02:12

Speaker 2

Hi everybody, this is Robert Chadwick with America Mortgages. Thank you for joining us for another webinar series. We are very excited to have Thomas Carden. We’ve had Thomas on multiple times. Thomas is the CEO of American International Tax Advisors. Similar to US they focus on a unique market which is the foreign nationals and US Expats filing taxes. Now in today’s webinar we’re going to cover tax strategies. And I think one thing that’s very interesting and very relevant these days is Thomas is going to talk about the big beautiful bill which as everybody is likely aware is trying to get passed in the US and will it or won’t it affect investors that are investing in US Real estate? So Thomas, thank you for joining. I appreciate it. I will let you introduce yourself and then we will go through the slides.

03:24

Speaker 2

After you’re done speaking we will go over the American mortgages slides and we’ll discuss the different loan programs available and a little bit about the company. And then we will do our standard question and answers towards the end. So if anybody has any questions, please feel free to put it in the chat at any time and they’ll be addressed at the end. Also in the chat box there are links for both Thomas and for myself to either schedule a call to speak to a US Loan officer or to schedule a call to speak to Thomas and his team. So with that said, Thomas, thank you again for joining us. We really appreciate it. Take it away.

04:10

Speaker 1

Okay, Robert, thank you. I just swapped me to. Not sure if you swapped me to the main screen yet with it, you know. My name is Thomas Cardin. I’m the director of American National Tax Advisors, one of Asia’s largest US centric tax firms. We handle the filing of taxes for both U.S. Citizens who are expats overseas and individuals and businesses doing business in the U.S. One of things I’m going to talk about because this is over US or foreign ownership of US Rental real estate in the United States. I’ve been doing this business about 30 years. Next year will actually be my 30th year doing u S taxes. Over the years I’ve seen tens of thousands of people do this.

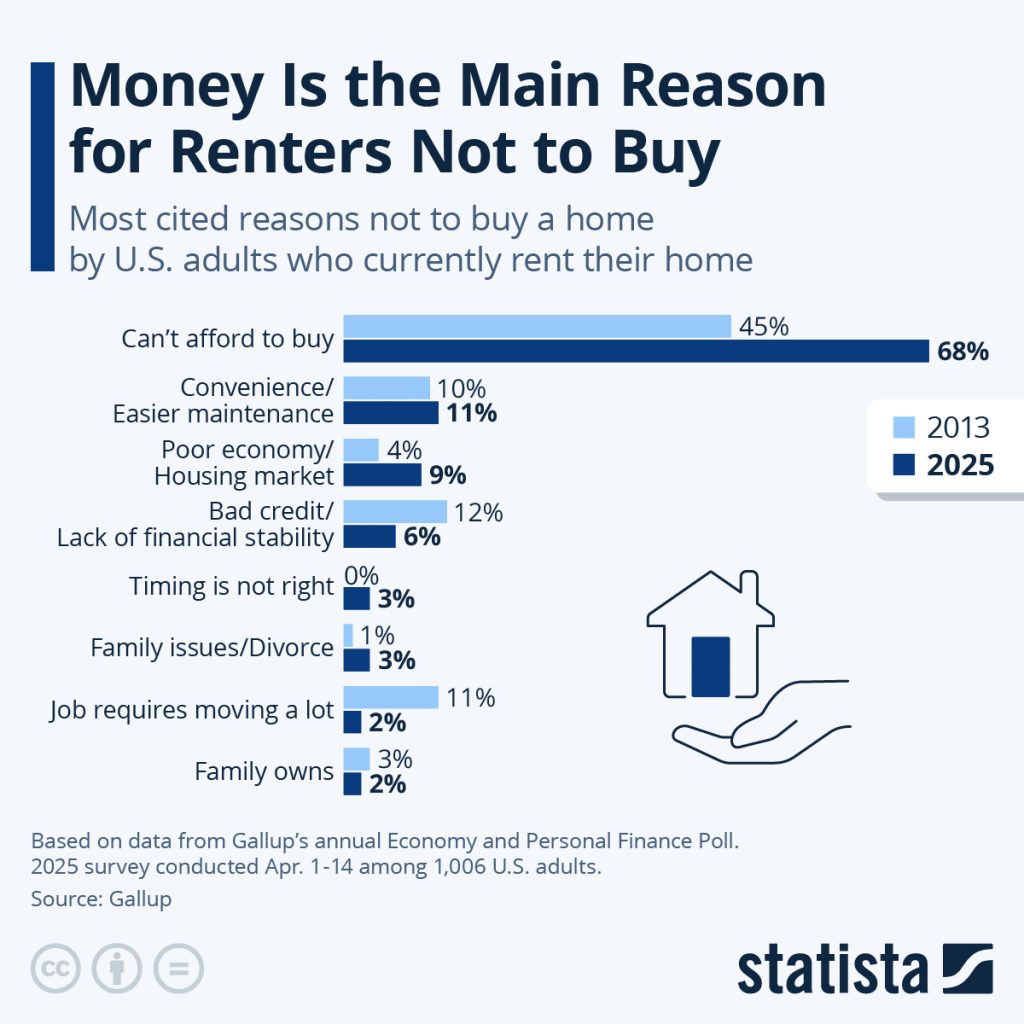

04:52

Speaker 1

There has never been a more steady way to build wealth that I have seen outside of rental real estate done properly with proper planning, you know, you can preserve wealth, you can save wealth. You can also maximize your earnings income now if you want cash flow and you can build capital depreciation if you want to. How you approach rental real estate in the United States is up to you on what your individual goals. But in almost every case, rental real estate provides a very valuable way to do this, even regard, even disregarding ups and downs of the markets to this. There’s never been a bad time to buy real estate over the long term in the United States, especially when it comes to rentals. This is combined with the fact that there is a general shortage of housing in the United States.

05:47

Speaker 1

So, you know, we may be in a top market, we may be at a bottom market, but in five years we are still going to be cheap from where we are right now. You know, with this is a really good way to do this. You want to go into the first slide? First slide for me.

06:00

Speaker 2

Sounds good.

