Like all investment types, knowing what you invest in is essential to meet your financial goals and timeline.

As we enter 2023 with a cloud of economic uncertainty looming overhead, it becomes more critical than ever that you consider the right moves before buying an investment property, especially overseas.

Clear Investment Goals and Motives

Before starting, we often ask potential investors some serious questions.

Have they invested before?

What asset class do they invest in, and what is the rate of return on your investment?

Get The Right Facts

Before investing in a foreign country, you must consider researching property trends and reading up on its economic and political situation to ascertain its investment viability better.

You may also wish to familiarise yourself with the targeted country by visiting it or talking to people who have lived there.

What additional or hidden costs (e.g., flying over to inspect the property) to the purchase?

Should the investment not pan out as expected, have you considered your exit strategy?

Use Professionals To Help

You may also want to seek out independent and experienced real estate agencies who may be able to help you source for the type of property you wish to invest in, in the location you want.

Do seek legal assistance to ensure your investment is legal and your rights are protected.

You may also want to chat with your tax consultant to be fully aware of applicable or deductible taxes to lower your taxable income.

Accumulating Foreign Currency Reserves

The stakes are higher when investing in foreign properties.

We gather the highs and lows from a seasoned property investor on potential pitfalls to avoid when buying offshore properties.

Tip #1: Know Your Exit Strategy When You Buy A Property.

Buying is easy, but selling is the problem.

The exit strategies in every country differ as much as the growth cycles.

Before investing, you need to know the cities the locals migrate to for job opportunities. How long you invest and how to exit.

When you buy the “wrong” properties in the wrong neighbourhoods, you may find yourself stuck when you want to sell.

Tip #2: Local Property Knowledge

Having local knowledge in the country you want to invest in is critical.

Knowing where the locals are buying, the law of the land, and taxation are essential.

In some countries, you can only sell your property to a citizen.

It is best to do independent research before starting your investment journey overseas.

Tip #3: Comply To Overseas Taxation Requirements

Rental properties may be subjected to income tax and yearly filing similar to Malaysia’s.

It is essential to find out how to do this correctly.

Tip #4: Currency Fluctuations & Exchange Rates

When you buy a foreign investment property, ensure that you are prepared for currency fluctuation, as the exchange rates may change dramatically.

Tip #5: Property Management, Maintenance & Tenants

A professional project management company takes care of tenants, turnover for Airbnb rentals, and general maintenance.

You wouldn’t want to deal with a clogged WC halfway around the world.

Tip #6: Retrace Past Property Performance For Future Potential.

Investing in foreign properties can run into management problems, especially regarding Guaranteed Rental Returns (GRR).

During the Covid-19 pandemic, property prices and mortgages fell – The market in 2022 has picked up significantly, and 2023 will be better for international property investment.

Tip #7: Bear in mind currency fluctuations, political changes, or conflicts

Pitfalls like currency fluctuations, international political situations, or conflicts can also affect investments.

Tip #8: More Countries, More Property Choices – How To Manage Distance & Time Zone

Investing in foreign properties opens you up to more choices in a larger property market, but the distance from your home base can be an issue.

Unless you outsource the project management of your properties, trivial matters like changing a lightbulb or unclogging a WC can become a problem.

Tip #9: Location Distance From Your Properties

Finding a balance of easy accessibility and being as close to your properties vs. your returns is essential.

Would you want a property close enough to drive by but earns little in ROI or somewhere further away that earns passive income?

Tip #10: Ascertain Your Objective For Investing In Foreign Properties

The scenario differed from five years ago when many were buying foreign properties in a hot market – a trend that will not likely be repeated.

The trend these days seems to be investing in properties with an intention or objective in mind, for example, for studies or retirement.

Property is a significant investment, so take your time to find the right one.

After all, property investment is about location, location, location, whether domestically or abroad.

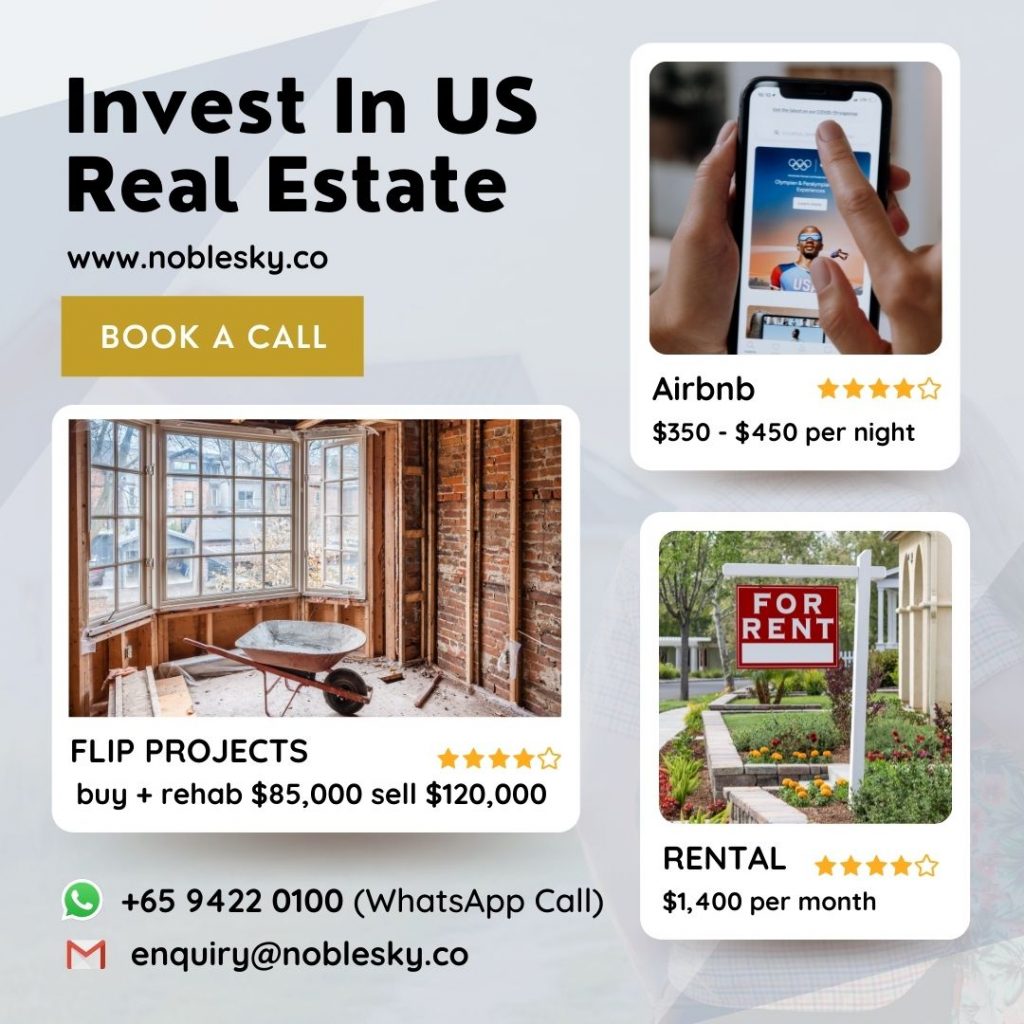

America Mortgages for Overseas Borrowers

Financing U.S. real estate for overseas borrowers, including foreign nationals and U.S. expats, is indeed possible through America mortgages. These specialised mortgage options cater to non-resident borrowers, allowing them to invest in U.S. properties. With America Mortgages, overseas investors can make informed decisions and achieve their financial goals in the U.S. property market. Connect with us today at [email protected] to find out more.