Are rising interest rates a hindrance or a golden, hidden opportunity for savvy U.S. real estate investors? In a mortgage environment where rising interest rates can trigger unease, it’s essential to grasp that the U.S. real estate market possesses its own distinct dynamics.

In this article, we will explore the facets of investing in real estate during times of high interest rates, shedding light on the untapped potential that lies within what may be perceived as a challenging terrain. Despite market fluctuations in everything from equities to crypto and the allure of alternative investments, one constant is always there: the enduring need for housing.

Even when conditions aren’t ideal, there will always be individuals seeking a place to call home, whether through rental properties or other real estate avenues. Read on for three tips you can reference if you’re looking to invest during a time of interest rate hikes.

Just last week, Barbara Corcoran, one of America’s most renowned real estate investors, posted to her one million followers that while high rates and high prices push “more buyers on the sidelines” to “wait it out,” she’s not exactly sure what everyone’s waiting for — because once interest rates go down, a home buying frenzy will begin, and prices will rise even more, she predicted.

How Does High Interest Impact Real Estate?

When the Federal Reserve increases rates, the market has a huge impact. Buying property gets more expensive. Therefore, the overall demand decreases for buyers who may have been looking previously, mainly from buyers who planned on buying properties to live in.

- More buyers are priced out

- Demand falls

- Supply falls

- Long-term impact depends on the growth of the overall economy

More Buyers Are Priced Out

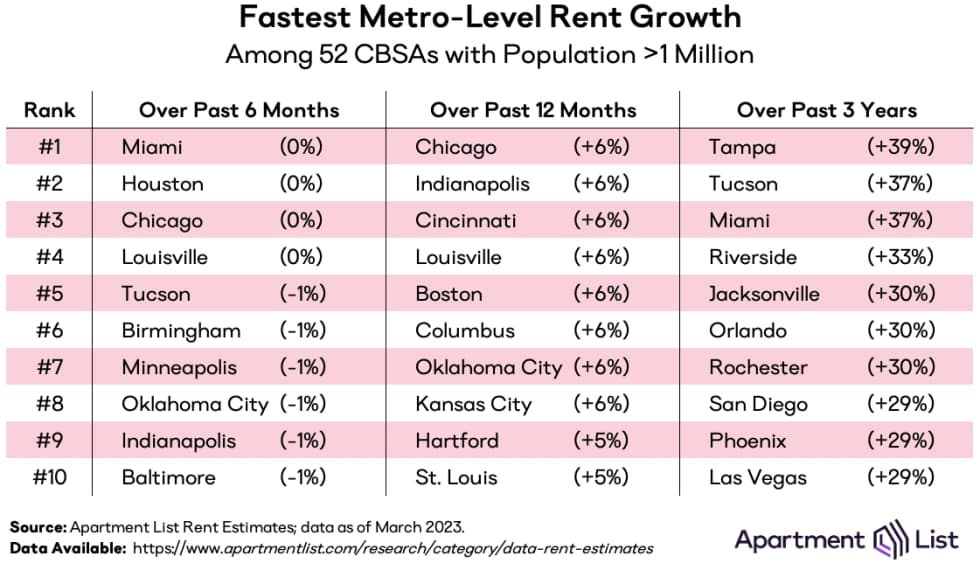

The owner-occupied buyers, which make up a huge percentage of the U.S. real estate market, will wait, forcing them to stay put, causing a lack of inventory turnover or rent increasing rental prices due to higher demand.

With a rise in mortgage rates also comes a rise in people looking to rent out homes because they have limited options. This is the perfect opportunity for investors to look not at the interest rate, as they can always refinance if rates dip, but as a pure cash-flow play with appreciation once rates decrease.

Demand Falls

The demand for homes is lower when interest rates rise, which is what the Federal Reserve wants to happen. To maintain a stable market, increase affordability, and have lower interest rates in the long run, the Fed has to increase rates from time to time.

So, what does this mean for buyers and investors? With less demand for homes, investors may be wary of stepping into the real estate market, and buyers must either pay the price or wait until the federal funds rate goes down and the market is more favorable.

Supply Falls

The supply of homes can also face restrictions as homeowners are hesitant to sell because doing so would mean entering the market as buyers in a higher rate environment, which could significantly increase their borrowing costs. According to a recent Redfin report, about 80% of homeowners with mortgages currently enjoy interest rates below 5%. With rates now hovering between 7-8%, more sellers are choosing to stay put. As a result, active buyers are left with a dwindling inventory to select from.

