CALIFORNIA

Californication, Red Hot Chili Peppers

In last week’s “Buyer’s Guide to California Pt 1 – Education Matters,,” we discussed why Education is an important driver of where overseas borrowers choose to invest in real estate.

In that report, we looked at the top 50 Public, and Private high schools, average ACT/SAT scores, Median Household Income, Average Home Prices, and Rental Yield.

We argued that when looking at where to make your U.S. property investment, the quality of education in the nearby city/area is a factor in the decision since there is always a notion of “can I live there one day” and “maybe my children can go to school there“. Popular cities in the U.S. will undoubtedly have good schools in the city or in the vicinity.

“Popularity as a living destination” in turn drives demand, home value appreciation, and strong growth in rental income.

This week we focus on Demographics.

An under-appreciated factor in determining where to own is what city has the most culturally similar population. It’s much easier when you have neighbors that speak your language and share similar cultures and values.

We will answer these questions (and much more)!

- Which high schools in California has the highest Asian population?

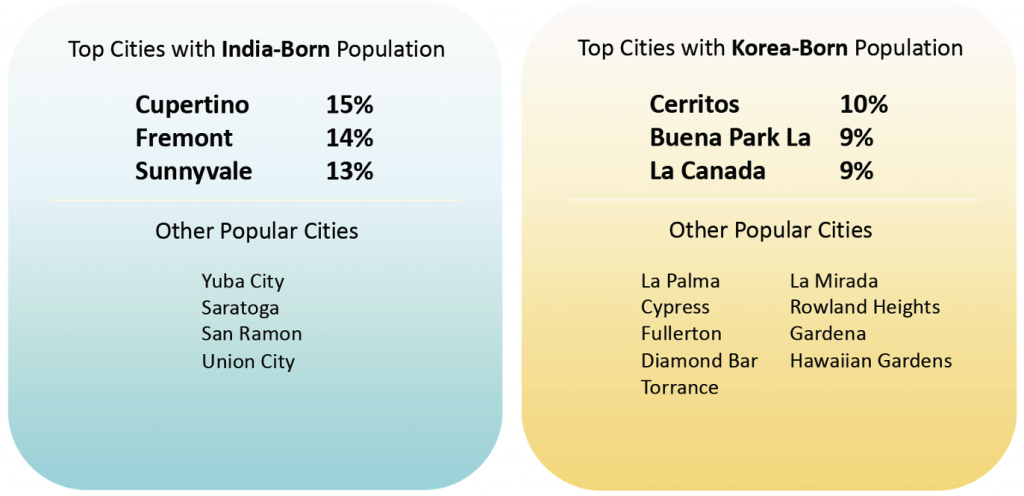

- Which cities have the most Korean-born residents?

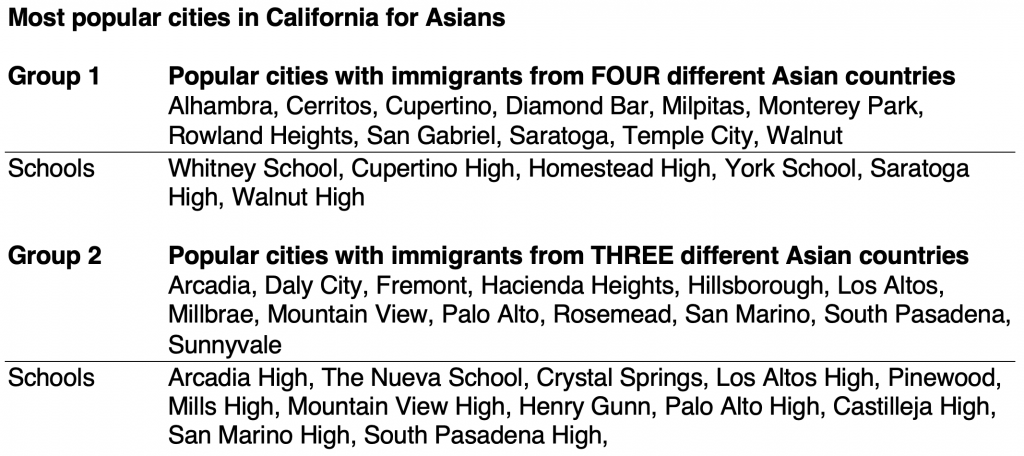

- Which cities have the highest total Asian population and the respective top schools?

