The $1 Trillion Blueprint That’s Completely Legal to Replicate

What if you could copy the smartest classmate in school and not get in trouble?

Peek behind the curtain of the world’s most successful real estate investor and legally copy their exact playbook? Meet Blackstone – the $1 trillion alternative asset manager that has quietly become the most dominant force in American real estate. While everyone else was debating whether to invest in stocks or crypto, Blackstone was building an empire, one single-family home at a time.

Here’s the kicker: everything they do is completely transparent, publicly documented, and 100% legal to replicate. You’re not just allowed to copy their strategy – you’re encouraged to.

It’s one thing when I tell clients to, but Blackstone has a little more credibility than I do, so you should listen. Warren Buffett created a generation of value investors. Why not let Blackstone do the same for real estate investing?

The Mind-Blowing 2025 Numbers Behind Their Success

Let’s start with some numbers from 2025 that will make your jaw drop:

Blackstone’s Empire:

- 274,859 rental housing units under management

- Over $1 trillion in total assets

- Only owns 0.06% of U.S. single-family homes, yet generates massive returns

The 2025 Market Explosion:

- Foreign buyers purchased $56 billion in U.S. residential properties from April 2024 to March 2025

- 78,100 international property purchases – a massive 44% increase year-over-year

- 33.2% surge in dollar volume – the highest growth since 2017

- Record median foreign buyer purchase price: $494,400

But here’s what’s truly remarkable: Blackstone owns less than 1% of rental housing in the U.S., yet their influence and returns are extraordinary. They’ve cracked the code on something most investors miss entirely, and now international money is flooding in to copy their approach.

The 2025 International Money Tsunami

The latest data reveals something unprecedented: International buyers aren’t just participating in this market – they’re leading a full-scale invasion. The 2025 numbers show the biggest surge in foreign real estate investment since 2017, with smart money following Blackstone’s blueprint.

This surge isn’t happening in isolation. As outlined in “The Coming Monetary Reset: Why International Investors Are Turning to U.S. Real Estate, Gold and Bitcoin”, global investors are increasingly seeking dollar-denominated assets as a hedge against monetary uncertainty.

The 2025 Winners (Latest Data):

- China: $13.7 billion invested (11,700 homes purchased)

- Canada: $6.2 billion invested (10,900 homes purchased)

- Mexico: $4.4 billion invested (6,200 homes purchased)

- India: $2.2 billion invested (4,700 homes purchased)

- United Kingdom: $2.0 billion invested (3,100 homes purchased)

They understand what Blackstone knows: American single-family rentals are the ultimate wealth-building machine.

The Secret Sauce: It’s Not What You Think

Forget everything you think you know about real estate investing. Blackstone’s success isn’t about buying the most expensive properties or having unlimited capital. Their secret weapon?

Following two simple words: Jobs (growth) and Population (growth). This is the blueprint I use for presenting to private banks globally. The U.S. gentrifies better than any other country, and the reshoring of manufacturing is making it easier to choose where to invest.

“Really, what we try to follow across the globe is job and population growth,” says Kathleen McCarthy, global co-head of Blackstone Real Estate.

That’s it. While everyone else is chasing shiny objects, Blackstone follows people and paychecks. And the 2025 data proves international investors are copying this exact strategy.

The “Big Six” Markets Making Millionaires

Investors who own at least 1,000 homes have 45% of their single-family holdings in six markets: Atlanta, Phoenix, Dallas, Charlotte, Houston, and Tampa.

These aren’t random picks. Each of these cities represents a perfect storm of job creation, population growth, and rental demand. Here’s what makes them special:

- Atlanta, Georgia: The logistics capital of America

- Phoenix, Arizona: Tech boom meets retiree migration

- Dallas, Texas: Corporate relocation headquarters

- Charlotte, North Carolina: Banking and finance hub

- Houston, Texas: Energy sector powerhouse

- Tampa, Florida: Tourism and lifestyle destination

The 2025 Geographic Gold Rush

The latest data shows where international money is concentrating, and for good reason. As detailed in our analysis of “How U.S. Politics Influences Real Estate for Global Investors”, political stability and business-friendly policies play a crucial role in investment decisions.

