In the webinar, “Investing in NYC Real Estate for Global Clients,” Alistar Aunty, Managing Director of Bridgewater International, and Robert Chadwick, CEO of America Mortgages, provided valuable insights into NYC real estate. They discussed the benefits of full-service property management for international investors, strategies to enhance ROI, and NYC’s property market dynamics.

Bridgewater’s investor support, and mortgage options tailored for global clients. For those who couldn’t attend, the recording is now accessible here.

During the session, Alistar Aunty (AA) and Robert Chadwick (RC) addressed a variety of questions, offering informative responses to help global investors make informed decisions in the NYC real estate market. Remarks have been edited for clarity and brevity.

Do you only manage properties in NYC, or do you cover other states as well?

AA: We primarily manage properties in New York, New Jersey, and Florida. We have managed properties in other locations, like Chicago, but our main focus and expertise are in NYC, NJ, and FL.

What is the rental market like in New York

AA: The rental market in NYC is robust, with high demand since about 70% of residents rent. A well-maintained property in a good location will always attract tenants, especially if it has amenities.

What about capital growth?

AA: Historically, NYC has shown steady capital appreciation. Although recent interest rate hikes have kept prices relatively static, we expect capital growth to resume as interest rates decrease. If trends from 1999 to 2019 continue, there should be good appreciation in the coming years.

Would you help in finding tenants for us?

AA: Yes, finding tenants is a key part of our services. The sooner we can secure a well-qualified tenant, the sooner you start earning income and improving your return on investment.

Hi Alistar, how frequently do you conduct routine site visits to the properties you manage?

AA: For newly purchased properties, we conduct several visits during the build phase and a pre-completion inspection. Once occupied, we visit 1–2 times per year, which balances tenant privacy with inspection needs.

Hi Robert, what’s your advice? Should we wait for interest rates to drop, given the potential upcoming rate cut?

RC: I recommend buying now and refinancing later if rates drop, as waiting could mean missing a buyer’s market. Once rates decrease, demand might push prices up.