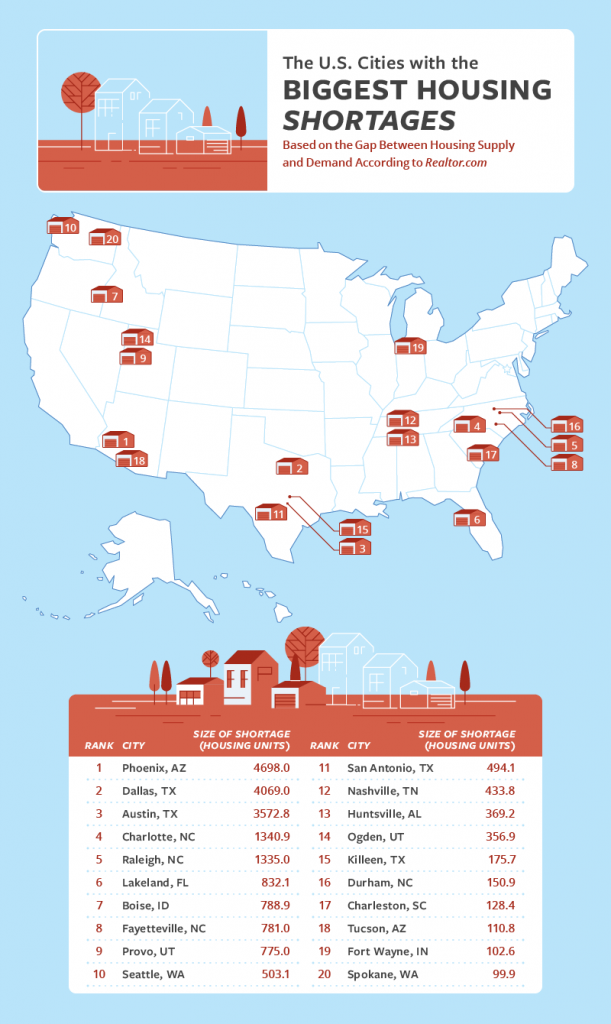

In addition, according to the National Association of Realtors, the United States is currently experiencing a housing shortage of between 5.5 and 6.8 million units, with the gap between supply and demand widening every year.

Long-term Impact Depends on Growth of Overall Economy

The lasting effects of high interest rates on the real estate market depend on the overall performance and growth of the economy. As the economy stabilizes or expands, the dynamics of the real estate market may evolve, potentially creating new investment opportunities in this challenging landscape.

3 Tips for Investing in Real Estate in High Interest Times

So, you want to invest in real estate despite market volatility? This certainly isn’t impossible, and these tips may help shape a successful investment strategy:

- Buy if you can

- Consider a long-term strategy

- Utilise fixed interest-only loans

Buy If You Can

Higher interest rates will result in higher borrowing costs. This will price many buyers out of the market and result in less demand and possibly lower prices. It could be a worthwhile investment if you can afford to purchase a property during a time of high interest rates. Many home sellers will be trying to get their homes off of the market with no luck due to the lower demand. If you have the funds available, you may be able to negotiate a lower asking price by making a competitive offer (eg: cash, no contingencies).

You can also consider increasing your down payment amount. A higher down payment means less risk for the lender; this will help you secure a lower interest rate, which will lower your monthly payment and save you on interest in the long run, potential increasing your rental yield.

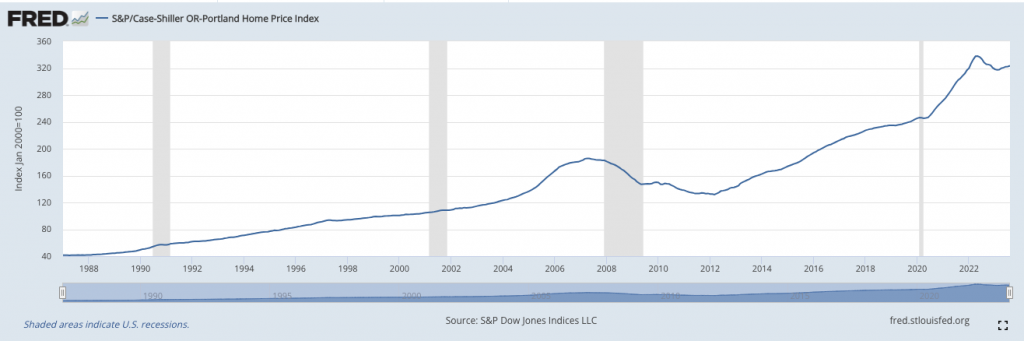

One factor that will always remain true, even during tough market times, is that people will always need a place to live, and property values have historically bounced back and increased after economic downturns.