06:05

Speaker 1

Okay, and here we go, one more slide. Okay. Overview of foreign ownership in US Real estate. Okay, here’s one of the great things about US Real estate to this. It’s an open market, okay? You as any individual can go in and buy property to this. Unless you are literally on a, one of the rare restriction list to this, you know, to this. And you are protected under a very strong legal system. US Real estate is a magnet for national capital due to strong legal protections and market stability. What that means is you are treated no differently as a foreign national as if you are national in the US There are some exceptions and a big beautiful bill will go through with this towards the end of this. But you’re treated as exactly the same for ownership.

07:00

Speaker 1

They’re not going to go in and seize your assets to this. You’re not in court in any difference with this. You are treated as the exact same from a legal ownership standpoint of this and that legal strength of ownership and property in the United States is absolutely incredibly strong. It’s hard to debate how good the US Ownership of property is. It’s a bedrock of US wealth for individuals and that proceeds to you as non US Resident if you choose to buy a real estate there. Next slide please. Okay. US Tax framework foreign owners. Okay. Foreign owners are subject to US tax on rental income from US property withholding tax. Now withholding tax is 30% on gross rental income unless specific steps are taken. These steps are incredibly easy to take. Net income taxation.

07:58

Speaker 1

With proper filing, the tax is only on net rental income after deduction. Okay? Now that’s a very important thing on this and why you want to file US Tax returns when you own US Rental property, even if you’re not resident in the United States. Now if you’re not resident in The United States, you’re only taxed on the rental income to this. But I always use the term and Robert will know this term very well. You can be cash flow positive and rental property in the United States and tax flow negative. That’s because the, there is a lot of tax incentives for owning rental real estate in the United States and one of the biggest expenses, depreciation. We’re going to go through a lot more in detail on that.

08:43

Speaker 1

But for a majority of the years that you would own rental real estate, I mean the mass majority of years, you should owe no U.S. Tax on the rental real estate as long as you don’t sell the property to this. So we’ll go into the next slide on this one, Robert. Key tax deduction foreign owners, okay? Common deductions, mortgage interest, okay. Property management fees, repairs, advertising, cleaning and more. Now here’s the biggest one in this depreciation. Significant annual deduction for wear and tear on the property to this. Now what that means is you have when you buy a house or a condominium or even a commercial property, okay. While the land itself is not a depreciable expense to this, the actual buildings and infrastructure on that property are a depreciable expense.

09:39

Speaker 1

Now what that means is each and every year you are going to get a percentage of about 125th of the property to this as an expense. Because the idea of that is that building and the assets on it will actually decrease in value. In reality, they almost never do this, but each and every year you get an expense to this. Now the actual depreciation schedule is over 27 and a half years and it’s a straight line. I’m going to use a little bit easier, more math for you. Okay, let’s say it’s a 25 year depreciation cycle which means that each year you get 4% off of the value of the buildings and the assets when you buy it as a depreciation.

10:23

Speaker 1

Now that generally with a yield term of about 8 to 9% of rental yields in most places, that’s going to wipe out about 50% of your profits from a tax standpoint each year to it. This is the reason why with smart planning you can get a nice cash flow income out of US Rentals real estate and be tax and be tax flow negative to this with it. So the entire incentive of the US Tax system in the United States is to incentivize you to own rental real estate in the United States with this. It’s one of the Very few things other than farming income that you can get really positive tax implications on. Okay. And again, you know, the second part of that is many or most foreign owners will pay little or no US tax when deductions are applied.

11:14

Speaker 1

But yet you can still get a nice cash flow income to this should you choose to get cash flow out of this. Next slide. Okay, now reducing or limiting withholding tax. Okay. The first key to this is file a U.S. Tax return with this. Okay? If you’re filing a U.S. Tax return, that gross tax goes, that gross tax of 30% goes away to this you’re now doing net income tax. Okay? The second step on this is in order to file a tax return is you’ll need what’s called an ITIN number. Now that’s an application you would actually fill out generally with your first tax return. We actually do that. We’re a certified acceptance agent. So we can get you a tax ID number and then submit a Form W8ECI that allows you to get that tax ID number.

12:01

Speaker 1

Those two combinations allow you to avoid the withholding on 30% gross and just deal with your net tax issues to it. It’s fairly efficient way and it makes owning rental real estate very nice in the United States. Next slide. Okay. Benefit to U.S. Tax treaties. Okay, now there are a very, a lot of tax treaties on this and this is going to actually come into effect with the big beautiful bill on this stuff. Okay? And there are a whole lot of them. So it’s impossible for me to go through every one of these things with this now. But some tax treaties may very specifically lower US Tax rates on rental incomes. So even if you were owing tax on a U.S.

12:44

Speaker 1

Rental property, you may be able to use the individual tax treaty to lower those, those taxation to this on that should you use to do this in a taxable way. Now secondly to this is no double taxation. Foreign tax credits may apply if it’s taxed, if the income is taxed in both centuries, which generally means. So say you’re paying a certain tax rate in the United States on this when it flows to you as actual income tax to you and you’re in a different country with a U.S. Tax rate generally that other country that you’re maybe resident in should not be able to tax you again, they’d have to give you a credit back for that tax in the United States. Again, there’s a whole lot of countries on this with tax agreements.

13:26

Speaker 1

You have you want to talk to us and we can give you a Little bit of guidance on that. And then even some countries completely exempt, you know, certain types of income from US Tax with this. So again, you know, context. And by the way, because you’re coming in through American Mortgages on this, we give you a free hour consultation on talking about US Tax rental property and stuff to this. So give us a call. You know, all the contact information is later on in this. But you know, if you need specific questions or will help you, there’s no charge to do that whatsoever. To this next slide. Okay, now we talked about depreciation. Now in a lot of times in the US Tax code, they’ll give you a stick and a carrot.

14:07

Speaker 1

The carrot in this case is depreciation to own US Rental property to this. Now, what you generally do in rental property is the first rule is never selling US Rental property, okay? Which means you don’t want to go and sell because when you do, you have to take all that depreciation you took off as an expense for income in the year you’ve sold the property. Plus you’d be taxed on the capital gains, which means the increase of price of the rental property. This can be, you know, not the greatest tax rate in the world because recapture depreciation, especially over a large number of years, can be bad. However, however, again they give you another carrot, which is called a 1031 exchange. Now, a 1031 exchange means you go in.