- Does the highest Asian population determine how home prices will behave?

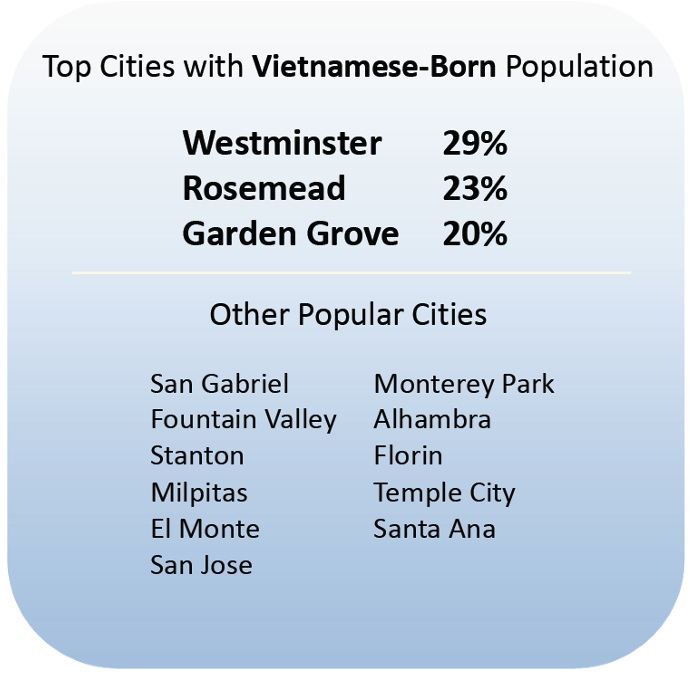

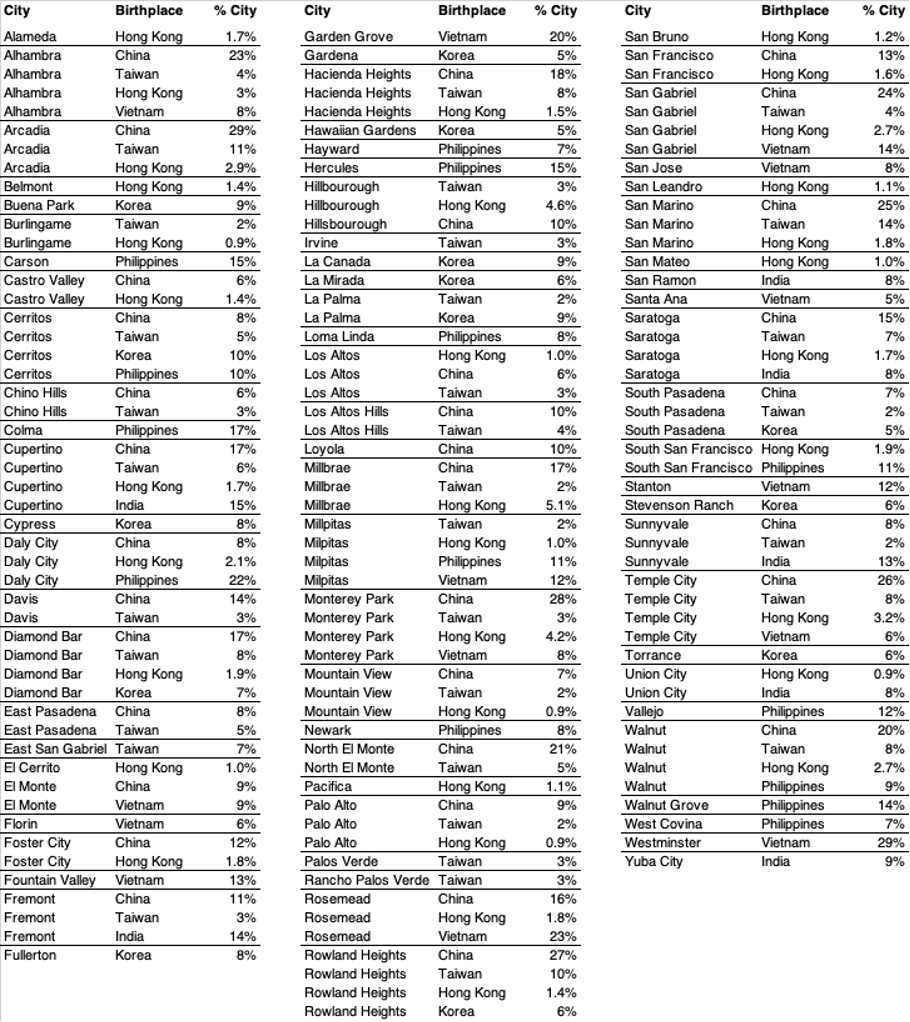

- Which California cities have the highest: Hong Kong, China, Taiwan, India, South Korea, and Philippines-BORN residents?