Consider a Long-Term Strategy

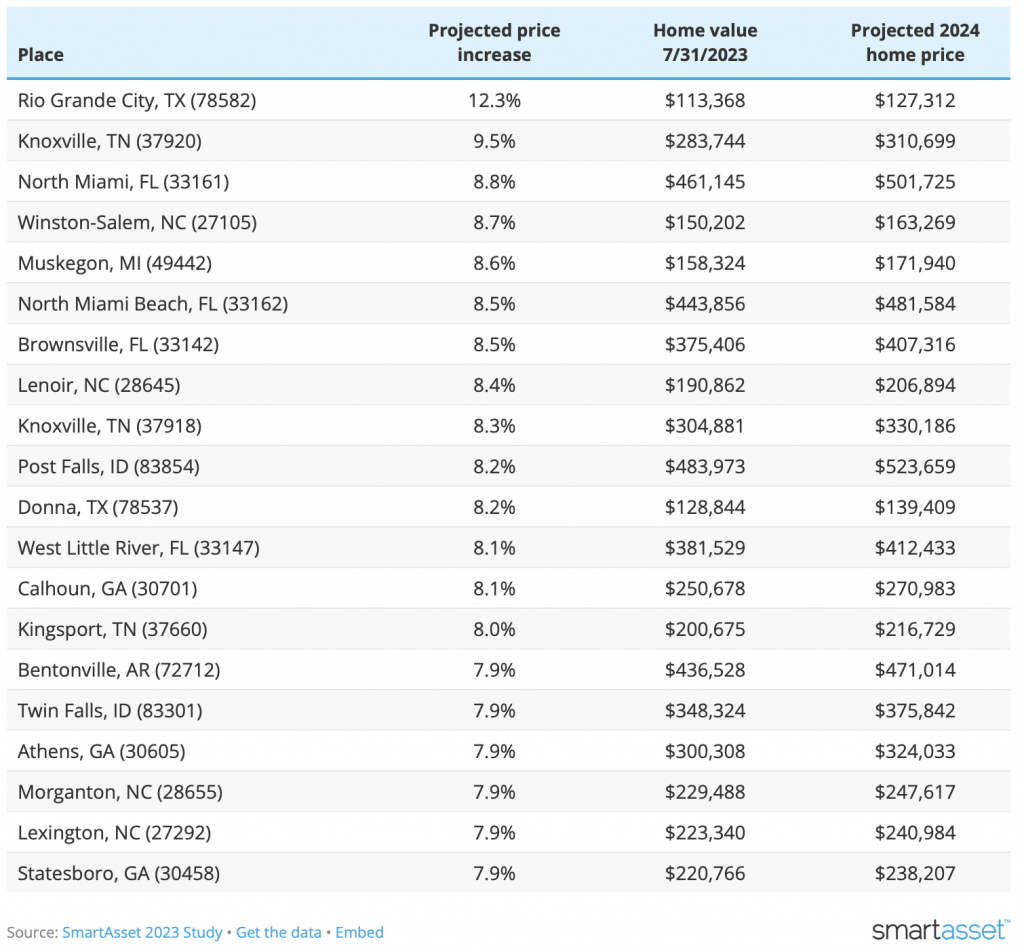

Compared to last year, American homebuyers have seen a 24% decrease in their spending power, as interest rates surpass 7%. With market volatility making buying difficult, many people will opt for renting because it’s what they can afford. As an investor, this presents a unique opportunity for you.

Borrowing money becomes more expensive when the Fed raises rates, and the demand for rental homes and apartments will increase as many prospective homebuyers will struggle to qualify for a mortgage and will need to resort to renting. A rental property in the right neighborhood can be a great investment that can increase in value over time and help you hedge against inflation.

Purchasing a rental property can allow you to yield high returns, especially if you decide on a long-term strategy. According to a recent report from RentHop, a long-term rental strategy is more profitable for landlords that owning 1-3-bedroom units in major cities with higher long-term rents such as New York City, Miami, and Los Angeles.

Investing in a home or apartment can help you take advantage of the current increased rental demand. However, you could also consider investing in commercial real estate, like duplexes and multifamily properties.

Take Advantage of Interest-Only Loans

You might also want to consider financing options like a fixed interest-only loan mortgage. A fixed interest-only mortgage has a fixed 10-year interest rate, but you are only paying the monthly interest and not anything towards the principal. These loan programs give you the comfort of a fixed rate but the flexibility of paying only the interest until rates decrease. The beautiful advantage of this program is if rates never decrease (doubtful), you have a rate that is fixed, and after that, the interest-only portion will convert to a 30-year fixed principal and interest loan without an adjustment in rate. Yes, we stated that correctly, America Mortgages has a 40-year amortized mortgage regardless of the age of the borrower.

As a real estate investor, an interest-only loan can be a great option if you want to secure lower payments for a fixed period of time and gain predictability with your payments long term. This is especially lucrative for investors with a long-term hold strategy.

Many believe you should invest in real estate during times of high inflation. You just need to have an investment strategy and align yourself with real estate professionals who can help set you up for the long haul.

Final Thoughts

Are you considering investing during high-interest times? You could have some luck here and achieve a significant return with the proper approach. As mentioned previously, high interest rates are not necessarily a reason to step out of the market. Interest rate hikes can allow investors to take advantage of having less buyers in the market and increased demand for rentals.

A rising rate environment doesn’t need to slow you down. People will always need housing, and even as we approach an economic downturn, real estate has historically bounced back and increased in value over time.

As a company, America Mortgage’s only focus is providing U.S. mortgage financing for non-resident U.S. real estate investors, both Foreign Nationals and U.S. Expats. If you’d like to schedule a no-obligation appointment with one of our U.S. loan officers to discuss U.S. mortgage options, please use our 24/7 calendar link.

www.americamortgages.com