14:52

Speaker 1

So say your property is getting tired or you’ve got so much equity in the property that you want to do something else. You want to move from a house in Texas to another property somewhere else with this or an apartment building somewhere. What you can do is you could sell the property and with a certain amount of time, you have to identify the next rental property and transfer the money into that new rental property with this. That gets you no capital gains tax with this. And you are nice and clean on the tax issue. And if the property is now worth more money than when you start the original property started off with, you now have a bigger depreciable base on this. The second side on this, and this is where Robert really loves talking about this, is never sell the property.

15:36

Speaker 1

As the property increases in value over the years, you can refinance that property and take a new loan on the equity you have in that property and pull the money out and the loan is free for life to this. And now when that passes through to your heirs, if this property passes through to your heirs, their cost basis is the basis upon the date you pass away and all that capital gains goes away for them. There’s a very nice way to plan to never have to deal with either capital gains tax or recap or capture depreciation and still maximize stuff. Now one of the wackier things about this too is calculations.

16:15

Speaker 1

You know, if you’re doing this and you’re using finance properly, what you do is you go buy a piece of property or several properties for say half a million US dollars to this. Now when you buy that property for half a million US Dollars, you know, eight to ten years later, you can probably go take your equity out of the half a million dollars that you put into the property originally in a new finance loan with us. Guess what? You still own your property though. So that property will continue to increase over the years and cover the, COVID the mortgage balance on this thing. And guess what? 10 more years later you can probably take your, the amount you put in out again onto this.

16:53

Speaker 1

The average increase in property over the decades has been about 10% in the United States for capital depreciation, 8 to 10% depending on where you’re at with this. It’s a real nice way to avoid taxation almost completely with this. In fact, in most other countries to this, when you’re bringing the money back in the countries, if you’re using a loan on that, they’re not going to tax you either because it’s not income, it’s a loan back to you. It’s a way to use rental real estate in the United States for your advantage. It’s the only time you can go sell your cake and still have it too. With this next slide, avoiding common fit costs. Okay, the compliance issue. Failure to file or withholding can lead to liens, penalties or immigration issues. You need to file your tax returns. It’s that simple.

17:44

Speaker 1

Make sure you’ve got everything in compliance. When you’re using a rental real estate agent, you know who’s managing the things, make sure they’re filing on your documents. You can also talk to us. We don’t just help with planning, we actually do all the compliance as well. So we can make sure that you’re in compliance and being as tax efficient as possible. So we can help with both the planning and the compliance side on handling US Tax returns to this and then, you know, again, consult competent international tax advisors. Also, I’m going to give a plug to Robert here. Robert solved a lot of and American Mortgage solved a lot of issues we had for our clients dealing with the US Rental real estate to US Financing when you’re living overseas, even as an American, is difficult.

18:28

Speaker 1

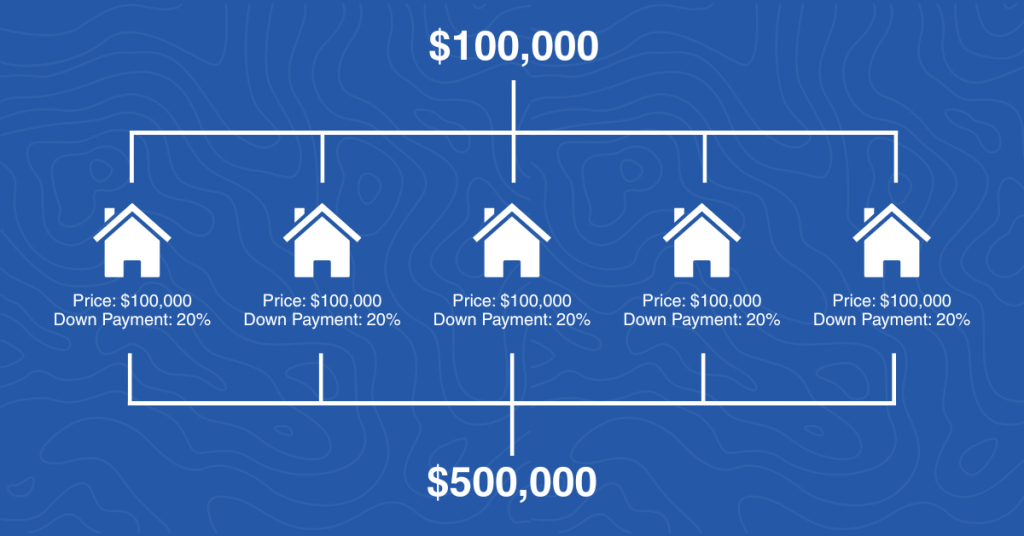

When you’re not an American, it was almost impossible. However, Robert gives you X and American mortgages gives you a lot of access into those mortgages, which are a very tax advantage. Smart way to deal with your property. This. And I’m going to give you one example on how this begins to magnify things. Okay, we’ve already talked about expenses. Mortgage interest is an expense to this and you know, to this. So now what you do is when you have that half a million dollars, you could go into the US in most cities in the US and buy one rental property for half a million dollars with this. Now that is not the smartest way to do this because you don’t have the rental expense on the mortgage with this to this.

19:10

Speaker 1

Now what you want to do though is if you buy five properties to this, you can do that with the same property. So say you buy two and a half million dollars worth of real estate using that half a million dollars. Now here’s the good thing about doing the strategy. The mortgage should be paid off by the rental income yields on these properties. Your expenses should be equal to that. Or with the depreciation, you should owe no tax on that. But instead of having a gain on $500,000 at 8 to 10%, you’re now having a gain on $2.5 million at 8 to 10%. Your gains over a period of time on capital appreciation massively outweigh your tax issues. And again in just several more years, you go in and refinance or you identify other properties and you can use this.