Top Destinations for Foreign Buyers (2025):

- Florida: 21% of all international purchases (leading for 15+ years)

- California: 15% of foreign buyer activity

- Texas: 10% of international investment

- New York: 7% of foreign purchases

- Arizona: 5% of international buyers

Florida’s dominance isn’t accidental – it perfectly aligns with Blackstone’s strategy of targeting high-growth, business-friendly markets with strong rental demand. For investors comparing major markets, our “Florida vs California: The Ultimate Real Estate Investment Showdown for International Buyers” provides detailed market analysis.

The “Hidden Goldmine” Markets Most People Ignore

While everyone fights over expensive coastal properties, the smart money is flowing to unexpected places. There are 28 “SFR Growth” counties where rental yields exceed 10% and wages are growing.

The 2025 Yield Champions:

- Indian River County, FL: 14.6% annual gross rental yield

- St. Louis City, MO: 14.6% annual gross rental yield

- Cameron County, TX: 13.2% annual gross rental yield

- Monroe County, NY: 12.8% annual gross rental yield

- Richmond County, GA: 12.7% annual gross rental yield

To put this in perspective: while the stock market averages 10% annually over decades, these markets are delivering that in rental income alone – before any property appreciation.

What makes this MORE attractive is that America Mortgages offers up to 75% financing for non-U.S. citizens living overseas. We use the rental income to qualify, and with rental yields so high, it’s never been easier to get a mortgage. We don’t require personal financials or any form of credit.

The Regional Performance Revolution

The 2025 data reveals dramatic regional variations:

The Hottest Growth Markets:

- Midwest: Leading with 5.26% rent growth

- Northeast: Strong performance at 4.84% growth

- Detroit: 6% year-over-year rent increases

- Washington D.C.: 6.4% annual rent growth

- Chicago: Consistent 5.6% growth

Meanwhile, expensive coastal markets are moderating, creating opportunities in previously overlooked regions.

The Perfect Storm Creating This 2025 Opportunity

Several massive trends are converging to create what might be the investment opportunity of a lifetime:

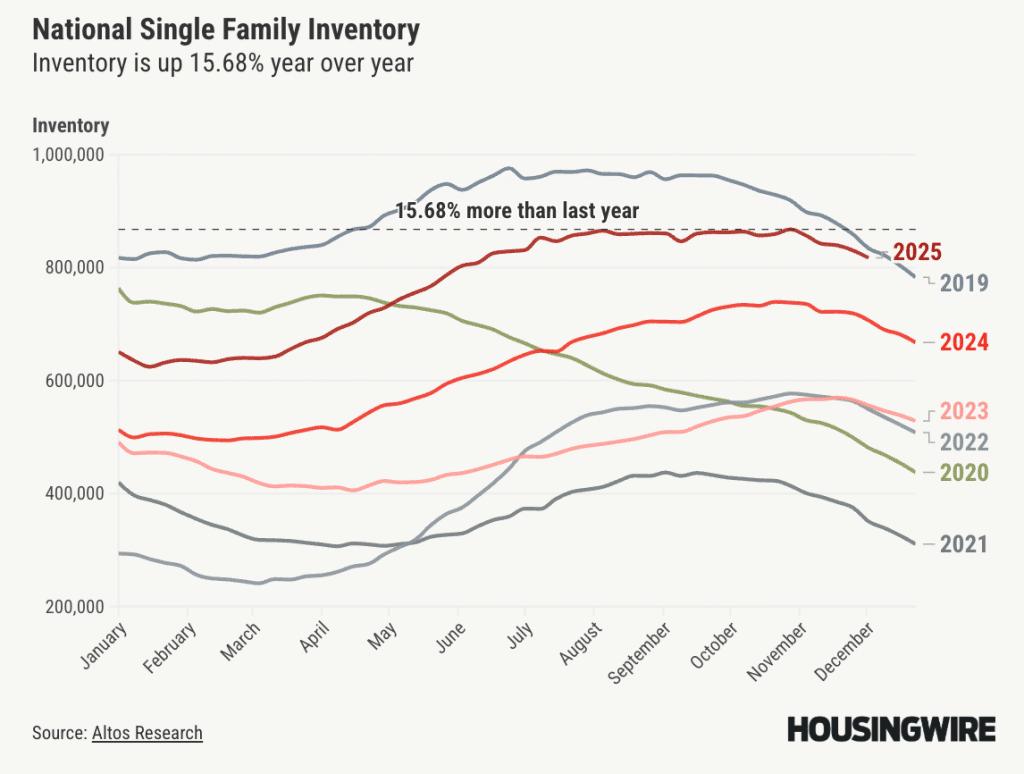

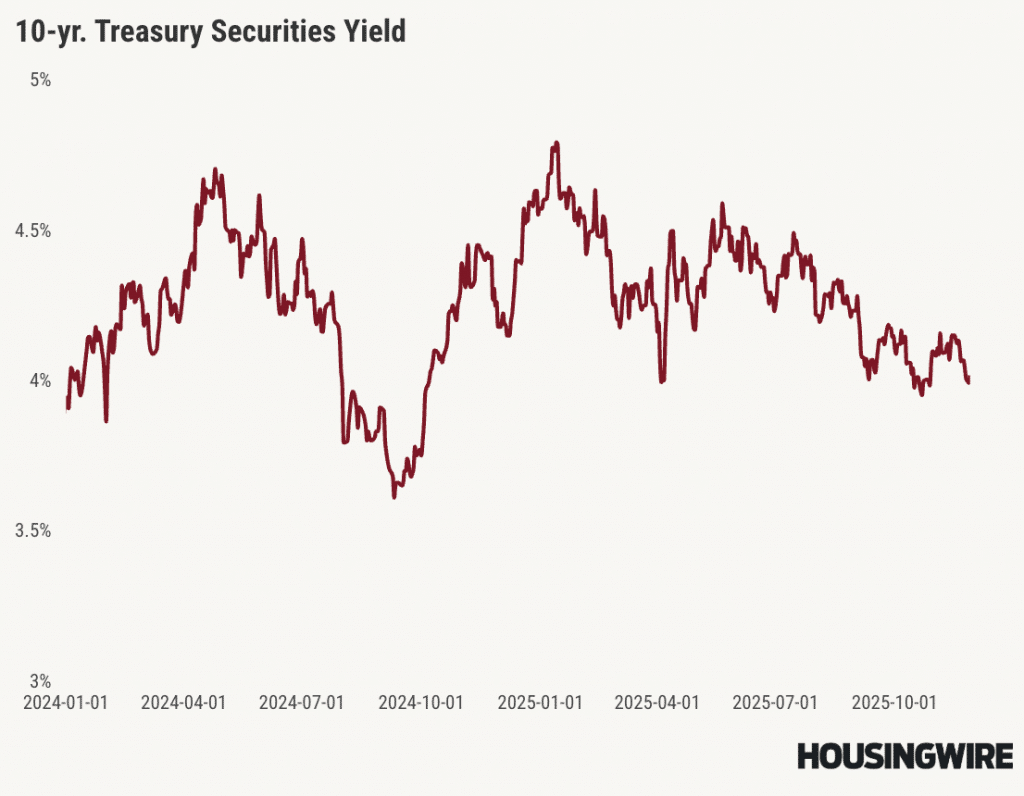

- The Supply Crisis Intensifies Build-to-rent starts reached 7.8% in Q3 2024 – a record high – yet demand still outstrips supply. “Buying is still cheaper than building in many markets,” says Will Pattison of MetLife Investment Management.