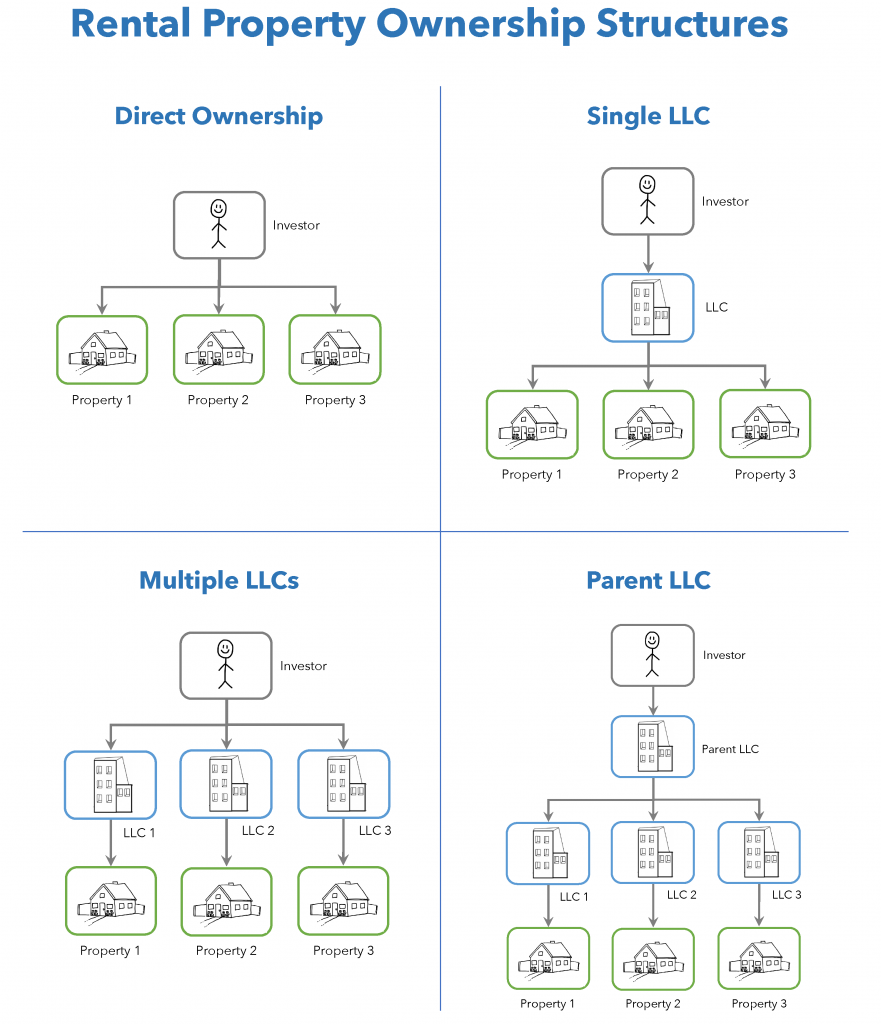

Thank you for the webinar. I work with high-net-worth individuals and families based in Africa. Can a bespoke New York/international property investment vehicle/company be designed and managed for high-net-worth families? Are there any residence advantages?

RC & AA: Yes, a bespoke investment structure, like a U.S. LLC, can be set up to manage properties for high-net-worth individuals, providing legal and tax benefits, such as estate tax advantages.

What’s the average mortgage rate for foreign buyers?

RC: Foreign buyers typically pay about 1% more than U.S. residents with excellent credit. Current rates for foreign buyers are in the high 6% to mid-7% range.

How do you think interest rates will change moving forward?

RC: Interest rates are expected to decrease, especially with a pro-real-estate administration that may lower rates to stimulate the market.

I’m a U.S. citizen living overseas with little to no U.S. credit. Which mortgage program applies to me?

RC: You would initially qualify as a foreign national. After reestablishing U.S. credit over about two years, you could switch to an expat loan, typically at a slightly better rate.

What is the current 30-year fixed rate?

RC: Rates vary depending on factors like loan-to-value (LTV) and borrower profile. For foreign buyers, rates generally start around 6% and can go higher.

What are the typical exit costs (e.g., capital gains, broker fees)?

RC: Broker fees are typically 2% of the loan amount. The U.S. offers tax benefits like the 1031 exchange, which defers capital gains tax if proceeds are reinvested in a similar or more expensive property.

Is it possible to qualify for a mortgage on an off-plan property before completion?

RC: Yes, we can pre-approve you for off-plan properties, but locking in the rate long-term may be challenging. Given current trends, you might want to avoid locking in as rates are likely to decrease.

If I bought a property but already own in Connecticut, can I buy now (pre-build) and take advantage of the 1031 Exchange when I sell my Connecticut property?

AA: Yes, you can use the 1031 Exchange if you complete the purchase of a new property within 180 days after selling the Connecticut property, and the new property is of equal or higher value.

What rates apply in different scenarios?

RC: Rates depend on factors like LTV and borrower profile. Foreign buyers usually face slightly higher rates and slightly reduced LTV compared to U.S. residents.

I’m a dual citizen living in Australia but own property in the USA. Can I benefit from your services even if I visit the U.S. often?

AA: Yes, we can provide property management and related services even if you frequently visit, as we cater to both U.S.-based and international clients.

Do banks/lenders apply fees and charges for refinancing? If so, approximately how much?

RC: Yes, refinancing involves fees for appraisal, taxes, insurance, escrow, etc. On average, these costs are about 3% of the property’s closing price.

Contact us at [email protected]

Invertir en bienes raíces en la ciudad de Nueva York (NYC) ofrece oportunidades únicas para inversores internacionales. En un seminario web reciente, Alistar Aunty, Director General de Bridgewater International, y Robert Chadwick, Director Ejecutivo de America Mortgages, compartieron valiosas perspectivas sobre el mercado inmobiliario de NYC. Discutieron los beneficios de una gestión integral de propiedades para inversores internacionales, estrategias para mejorar el retorno de inversión (ROI) y las dinámicas del mercado inmobiliario de NYC. Para quienes no pudieron asistir, la grabación está disponible aquí.

Gestión de Propiedades en NYC

Bridgewater International se especializa en la gestión de propiedades en Nueva York, Nueva Jersey y Florida, ofreciendo servicios completos que incluyen la búsqueda de inquilinos, mantenimiento y gestión de arrendamientos. Su experiencia en el mercado local garantiza que las propiedades estén bien mantenidas y ocupadas, maximizando así el retorno de inversión para los propietarios internacionales.

Mercado de Alquiler en Nueva York

El mercado de alquiler en NYC es robusto, con una alta demanda, ya que aproximadamente el 70% de los residentes alquilan. Una propiedad bien mantenida en una buena ubicación siempre atraerá a inquilinos, especialmente si cuenta con comodidades adicionales.