20:01

Speaker 1

In fact, and here’s another strength of this. It would cost you nothing when that has doubled in value in the price of what you’ve put into your initial down payment on this to pull that money out, other than some small origination fees and interest on it, to then go and buy another property to this. So say you bought that two and a half million dollars worth of property in five to eight years, possibly 10. You could, you can refinance and guess what, buy four or five more properties in this. You know your tax advantage on using your debt properly when you’re dealing with U.S. Rental real estate. To this incentives are there in every way. Next slide, proposed tax, rental changes and remittance tax. Okay, we’re going to go through several of these things with this.

20:47

Speaker 1

Okay, there is supposedly a new excise tax, 3 1/2% on international money transfers. It’s back and forth on whether it’s 5% with this. Okay, now with that would that sounds horrible when you’re taking money out of the U.S. Okay, but what they’ve come to and right now to give you examples of this, they, the U.S. The, the house has passed this in the United States. There’s, there’s three more steps on this. The Senate has to pass their version of the bill, then it goes to a committee that equalizes the bill, then both houses have to pass that again and then it has to be signed by the U. By the, by the President. Right now we’re only at the earliest step of this. Now here’s the good news about this, okay?

21:28

Speaker 1

Because you’re going to hear a lot of terror stuff on this remittance basis. When it comes to, when it comes to remittances, if you are a US Citizen or green card holder, this does not apply to you. If you are taking investment income back out of the United States as well, guess what, it doesn’t apply to you as well. Now this is still subject to change and outside there, but right now the big fear of this is not going to be a big issue to you know, with this, because on rental income with this. Now secondarily to that, i’m going to have to give you a list on this some of the other changes of this. Okay?

22:06

Speaker 1

With this there’s a hundred percent bonus depreciation extension which means when you purchase a property, if you do improvements and that kind of stuff with this, you can take that as an expense in the first year should you need to. Okay, that was already in a previous bill, but that has been extended to this. And then there’s what’s called section 179 deduction expansion. Okay? A section 179 expenses. If this qualifies as a business and it’s possible to structure rental property that way, you can take a much larger amount of money as a one year expense. Now most of the time this will be for some type of improvement or replacement with us now generally if you have you buy new kitchen appliances for your rental properties with it, that would normally be depreciable over say three to five years.

22:55

Speaker 1

You put new carpet in, again depreciable over a period of time with the new one. Section179, if your rental meets the right requirements, they all become an expense immediately. And now here’s the thing about this too. Again, there’s incentives to this. If you’re not, if you don’t need that expense as a 179. You take it over the five year period and you keep your positive cash flow over a longer period of time with this. The depreciation over a longer period of time is very nice for you to this, you know. Okay, so let me read some of the other ones here. Sorry, put my glasses back on. Okay. There’s sections enhanced section 199A qualified business income deductions to this. Okay. Means many pass through entities including rental real estate businesses can have certain expenses that are, you know, going to give you this.

23:43

Speaker 1

Now the rate used to be 20%. That’s now 23% opportunity zone renewal. Which means that if you go into a poor area and you buy a rental property with this to it. So an economically challenged area to this, which oddly will give you generally higher yields, rental yields. They will also give you very large tax credits for being and operating inside that area as well. And that’s a bigger issue. There’s also an increase of a mortgage interest deduction and several other things. Now we’re probably going to do another seminar in four to six weeks about that once it passes through the senate and gets a final bill on this. So stay tuned. But for right now there’s not really a bad issue except for one possible issue with this. Okay. And let me find another sheet on this.

24:34

Speaker 1

Okay. There is a, there is a part of this that they’re debating on whether they keep this in or not called discriminatory foreign countries. Under the one big beautiful bill, those incomes, okay. These would have, if you’re subject to the 30% tax to this, these would actually have an increasing tax regimes. If you are a resident of a country that has not yet been named that they put the rules being discriminatory against U.S. Tax rules. That list does not come up with yet to this. You have tax treaties to go to this. However, again, if you get around that 30% tax withholding in the first place, discriminatory taxes should not come into effect. That would only be the case if you choose to not file a tax return on your gross income with this to this.

25:22

Speaker 1

So it would be rare that somebody that I would advise would ever be subject to that tax. And almost none of our clients who have U.S. Rental real estate or not U.S. National pay any U S Tax. Smart planning on this can make you eliminate U S Tax on this to this. And it’s, you know, there’s just, there’s just ways to plan completely around it. It makes this investment, especially with the long term yields of 8 to 10% on rental real estate. Very, very attractive. I’m going to go back to my opening statement again. I’ve been doing this just about 30 years now. I have seen lots and lots of clients and wealthy clients. I’ve seen bitcoin people. I’ve seen people do gold. I’ve seen people, startup companies.

26:07

Speaker 1

There is no more consistent way with minimal risk to build wealth that I know of from experience than owning US Rental real estate. Smart planning on this can maximize your yields and really help you, you know, build your wealth, work and, or increase your cash flow with very minimal tax issues, you know, to it. I think that any more slides to it, oh, we’re all good to this and like I said, we can help you file the ITIN number. We can, you know, and consult with us and we’re good. You’ve got Chris’s email. He’s my practice manager to this. We are located in Bangkok, Thailand, but we operate around the world to this. We’re actually, as far as we know, the largest firm in Asia who specialized in this.

26:58

Speaker 1

But we deal with everything from Australia to New Zealand, Saudi Arabia, Japan, all the way through China with this. We can help you handle this and plan this in a way that’ll make it tax efficient with us. Robert, you want to do questions now or you want to go ahead and wait till your, your scenario is done? You’re, you’re on mute, Robert?

27:26

Speaker 2

Yeah, so we’ll do the questions and answers at the end. Thomas, thank you very much. I know especially when it came to the big beautiful bill or what’s supposed to be passed as that, you know, there was a lot of concern, a lot of questions. But yeah, it seems like from my understanding anyway, that it really won’t affect anybody negatively. They’ll actually be positive benefits if it does get passed.

27:55

Speaker 1

As at this point, we’re still dealing again, we’re still dealing with proposals. It’s a work in progress with this. But you’d have to do things pretty poorly to be subject to that particular tax issue. It’s really the only negative to this. They’re actually trying to give more incentives to build rental real estate in the United States with stuff. So this bill should actually be a net positive for everybody. And I, how do I describe. I can’t conceive of any clients of mine that I would let pay the extra tax with us. It’s just outside, you know, to this, you could do things really poorly and be subject to it. But you should never be subject to a proper planning.