Demographics matter!

In this study, we solely focus on the Asian population in schools. Asians have been the biggest group of immigrants over the last 60++ years, spurred mainly by the Immigration Act of 1965 but also the Taiwan Relations Act of 1979, the Luce-Celler Act of 1946 as well other obvious political issues of the time.

In addition to the above reasons, many immigrants just wanted a better life for their families, they studied hard, and slowly communities grew around the top education destinations.

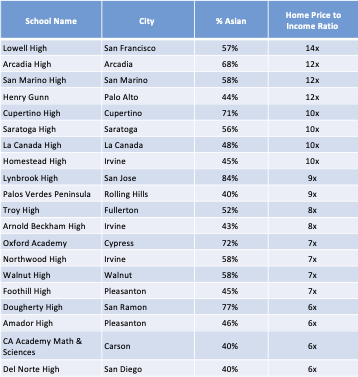

Here is the Asian population (>40%) for the top 50 Public and Private Schools in California.

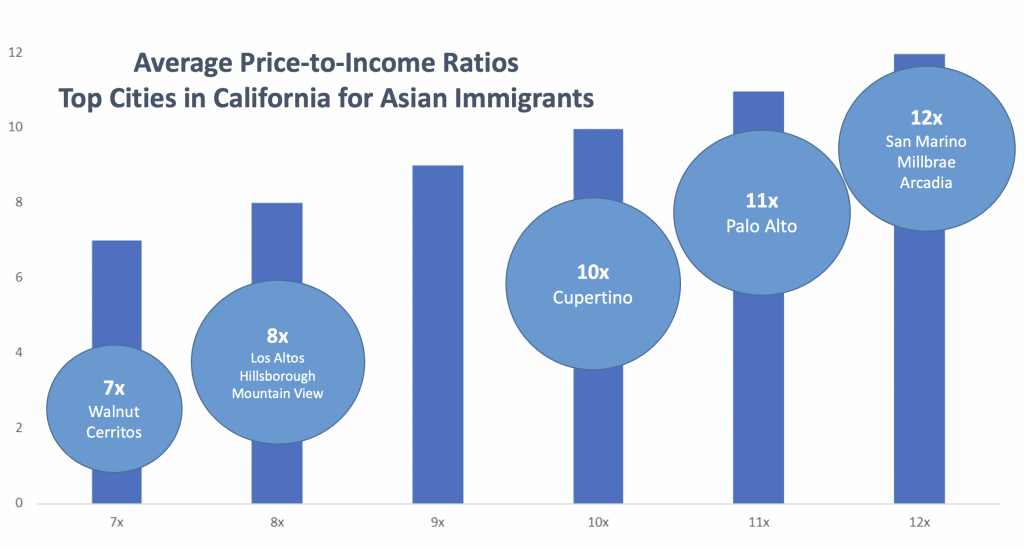

You can also see that these cities have the highest Home Price to Median Income ratios, highlighting the center of attraction for Asians moving to the U.S.

Note a common rule for affordability is for a home price to be UNDER 3x your income!

Public High Schools

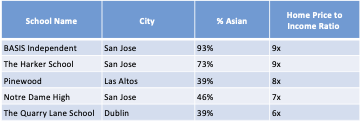

Private High Schools

Takeaway – You can see cities where the top schools are located have very high Home Price to Income Ratios which highlights the property value growth driven by families moving to these cities, in particular Asians.

The next study is very interesting!