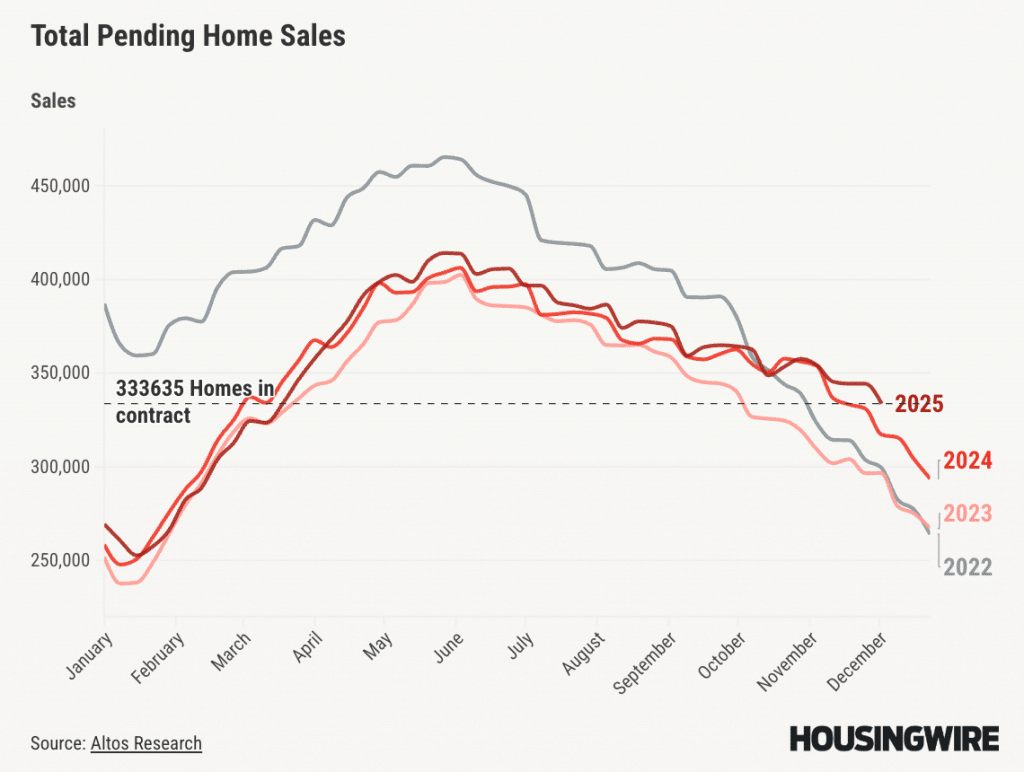

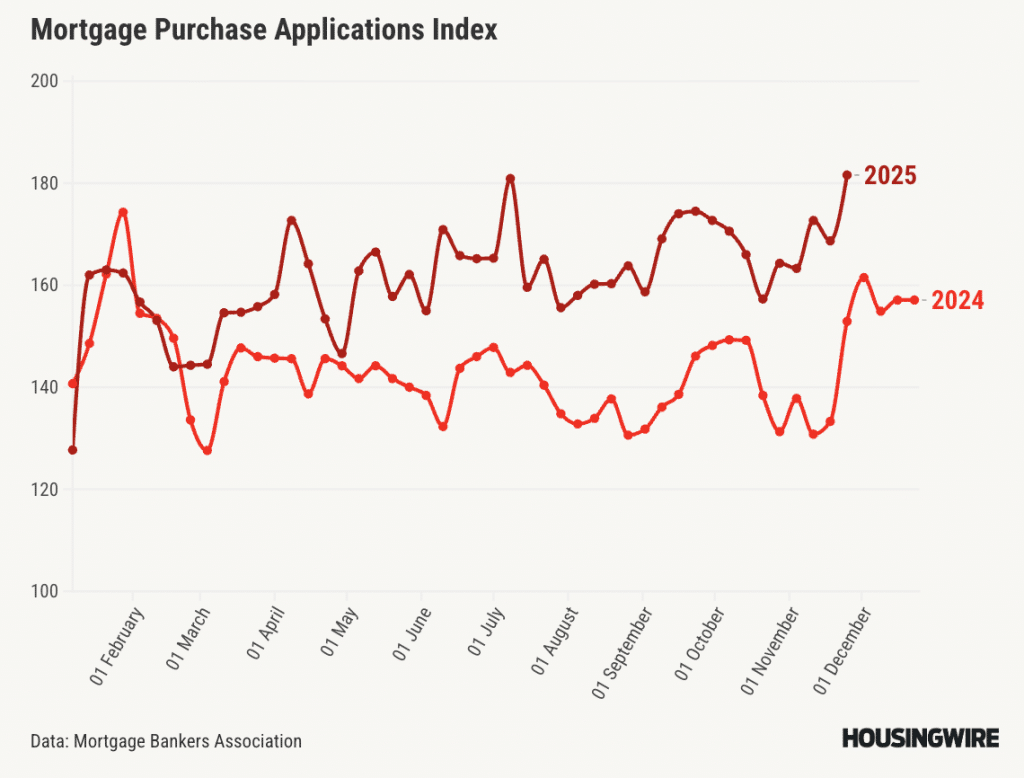

- The Renter Nation Expands High mortgage rates have created a captive audience of renters who can’t afford to buy, driving vacancy rates to 6% in Q3 2024 – the highest in 26 quarters.

- The International Invasion The 44% surge in international property purchases shows global investors are deploying capital aggressively, following institutional strategies.

Your Step-by-Step Blueprint to Copy Blackstone

Phase 1: The Foundation (Months 1-6)

- Target Florida, Texas, or Arizona markets (following 2025 foreign buyer trends)

- Start with $150K-$750K in available capital (adjusted for 2025 prices)

- Focus on properties priced $250K-$500K for optimal yields

- Contact America Mortgages Concierge desk to:

- Speak to realtor in your desired city

- Establish U.S. legal entity (Delaware LLC recommended)

- Open bank account

- Speak to a U.S. accountant

- Get pre-approved by America Mortgages loan officer in your timezone

For detailed guidance on the mortgage process, see our comprehensive guide “How Non-U.S. Citizens Can Secure a Mortgage for U.S. Real Estate Investment”.

Phase 2: The Build-Up (Year 1-2)

- Acquire 5-10 properties in your chosen market

- Target the $494,400 median price point where international buyers are active

- Implement technology for property management

- Aim for 7-10% gross rental yields minimum

Phase 3: The Scale (Year 2-5)

- Expand to 25-50 properties

- Add second market from the “Big Six” for diversification

- Build institutional-quality operations