28:33

Speaker 2

Yeah, I absolutely agree. You know and I. One of the things that comes up in almost every conversation that we have, especially for new real estate investors in the US is you know, what are the tax consequences? Is it global taxation if I own real estate? And this is why we, you know, we partnered with an expert like yourself because of all the tax advisors that we’ve worked with since we started this company. And I have to say, and Thomas, thank you for giving kudos to us during your presentation. But you know, back at you guys are phenomenal. You’re, I mean not magician, but yeah, you know, everybody that we’ve referred to you as absolutely satisfied. So, you know, thank you for that. I appreciate it.

29:19

Speaker 1

We try to deal with especially rental real estate to long term relationship. We try to deal with our clients and long term relationships. That’s, that’s our goal.

29:27

Speaker 2

Yeah. So I’ll start our slides and then at the end again there’s the chat bot or chat box within the zoom screen. Please put your questions in there and we’ll address them individually as we go at the very end. So Thomas, thanks. We’ll see you in about 10 minutes for the question and answer series. Okay. All right. So you know, of course we’re America Mortgages, part of Global Mortgage Group. We focus only on providing US mortgage financing for non US residents that’s both foreign nationals, so people without a US passport and US expats. So a general overview of the American mortgages loan programs we are able to do. Purchase loans, refinance loans and cash out or equity release. If you’re a non US citizen not holding a US passport, you can get up to 75% financing in all 50 states.

30:51

Speaker 2

If you are a US expat, then it’s exactly like it would be if you were still living and working in the US you can get up to 80% loan to value. These are of course for investment properties. So properties that you have no intention of living in but you’re going to rent and generate rental income. All of these loans that we offer, especially now where interest rates, although I do think there, if you look at them, I guess over the say a 50 year period, rates are still quite good. But if you look at it post Covid, it’s a little bit higher. So all of our loans are 30 year fixes regardless of the borrower’s age.

31:33

Speaker 2

So that’s something to really take notice of because the US is the only country that has that most Countries have age restrictions depending on the, you know, either the borrower’s specific age or their working age. And that’s where the amortization stops. In the U.S. Regardless if you’re 19 or 99, you cannot discriminate when it comes to mortgage lending. So everybody gets to take advantage of a 30 year amortization. We have a really slick loan program that is a 10 year fixed interest only. It’s a fixed rate for a 10 year period. After that 10 year period you would expect that loan to adjust to whatever the market rate is, but it does not. That rate stays the same, but now you’re paying principal and interest for another 20 years. It is a perfect way to maximize your rental returns.

32:30

Speaker 2

Loan programs Again, in all 50 states we use common sense underwriting. What does that mean? Well, we qualify the properties. If you’re buying an investment property only on the rental income of the property. So if you’re going to buy a building, of course you’re not going to qualify off of your personal income. You’re going to qualify on the cash flow of that building. And that’s how we look at rental properties. From one to four units you can get up to again if you’re a foreign national, up to 75%. As long as the rents will cover the taxes, insurance and any HOA association fees, then the loan qualifies. Super slick program. In the event that say the cash flow of the property does not qualify, we allow foreign earned income and that is both foreign nationals and for US Expats.

33:25

Speaker 2

So of course non US citizens living overseas. US citizens also living abroad. We have all of these programs available. No US credit is required foreign nationals. For US Expats, we would like to see that you have at least a 640 credit score. We do realize that there may be a lot of US expats that have been abroad for many years and no longer maintain US credit. Perfectly fine. We will treat you as a foreign national. The benefit of that is once you do re establish credit, then you can refinance out at maybe a higher loan to value or even maybe slightly better rate because you are a US citizen with credit. So we have a mortgage portal that allows you to securely apply for a loan, send all your documents in encrypted format.

34:19

Speaker 2

Once we receive that, it takes us about 24 to 72 hours to issue you a loan approval. Once you have that loan approval, you can actually go out shopping. So we issue you a letter. Once you find a property that you want, you contact that realtor you submit the letter along with that offer, and that shows that you’ve already gone through the financing process. On average, it takes us about 30 to 45 days to close a loan. You can close and you can open and close your entire loan without ever having to travel to the US So we have a variety of ways to close your loan, to take your application on the portal, and to be able to do the entire transaction without having to travel.

35:09

Speaker 2

One of the things that we are absolutely proud of is 97% of our loan applications are approved. Now, we are a direct lender, but we are also a broker which allows us to be able to normally find you the best rates and the best terms available. And I think what makes us also very unique, and there was a review that came in yesterday from a client, because 100% of our clients are clients just like you. This is all we do. This isn’t like a side business. This is 100% of our business. We know exactly what it takes to get a loan from application to closing for a non US Resident. We had a client that had just, he was in the process of doing a loan going with a broker in the US that thought he knew what foreign national lending was.

36:02

Speaker 2

They got to the third week, one week before closing, and they canceled and turned down his loan. So we came in and were actually able to close that loan within 10 days. So that’s the power of American mortgages. We have loan officers 24, 7 in 12 different countries, meaning that no longer do you need to stay up at midnight to be able to do a call with somebody in New York and try to explain as an example why Hong Kong doesn’t have a zip code. We understand this. This is all we do. Multiple languages, not an issue. So we’ll go through the loan programs. Should probably take five to 10 minutes. And then again, we will have the questions and answer within the chat.

36:45

Speaker 2

You do have the link to set a call with a loan officer based on your timing and also schedule an appointment with Thomas. So this is by far our most popular rental program. And this is the one that I was referring to in the very beginning where we do not require you to provide personal income. Now, I, you know, certainly when you hear that, you think, you know, it sounds a little bit off. But actually, if you think about it is purely common sense underwriting. If the property can qualify and be able to service the debt, the loan should qualify. We have these loan programs that go as low as $100,000. All the way up to 3 million for our own lending purposes. If it’s above 3 million, we have options as a broker.