Crecimiento de Capital

Históricamente, NYC ha mostrado una apreciación constante del capital. Aunque los recientes aumentos en las tasas de interés han mantenido los precios relativamente estables, se espera que el crecimiento del capital se reanude a medida que disminuyan las tasas de interés. Si las tendencias de 1999 a 2019 continúan, debería haber una buena apreciación en los próximos años.

Asistencia en la Búsqueda de Inquilinos

La búsqueda de inquilinos es una parte clave de los servicios ofrecidos. Cuanto antes se pueda asegurar un inquilino bien calificado, antes se comenzará a generar ingresos y a mejorar el retorno de inversión.

Visitas de Inspección

Para propiedades recién adquiridas, se realizan varias visitas durante la fase de construcción y una inspección previa a la finalización. Una vez ocupadas, se visitan de 1 a 2 veces por año, equilibrando la privacidad del inquilino con las necesidades de inspección.

Opciones de Financiamiento para Inversores Internacionales

America Mortgages ofrece soluciones de financiamiento hipotecario para expatriados estadounidenses y nacionales extranjeros que viven en el extranjero. Con más de 150 programas de bancos y prestamistas de EE. UU., proporcionan opciones de financiamiento adaptadas a las necesidades de los inversores internacionales. Para obtener más información, visite su sitio web en www.americamortgages.com.

Conclusión

Invertir en bienes raíces en NYC presenta oportunidades significativas para inversores internacionales. Con la gestión adecuada y una comprensión clara del mercado, los inversores pueden lograr un crecimiento de capital estable y un flujo de ingresos constante. Colaborar con expertos locales y aprovechar las opciones de financiamiento disponibles puede facilitar el proceso y maximizar el retorno de inversión.

Contáctanos en [email protected]

在纽约市投资房地产为全球投资者提供了独特的机会。 在最近的网络研讨会上,Bridgewater International 的总经理 Alistar Aunty 和 America Mortgages 的首席执行官 Robert Chadwick 分享了关于纽约市房地产市场的宝贵见解。 他们讨论了为国际投资者提供全方位物业管理的好处、提高投资回报率(ROI)的策略以及纽约市房地产市场的动态。 对于未能参加的朋友,研讨会的录制可以在**这里**观看。

物业管理服务

Bridgewater International 专注于纽约、新泽西和佛罗里达州的物业管理,提供包括寻找租户、维护和租赁管理等一站式服务。 他们在本地市场的经验确保物业得到妥善维护并且能够吸引租户,从而最大化国际投资者的投资回报。

租赁市场

纽约市的租赁市场非常强劲,约70%的居民是租户。 一处位于好地段且维护得当的物业,尤其是附带附加设施的物业,通常能够吸引租户。

资本增值

从历史数据来看,纽约市的资本增值稳定。 尽管近期利率上升使房价相对稳定,但随着利率的下降,资本增值预计将恢复。 如果1999年至2019年的趋势得以延续,未来几年应会出现良好的资本增值。

租户寻找服务

寻找合适的租户是提供的关键服务之一。 尽早确保找到合格的租户,能帮助尽快开始产生收入并改善投资回报。

定期检查

对于新购买的物业,在建设阶段会进行多次访问,并进行完工前的检查。 一旦物业被租赁,每年会进行1至2次检查,以平衡租户的隐私与检查需求。

国际投资者的融资选择

America Mortgages 提供为在海外的美国外派人员和外国国民量身定制的房贷解决方案。 他们与超过150家银行和贷款机构合作,提供适合国际投资者需求的融资选项。 欲了解更多信息,请访问其官方网站:www.americamortgages.com

结论

投资纽约市房地产为国际投资者提供了显著的机会。 通过适当的管理和对市场的清晰理解,投资者可以实现稳定的资本增值和持续的收入流。 与本地专家合作并利用现有的融资选项可以简化流程,最大化投资回报。

欲了解更多信息,请访问 America Mortgages。 我们的团队随时为您提供帮助,无论您身在何处。 准备好通过专业的保险帮助使您的美国房产投资更成功吗?今天就开始与 America Mortgages 和 Steadily 合作吧。

要与美国贷款专家安排通话,请点击 这里。如需立即帮助,请拨打 +1 (845) 583-0830。

通过 [email protected] 联系我们