The 2025 Foreign Investor Advantage

International investors have several compelling advantages revealed by the latest data:

- Leverage Power: Obtain 75% financing from America Mortgages, expanding your rental yield

- Premium Positioning: Foreign buyers’ median price of $494,400 vs. $408,500 for domestic buyers

- Diversification: Geographic and economic diversification away from home country

- Growth Markets: Access to the world’s largest and most stable rental market

For UK and Canadian investors specifically, our detailed analysis “UK and Canadian Investors: Your Ultimate Guide to U.S. Real Estate Investment in 2025” provides market-specific insights and opportunities.

The 2025 Numbers That Will Change Your Life

Let’s do some math based on current market conditions:

Conservative Scenario (10 Properties @ $400K each – 2025 adjusted):

- Total Investment: $4 million

- Annual Rental Income (7% yield): $280,000

- Property Appreciation (3% annually): $120,000

- Total Annual Return: $400,000 (10%)

Aggressive Scenario (25 Properties in High-Yield Markets):

- Total Investment: $10 million

- Annual Rental Income (10% yield): $1,000,000

- Property Appreciation (4% annually): $400,000

- Total Annual Return: $1,400,000 (14%)

Special Opportunities: Vacation Home Investments

For those interested in combining lifestyle and investment returns, the vacation home market offers unique opportunities. Our guide “Your Dream U.S. Vacation Home Awaits: A Complete Guide for International Buyers” explores how to maximize both personal enjoyment and rental income from vacation properties.