37:40

Speaker 2

Now the way this works, if you look at the bottom of the slide and to make it simple, as long as the rental income and we get this number not arbitrary, it’s a number that we either get from an existing rental agreement or we get it from the valuation or the appraisal. Once ordered, we order a supplement to that and it gives us an average of rent. That is the amount that we use to qualify. So as long as it qualifies on a one to one basis, then the loan works. Say for example, it does not qualify, it does not mean that the loan is not approved. What it means is maybe you just have to come in with a little bit more money or maybe you just have to switch to an income loan.

38:28

Speaker 2

So if you are a US expat, super popular program as most US expats have probably experienced applying for a loan and if you go to the standard local American banks, as soon as they find out that you have foreign earned income, it’s pretty much a no go. And this is what happened to that particular client. What makes us unique, the issues that you would have with a US bank, foreign earned income, no W2 etc. That is not an issue with us. Again, 100% of our clients are our clients just like you. So our loan programs are absolutely specific for this. So you do have to provide two years of tax returns. Absolutely. Perfectly fine. You still need to maintain US credit but you do not need to have a W2. And foreign to earned income and foreign bank accounts are absolutely allowed.

39:26

Speaker 2

So on this loan program the minimum loan amount is $150,000 with a maximum loan to value of 80%. This works off of a debt to income ratio. The debt to income ratio for this program is 43%. It’s based on being able to service your debt in the country that you’re living in and also be able to service the debt if it’s a. If it’s a non rental property in the US if it’s a rental property it normally should offset it. So self the AM Student plus program. You know certainly this a something that everybody is a bit concerned about as the announcements have come out about certain schools or visas that are not being approved foreign students. Although my personal opinion is I think this will blow off before school starts.

40:21

Speaker 2

But if you do have a child that is attending a school in the US and you want to be able to buy a property. This qualifies as a loan program that we look at based on the cash flow of the property. Now even though your child is living there, this loan will qualify based on what would be the rental income of the property. So very similar to the AM Rental coverage Loan. It’s a very slick, easy program. The minimum loan amount on this is a little bit higher than our average. It’s $150,000. But it also again works on a one to one basis with the rental income. AM Investor Plus.

41:05

Speaker 2

Now, in the event that your property may not cash flow, say for example, once you get over a million dollars of a purchase, or even I would say $800,000 on a purchase, it does become a bit challenging, except in certain markets, maybe California and New York, to be able to get sufficient rental income to be able to service the debt on a one to one basis. And maybe you don’t want to come in with more money. We have a loan program that allows you to qualify using your foreign income but without using your foreign tax returns. As you can imagine, we’re doing loans all the way from Stockholm to Sydney to Singapore. If were to use tax returns, it would become very difficult. So how this loan qualifies is if you’re self employed, we want a letter from your accountant.

41:58

Speaker 2

If you’re employed, it needs to be a letter from your employer on the letterhead. And what it needs to state is two years of your income and your current year to date income and that’s it. There’s no requirement to have your tax returns. Translated this is sufficient enough for income. It does obviously work on a debt to income ratio. So the same thing as a US citizen, which is 43%, but it’s a very slick way to allow you to qualify for larger transaction loans without using your actual tax returns. Minimum loan amount on this is $150,000 up to $3 million. And again 30 year fixes, regardless of age on all of these loans.

42:43

Speaker 1

If.

42:43

Speaker 2

You are a high net worth client. And when we originally started actually Global Mortgage Group, which you know, evolved into American Mortgages, were dealing with a lot of private banks. A lot of private banks, as you’re likely aware, do not offer us mortgages. So were getting a lot of referrals on this and the biggest question was my client, you know, has taxes in multiple jurisdictions, very complicated, or maybe they don’t show exactly what they’re debt servicing ability is. So on these loans, rather than asking for tax returns or you know, an income letter or Qualifying off of the rental income, we go off of the asset statement. If you have sufficient cash bond stocks in the bank where we can qualify you on based on two months of the average balance.

43:33

Speaker 2

And how we look at it is we take it divided over a minimum fixed period of the loan. On average it’s five years. So we would take that portfolio and we would average the income say if you have five years over 60 months and that is the amount that’s used to qualify. The beauty of this is there’s no encumbrance on those assets meaning that say you’re using cash or stocks or bonds in order to qualify. Once the loan closes, you can trade it, you can sell it, you can do whatever you choose. There will be no charge on it. The only charge of course, just like any real estate would be first position on the property. These are for loan amounts from $3 million and we’ve done them as high as 100 million. Any questions on this? You know, feel free to reach out.

44:21

Speaker 2

So this is our contacts. You can scan our QR code. You know one of the things that is very unique and I think you’ll see it in the chat as well is we have a 24 hour phone number. So you can call that number 24 hours a day, seven days a week. It rotates to the loan officers that are in a 12 different countries. Somebody will answer and they can help you in your time zone and likely in your language as well. So that is it. Thomas, if you want to come back on we can start the questions and answer.

44:57

Speaker 1

Should be able to hear us loud and clear now.

44:58

Speaker 2

Yeah. Okay. Okay, let me pull up the chat here. Okay, so what I’ll do is I will go through these questions. I, if it’s pertaining to you, I’ll ask you to answer. If it’s pertaining to me then I’ll, I’ll take it. So first question. Are some states better for rental property than others?

45:27

Speaker 1

Wow.

45:27

Speaker 2

That’s I think on a tax basis. I don’t know if it makes any difference but you know, feel free to answer and then I’ll discuss the loan.

45:35

Speaker 1

Actually it makes a tremendous difference with this. It’s interesting that you mentioned New York and California. They have amongst the highest individual tax rates to us as well as the lowest. Sorry as the most regulations against taxations and you know to. They also have the most disallowance of potential deductions as well. Now there are states that are, you know, have no income tax even you should get in a taxable situation on this stuff. Two of the, two of the most favorites are Florida and Texas to this and I’m a Florida native with this and Florida is a wonderful state with this, but there’s some insurance issues. So honestly, you know, me particular, I’m looking at two states. The other is Nevada.

