel在俄勒冈州的活动包含在公司的扩展计划中,预计将创造多达3万个就业岗位。

- 犹他州

- **主要项目:**德州仪器的半导体晶圆厂。

- **投资:**德州仪器16亿美元投资的一部分,与德克萨斯州共享。

- **=> 就业:**预计在Lehi工厂直接创造500至800个制造和工程岗位。

总结

《CHIPS法案》的目标是:

- 减少美国对外国半导体制造的依赖。

- 在全国范围内创造高薪工作岗位。

- 提升在拥有大规模制造投资的州的地方经济。

《CHIPS法案》可能通过创造就业机会和人口增长,刺激半导体制造中心附近的地区住房市场。

我们很高兴为您介绍这些地区的房地产经纪人和物业管理人员。如果您有更大的兴趣,我们也乐意探索扩大这些服务的可能性。

这些州因现有基础设施、劳动力能力和有利政策,正在成为国内半导体复兴的领导者。

America Mortgages已准备好帮助您驾驭这些令人兴奋的机会。无论您是针对高需求市场的投资者,还是在探索融资选项的房主,我们都提供量身定制的解决方案以满足您的需求。

如需更多信息,您可以通过以下方式轻松联系我们:

安排方便的时间与我们的美国贷款专家交谈。

每周7天、每天24小时与美国贷款专家交流:+1 845-583-0830

安排方便的时间与我们的美国贷款专家交谈。