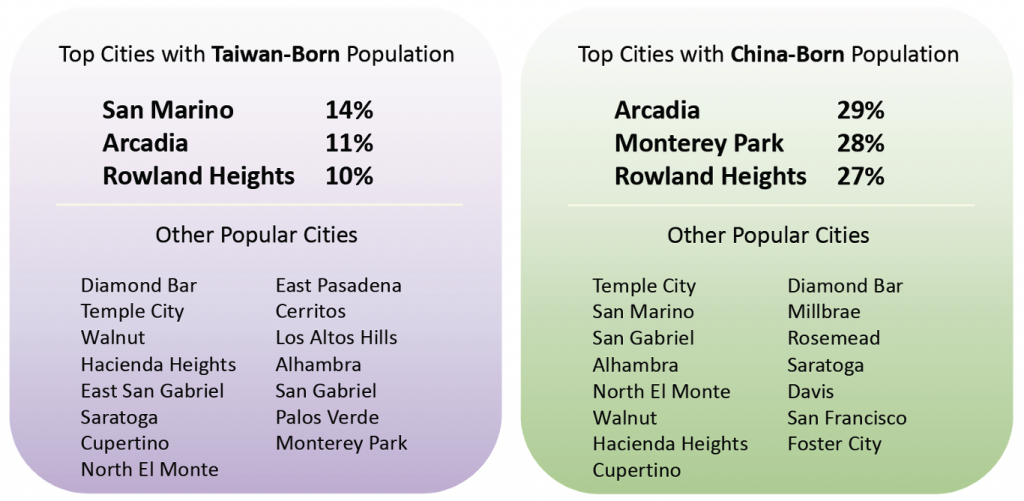

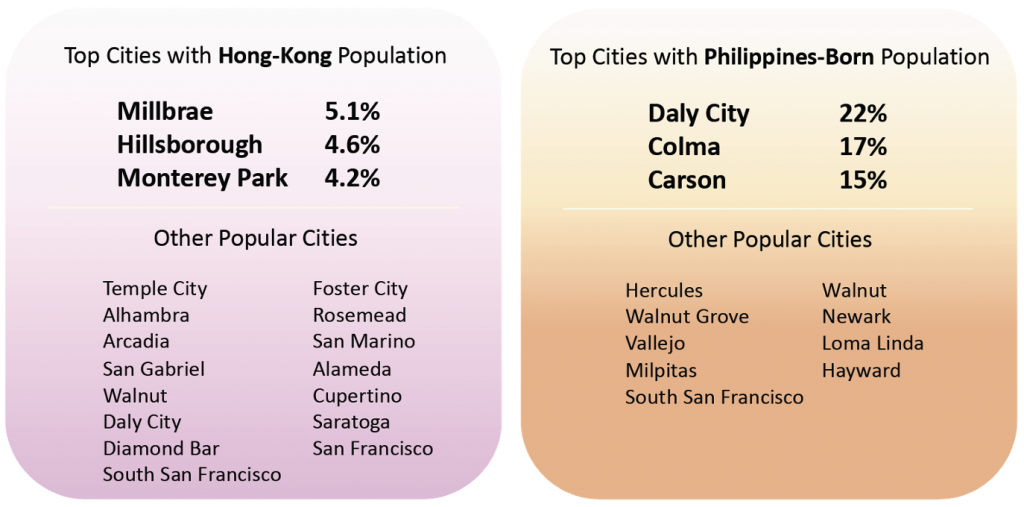

Our team looks at which California cities have the highest overseas-born residents, specifically from: China, Hong Kong, Taiwan, South Korea, Philippines, Vietnam, and India.

You guessed it, many are in the cities where the top schools are

We only used cities with over 20,000 population.

*Refer to full chart below

Here is same chart in Alphabetical Order

Illustrating popular cities ranked by multiple demographics

As you may observe in this report, the cities with the highest Asian immigrant population tend to be where the most demand is, especially when compared to household income, and it’s no surprise it’s also where the top high schools are.

That is to say, the schools and cities mentioned in last week’s report on Education being the main driver of price appreciation and rents are very similar to the cities mentioned in this report.

While this study is not meant to be a rigorous analysis by any means, it is close to my heart since I moved from Singapore to San Francisco when I was 16. My parents had the same thought process…strong Hong Kong population and good schools. I ended up finishing high school in San Francisco and attended UCLA.

Stay tuned for the final part of our Buyer’s Guide to California, where we take a quick look at the general carrying costs for a rental property, including taxes, deductions and other administrative costs.

Finally, we will be hosting a webinar with our California Partner for a real “on-the-ground” discussion along with a panel of real estate experts for the Bay Area, Palo Alto, Los Angeles, and Orange County. We are still finalising the exact details, but this will be in September.

Have a good weekend! If you want a copy of the spreadsheet with the data from our research, please contact us. We are happy to share our findings.