46:26

Speaker 1

So, you know, when I’m looking at rental real estate for myself, I’m looking in, you know, in the San Antonio area where your head office is and around Las Vegas and Nevada as well. Both have very large migration patterns into them and very positive tax implications on them as well. So those are the two states I prefer.

46:45

Speaker 2

Yeah, well, I mean, a great answer. And I actually, I mean, I should have thought of that before. I. When it comes to lending, it doesn’t make a difference to us because lending all 50 states, you know, there are certain states that maybe, you know, there’s certain restrictions on how you lend, but absolutely, it doesn’t matter to us. But you know, you may, if you’re considering which area to buy in or which properties to buy in, you may actually want to, you know, reach out to Thomas first and get an idea on the taxes. So. Okay, next question. What happens if I want to sell my property? I’m assuming that is a tax question.

47:30

Speaker 1

Yeah, that comes into the earlier question on this. You know, and I mean, and it is possible to sell the property to this. You’re not going to have the greatest tax situation. You’ll lose a fair amount of your gains if you go to sell this in a straight up way to do this from a tax wonk standpoint. The way to do this is though, if you’re looking at taking your initial equity out or even more equity that you built up over the years, the best way to do this is to call Robert up and actually just refinance the property. Take the equity back out of your initial investment or and plus gains to this and you still own the property. You still own the property for continue to appreciate over the future years with us by then.

48:11

Speaker 1

This is the other side of this too. Rents increase year by year in the United States as property values go up, rents increase as well. You’re going to find very few investments that you can sell the investment for your initial thing on take the money back out of it using a note. And yet your dividends, that is the rents continue to increase year by year. It’s the reason you want to do this. Now should you choose to not refinance but you know, say you’re tired of that particular area or that particular state for some reason, you can do the 1031 exchange and have no tax consequences. It’s just a matter of steps to go in and properly identify the new property. The money, the money taken out of the first sale has to go into escrow and go into the new sale straight.

48:56

Speaker 1

But it’s possible to do that as well with it. So, you know, you can. Selling is not the greatest aspect the way to do this from a tax efficiency standpoint, but there’s ways to take your money out and help yourself as well to those.

49:10

Speaker 2

So a question, Thomas, though. When you have depreciation and you’re taking the depreciation over a period of time and with proper tax planning, and I know you talk about this all the time, that you can actually not only not pay taxes, but you can show a loss every year based on whether it’s depreciation.

49:31

Speaker 1

That’s, that’s the basic idea of cash flow positive and tax flow negative. Now say you are getting an 8% yield off the property to this, okay. And your mortgage interest and everything is coming in. Right now we’re at a higher mortgage interest rates. We’re also getting higher yields. So say you are even after the mortgage interest making 5 and a half, 6% to this after your expenses. You know, you’re going to use the depreciation and your other expenses to kick that down to almost no income to a pot negative income. But the reality of it is your bank account is still going to be getting a check to it. Because while you’re taking the expense on that depreciation at roughly about 4% per year, that’s not coming cash out of your pocket.

50:16

Speaker 1

That 4% a year is coming back to you as real cash with it. It makes a big difference on how you deal with mortgages and stuff. And now one of the things about this, right now we’re at a higher interest rate to this, you know, and weirdly, that’s because that’s helping you get a better price in the United States on rental properties to this because it’s all about our yields. Now what you do in this situation is you just refinance in a couple years because you’re going to save 50, 100, $200,000 depending on how much property you buy right now. If you refinance in a couple years, your interest rates goes down, your cash flow gets even better to this planning makes all the difference in how you do this. It makes it Again, cash flow positive.

51:00

Speaker 2

Yeah, absolutely. And you know, we always recommend people to speak to a tax advisor even before they start investing. The one thing that, again, this is besides the long duration of the long amortization period for US Loans, regardless of age, is there’s no restrictions on the amount of properties that you can own with the maximum loan to value. So, well, as you were saying, you can pull out up to 65% if you’re a foreign national, up to 75% of your US expat of equity out of your property. And then you can turn around and use that money and get a, if you’re a foreign national, 75% loan to value or a U.S. Citizen, 80%. And you can just continue and continue to do this to where you had discussed in your presentation.

51:48

Speaker 2

You build up a massive portfolio to where you’re sitting pretty by the time you’re ready to retire.

52:27

Speaker 1

Exactly. It’s a great way to build wealth. I always refer to it as daisy chaining, especially if you’re in your 30s or early 40s. Buy one property now, in five to six years, refinance that property, get another property and by the time you are 60, 65 retire you can have four or five or six rental properties that are giving you a very nice yield because the rents don’t stay fixed, guys. They go up year after year to this. It’s a real nice way to build wealth.

53:11

Speaker 2

I absolutely agree. Okay, let’s get on to the questions here. I’m already pre approved for a loan with you guys. Any help in finding a property to buy in the usa? Super good question. And this was something that we had struggled with for the longest time. A lot of people that we dealt with, a lot of our clients were initially surprised if they could get a U.S. Mortgage, but we’ve had the difficulty of now where do I find a property? So we recently partnered with a new group called New Zip and you’ll be able to see this in the center portion of our website. But news that similar to us where they work with foreign nationals and similar to you, Thomas, where you work with, you know, U.S.

53:11

Speaker 2

Citizens and foreign nationals, they will match you with the perfect Realtor in the location that you want to find a property in. And the beauty of this, if you use New Zip Realtor to find your property and use American Mortgages to close your loan, new zip will give you a 50.50%. So basically 50 basis points of a credit that you can either use to, you know, for your closing costs you can use it to buy the interest rate down or you can even take it as cash in the bank at the end of closing. So if you have any questions on that, please reach out to one of our loan officers. They’re very versed on new zip. Now next question. This would be for you Thomas. Can you handle both U.S. And Canadian cross border taxation?

54:05

Speaker 1

Yes and no. I mean if it’s a US citizen to this we can certainly handle it. In the Canadian issues we actually work with a very articulate and good Canadian tax attorney here in Asia who helps out with all these issues as well. To this Canadians have very specific stuff. So. Yeah, well we don’t do that in house. We have somebody we work with who specifically handles all the Canadian issues to this, especially living overseas and residents and stuff. We can help out with that as well.

