In this edition of the Launchpad Series – we introduce the most widely-used tool for property investors at the moment, A Bridge Loan – often considered the “Swiss Army Knife” of financing solutions.

What are bridge loans?

A bridge loan is a type of asset-based, short-term loan, typically taken out for a few months to a couple of years pending the arrangement of longer-term financing or an exit, such as the sale. It is used to ‘bridge’ the gap during times when financing is critical but not readily available.

Bridge loans let homebuyers take out a mortgage against their current home to make the down payment on their new home. A bridge loan may also be a suitable choice for you if you want to purchase a new home before your current house has sold. This financing structure may also be beneficial to businesses that need to cover operating costs while waiting for long-term funding.

Introducing AM Bridge!

AM Bridge – A liquidity tool once reserved for the wealthy is now available for everyone!

Real Estate investors are often asset rich but cash poor. On paper, their net worth may be significant, but their wealth can be tied up in real estate or other businesses. Accessing such funds might mean sacrificing a stake in their business or surrendering some influence over its future – neither of which may be appealing.

It is not always the case that a real estate investor has a few hundred thousand dollars just sitting in the bank readily available to fund a property immediately. Even if they do, they may not wish to tie all their cash upon one property. In today’s market, the property that investors want could be in high demand and needs to be acted on quickly; these could be higher-yielding investments that need immediate funding. Having access to large sums of cash quickly and easily is what HNW investors have had at their disposal for decades. America Mortgages has now made this powerful liquidity tool available to everyone.

How is it used?

Here are some popular uses of “Bridging” Loans:

– Filling the contingency sale of an old property before you can purchase the new property. You can take a Bridge Loan and use your old house as collateral for the loan. The proceeds can then be used to pay a down payment for the new house and cover the costs of the loan. In most cases, the lender will offer a bridge loan worth approximately 80% of both houses’ combined value.

– To purchase based on the asset value of the new build so the borrower can meet the final payment before delivery.

– For the initial purchase until entitlement or for refinancing after a cash purchase until entitlement.

– To purchase greenfield land to begin commercial development. Once certain stages of development have been completed, it’s easier to obtain traditional bank financing.

– Cash-out Bridge Loan for short term personal or business use.

The Market

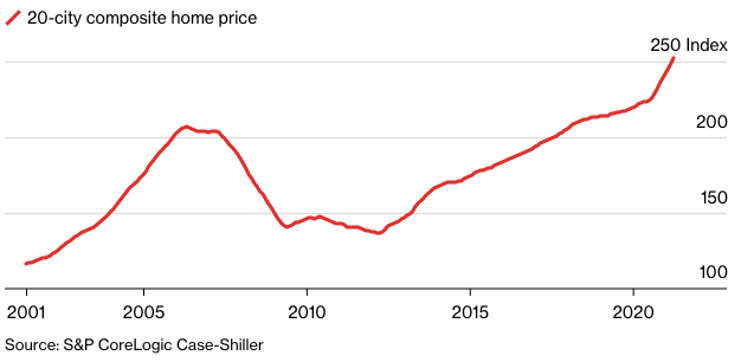

The pandemic has created a boom in the bridge loan market in several ways.

Firstly, it has created an economic environment filled with uncertainties, and as a result, more businesses need capital as soon as possible and can’t afford to wait for a traditional loan. They will thus turn to bridge loans.

Secondly, with the threat of the Delta variant and the increased number of companies delaying return-to-office plans, many are looking for new homes in more spacious areas. However, with how hot the property market is – data from Zillow show that houses are currently on the market for an average of 6 days only. Hence, it is critical for buyers to purchase their house as soon as possible to avoid disappointment. But, they may not have sold their old house yet and do not have enough money for this new house, which is why a bridge loan would be extra helpful.

Thirdly, there has been an accelerated trend of people migrating to Sunbelt cities due to greater job opportunities. This has driven up rents in these cities – the Phoenix area had the biggest rent increase in July, up 17% from a year ago. Due to the profitability of the rental trade, more developers and businesses are looking to acquire multifamily rental units. Short-term commercial bridge loans will provide them with the needed flexibility to take on such assets while they look for permanent financing options. This will help businesses get their assets to perform at maximum potential.

The Problem

When an American Mortgage bridge loan specialist gets a request for short term financing, they ask three things;

1. Where is the asset?

2. What is the value and the outstanding debt?

3. What situation are you trying to solve?

Number 3 is the most crucial and often the hardest to rationalize. Even the wealthiest people have used short-term bridge financing to access liquidity even when “conventional” options are still possible. This is mainly due to the time and effort required to obtain long-term financing. Cash-flow, credit issues, or asset use may prohibit a “conventional” bank loan. When time is a factor in a transaction, it is important to see the opportunity cost in not closing quickly or obtaining a simplified equity release.

Our Solution

Typically, the timeline for traditional bank loan processing from origination to closing is longer than most borrowers prefer for a time-sensitive funding solution or if the project lacks sufficient stable cash flow. The short-term nature of bridge loans generally allows alternative lenders to provide an approval decision and funding with greater speed than a more traditional lender. At America Mortgages, we’ve funded loans in as little as a couple of days since the initial contact.

To allow for such a speedy funding process, the sponsor’s expected property value and experience to execute the business plan are the determining factors in the decision-making process. For this reason, the loans are commonly non-recourse, which is another benefit to the borrower.

Bridge loans are often the preferred funding option for uses such as:

– Highly structured transactions

– Discounted note payoffs

– Lease-up stabilization

– Redevelopment of existing properties

– Repositioning of a tired or underperforming asset

– Property acquisitions with a short closing timeline (or challenges on the property or sponsor)

– Recapitalizations/Debt Restructuring or Partner Buyouts

– Other uses on a case-by-case basis depending on borrowers specific funding needs, where traditional funding sources like banks or insurance companies will have a hard time approving such loan requests.

– Lending to foreign nationals with a “same-as-cash” basis

Short-Term vs Long-Term

Unlike short-term financing, longer-term financing is susceptible to the regulatory hurdles associated with securing long-term fixed-rate mortgages. This is why bridge loans are often provided by unregulated lenders, family offices, or in some cases, HNW investors. In addition to the regulatory scrutiny, banks or insurance companies require, the sponsor’s credit history and financial strength also take a front seat in the credit decision for long-term loans. Keep in mind, America Mortgages will never work with “lend-to-own” investors and lenders. Our goal is to find you a solution that works with your situation with a long-term solution and exit from the bridge loan.

While bridge loans are the preferred option for many specific financing needs, several downsides come with short-term financing that is meant to fund projects. When assets need work, lenders will consider these higher risks and, therefore, charge higher interest rates.

Additionally, bridge lenders generally do not exceed 70%-85% of the property cost basis to limit their financial exposure. However, this leverage is higher than traditional lenders would advance for the same project. This is because bridge lenders rely on the sponsor to fix the issues, which made the property ineligible for long-term financing in the first place. This enables the asset to become stabilized and ready for exit through a sale or by refinancing the property through traditional channels.

There’s no denying a bridge loan can be convenient if you’re prepared for a change but don’t want to risk a contingent offer. A bridge loan can also be an excellent way to finance a new house if you need to relocate for a job. For more information on AM Bridge, please connect with us via email at [email protected]

www.americamortgages.com