The Build-to-Rent Revolution Accelerating

Build-to-rent (BTR) construction hit record levels in 2025, with starts reaching 7.8%. This isn’t just a trend – it’s a paradigm shift creating institutional-quality rental properties that offer:

- 15-25% rental premiums over older homes

- Lower maintenance costs in early years

- Modern amenities that attract quality tenants

- Institutional-quality assets from day one

The Technology Edge That Separates Winners from Losers

Blackstone doesn’t just buy properties – they optimize them with cutting-edge technology:

2025 Tech Stack:

- AI-Powered Pricing: Real-time rent optimization algorithms

- Predictive Analytics: Machine learning for maintenance and tenant retention

- Automated Operations: Streamlined property management systems

- Market Intelligence: Real-time data for investment decisions

The Global Perspective: Why 2025 Is The Moment

Living investment is the largest real estate sector globally, forecast to see $1.4 trillion in transactions over the next five years. The 2025 surge in international investment isn’t coincidental – it reflects a fundamental shift toward rental-based housing globally.

JLL predicts investor total rental stock holding will exceed 50 million by 2030, providing homes to approximately 10% of households in major markets.

Implementation Timeline Based on 2025 Market Conditions

Year 1: Foundation Building

- Establish U.S. legal entity and banking relationships

- Target the $400K-$500K price range (2025 adjusted)

- Obtain financing from America Mortgages to leverage rental yield

- Acquire first 5-10 properties in primary target market

- Focus on markets with strong foreign buyer presence

Year 2-3: Strategic Scaling

- Expand to 25-50 properties

- Add secondary market from top-performing regions

- Implement institutional-quality property management

The Bottom Line: Your 2025 Wealth-Building Decision

“International interest in buying U.S. real estate increased following the global economic recovery from several years of pandemic-related disruptions,” said NAR Chief Economist Lawrence Yun.

The 2025 data tells a clear story: International investors are flooding into U.S. real estate, following Blackstone’s proven blueprint, and generating extraordinary returns. The 33.2% surge in foreign investment and 44% increase in property purchases isn’t random – it’s calculated capital deployment by sophisticated investors who recognize an unprecedented opportunity.

The Time Is Now: Why 2025 Is Your Window

The latest data reveals several time-sensitive factors:

- First growth since 2017: After years of decline, foreign investment is surging

- Record prices: $494,400 median shows international confidence

- Supply constraints: Limited new construction supports rent growth

Remember: Blackstone owns less than 1% of rental housing in the U.S.. There’s room for everyone – but only for those bold enough to follow the path that $56 billion in international money is already taking.

The Greatest Real Estate Playbook Ever Written

Blackstone has given you the blueprint. The 2025 data has confirmed international investors are following it. The markets are identified. The trends are crystal clear. The only question left is: Will you join the $56 billion international money tsunami, or will you watch from the sidelines as others build generational wealth?

The greatest real estate investor in the world has shown you exactly how they did it. The 2025 numbers prove it works. Now it’s your turn to copy their homework – legally, ethically, and profitably.

Contact: [email protected]

Website: www.americamortgages.com

Speak to a U.S. Loan Expert 24 hours a day / 7 days a week: +1 845-583-0830

Need help getting started? Use our 24/7 online booking tool to schedule a free, no-obligation consultation with a licensed U.S. mortgage advisor.

The strategies outlined here are based on 2025 market data and publicly available information. Real estate investing involves risk, and past performance doesn’t guarantee future results. Consider consulting with qualified professionals before making investment decisions.

Frequently Asked Questions

Q1: What is the “$1 Trillion Blueprint”?

A: It’s Blackstone’s proven real estate strategy for building massive wealth in U.S. single-family rentals fully legal, transparent, and replicable by international investors.

Q2: Why is 2025 the right time to follow this strategy?

A: Foreign investment in U.S. real estate is surging002044% more properties purchased year-over-year, record prices, and strong rental demand creating a rare window of opportunity.

Q3: Which U.S. markets should I target?

A: Blackstone focuses on high-growth cities with job and population increases. The “Big Six” for investors: Atlanta, Phoenix, Dallas, Charlotte, Houston, and Tampa.

Q4: How can international investors participate?

A: Through programs like America Mortgages, non-U.S. citizens can get up to 75% financing without U.S. credit checks or personal financials, using rental income to qualify.

Q5: What kind of returns can I expect?

A: Depending on the strategy: 7–10% gross rental yields in high-growth markets, plus property appreciation, potentially yielding 10–14% annually or more.