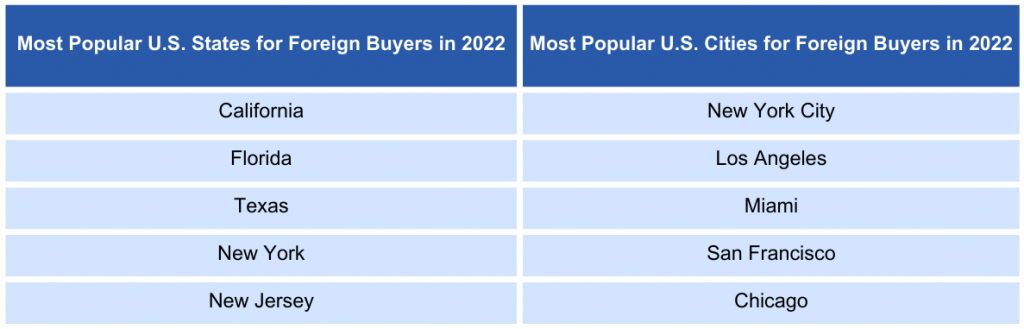

Investing in U.S. real estate as a U.S. expat or foreign national can be a profitable endeavour with a potential for significant returns. However, it can also be complex and challenging without the right knowledge and strategies in place. At America Mortgages, we offer these proven strategies to help you build a solid real estate portfolio, focusing solely on investment properties for rental income and appreciation. According to the National Association of REALTORS, foreign buyers accounted for an estimated $59 billion in U.S. residential real estate purchases in 2022, up 8.5% from 2021.

Understand the Financing Options

“Traditional” bank mortgages may be difficult if you have no U.S. credit and may require a significant down payment or AUM. However, as an expat or foreign national, America Mortgages offers financing solutions specifically designed for foreign nationals and U.S. expats. With a minimum of 25% down as a foreign national and 20% down as an expat, with no requirements for AUM, it helps facilitate your entry into the property market as a beginner or grow your portfolio as a seasoned investor.

Diversify Your Portfolio

Avoid putting all your eggs in one basket. Investing globally and diversifying in various real estate asset classes is becoming a successful tool for sophisticated investors. With the U.S. being the largest real estate market, it makes sense to build a portfolio with properties that will appreciate in value while also maintaining a steady yield. It’s also important to consider investing in different property types (such as single-family homes, apartment complexes, and commercial properties) and various locations to mitigate risk and boost potential returns.

Leverage Equity

As your properties appreciate in value, you build equity. Use this equity to finance the purchase of additional properties. America Mortgages can guide you in leveraging your equity effectively.

Prioritize Location

The adage ‘location, location, location’ holds true in real estate investing. Prioritize properties in areas with steady job growth, good schools, and amenities like shopping and public transport. These factors can enhance rental demand and property values.

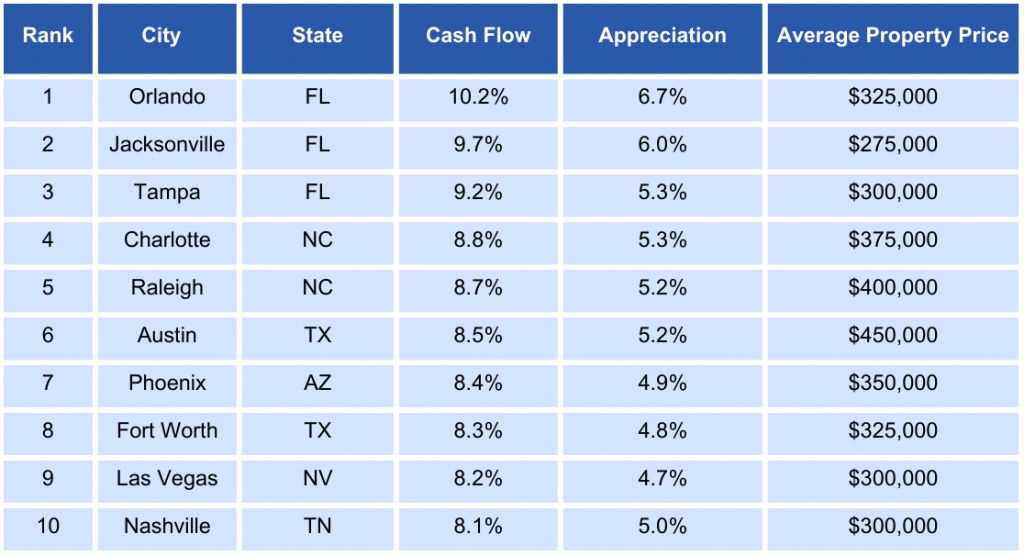

Here are the top 10 best places to buy rental property in 2023 for cash flow and appreciation, according to RealWealth:

Optimize Property Management

Efficient property management significantly affects your rental income and property values. America Mortgages works closely with reliable property management partners to ensure optimal handling of tenant relations, maintenance, and legal matters.

Marry the Property, Date the Rate

A principle America Mortgages upholds is to focus on the property first and the mortgage rate second. Choosing the right property that suits your investment goals is crucial, while the mortgage rate can be adjusted over time.

As a company, our only focus is providing U.S. mortgage financing for foreign nationals and U.S. expats. With America Mortgages as your trusted partner, building a robust U.S. real estate investment portfolio as a U.S. expat or foreign national is a very achievable goal. Our experienced team can guide you through this exciting journey, ensuring you’re well-equipped to make informed decisions and optimize your investment potential. We are with you for the long haul and not the short journey. Start your journey with us at [email protected]