54:35

Speaker 2

Perfect, thank you. So I think on that probably best to reach out to Thomas and yeah.

54:41

Speaker 1

Just give us a call and we can refer you to the right in the right direction.

55:02

Speaker 1

The cost of doing a tax return in the US each year and number two, is it preferable to hold a property in an llc? So you want to answer one and I’m happy to answer two.

55:02

Speaker 1

It can vary depending upon the type of rental property to this. Most of the time that we’re dealing with a non resident alien and say it’s a one apartment to this it’s about a 600 a year charge to handle the 1040 non resident tax return to this. So it works out really well. Now if you’re going to only own one property with it, from an LLC standpoint to this it’s generally not worth the cost of having the llc. Most of the LLC advantages are not taxed because the tax flows from the LLC straight to you as an individual to this it’s not really tax saving. However, what you can do is you can isolate liability to this. So should you own a large number of properties in the U.S.

55:50

Speaker 1

You know, in one tenant does something stupid and say your one tenant burns down the duplex and your other tenant on the other side dies, passes away, he’s not going to go see that tenant. He’s probably, he may go after you do this and have a difficult issue, especially if he sees 20 rental real estate properties. However, what you would do in that particular case is own each or a couple properties in an LLC in that area and lower your liability. Most of the llc, in fact, it’s called a limited liability company. That’s generally the biggest benefit of it is it allows you to do that. Now there are some estate tax issues as well that can help you out as well.

56:29

Speaker 1

So if you get a lot of these too, because the LLC can have an unlimited lifespan unserved person, so you can escape estate taxes as well if that becomes an issue. So there are some things but it’s a mixture of yes, no and maybe whether that will benefit you if you’re in that situation. You want to know about an llc, give us a call back and we’ll give you a specific thing on this. Again, we do an hour consultation with no charge. You know, for you because you’re American Mortgage referral.

56:56

Speaker 2

Yeah, I think going back on the llc, we can do a loan in either individual name or we can do it in the entity in the llc. And I think a lot of people like you said, besides the various tax advantages, but people put it in an LLC to protect their personal wealth. You know, if you get exactly. You’re only suing that llc, you’re not going above it. So.

57:21

Speaker 1

Yeah.

57:22

Speaker 2

Next question. What do you think of Houston Multifamily Rentals and San Antonio Multifamily rentals? I have 1 million Canadian liquid as a down payment. What’s the most that I can leverage to this would be for me?

58:08

Speaker 1

I’m all in for. For Houston on for tax purposes.

58:18

Speaker 2

Next question. For the rental coverage program, how do I show a property’s projected rental income? Will America Mortgages help? That’s a very good question. It comes up a lot. So if the property that say you’re buying a property or refinancing a property and has an existing rental agreement, that is what we will use if you’re buying a new property. So the property does not have to be tenanted 10 to tenanted when it’s closed or when the loan closes, but we will do another evaluation alongside of the appraisal. But that valuation is only coming up with the average rental income for that type of property. That is what we will use to qualify if there’s no rental agreement in place.

59:07

Speaker 2

You know, it’s because the US appraisals and valuations are all done through a third party where there’s very little input that they have from us where matter of fact, we’re not even allowed to talk to the appraisers except for to address certain issues. But it is a very accurate number of what the rental income will generate. Next question, tips to manage taxes. If I own multiple US Properties, contact Thomas.

59:40

Speaker 1

I think that’s one of the wackier things about this is, you know, especially if you’re living overseas, you get a tax deductible trip to the United States to view your rental properties to that’s a valid expense off of your rental properties to this. So you know that including hotels and food and travel for you as the owner of this property with us. So you know, and yeah, it, you know, certain expenses can be spread amongst multiple units and sometimes to this. But you know, yeah, we help out with that. You do, you do have to file multiple state returns if you’re in a different state to this, even though you don’t, you may not owe any tax to it. So a lot of times, especially in Florida, Nevada and Texas, your head just, you just don’t have that fee with it.

01:00:27

Speaker 1

But you know, we can help you know, schedule all the different taxes across expenses across those different rental properties with it. One of the things about this too is a very good property manager and I know Robert has a list of those as well will help you dramatically, you know, to this they should give you most of your expenses very specifically line itemed out to it as well. So most of your accounting work is done by your property manager. We handle the tax side and make sure you’re efficient as possible.

01:00:55

Speaker 2

Fantastic answer. Next question. Can I reduce the tax I pay on rental income? Well, this is exactly where you come in.

01:01:04

Speaker 1

Yes. I mean especially you know, with it and you know, we have this conversation inside the office on a regular basis we do with rental properties. And we had a gentleman come in who they wanted to go buy a very expensive property in Boston to this and very wealthy individual, rather famous individual. And were like, you want to finance this property with this because your rental yield is going to your depreciation is not going to cover your rental yield on this, but you can do this and instead of coming up with a million four, which was what this condominium cost, come up with the $400,000 off this thing. It’s going to continue to grow year after year by net asset value to us and let the rental yield, the rent itself, pay off the mortgage interest on stuff, debt, depreciation, all those things are.

01:01:56

Speaker 1

And other expenses are really the way to lower that taxation. And even up to this and saying, I’m going to go once a year and view my rental property as the owner of this. That’s generally a deductible expense. So, yeah, proper planning. Give us a call and we can help you figure out the ways to lower to know, negate your taxation issue. My favorite saying about owning rental property, cash flow positive, tax flow negative.

01:02:24

Speaker 2

Absolutely. And I’ve sort of picked up on that as over the years, if you said this. But you know, I will say that all of the clients that we’ve had that have dealt with you have paid no income tax on rental properties. So again, the proper tax planning, I think especially there’s this misunderstanding of taxes in the US as soon as somebody thinks taxes, oh my God, it’s going to eat me alive. In the US Especially when it comes to real estate, it’s the exact opposite. Especially when you compare it to Australia or the uk which is a nightmare. Taxes.

01:03:04

Speaker 1

My camera just fell.

01:03:06

Speaker 2

Thomas, you okay?

01:03:07

Speaker 1

Yeah, yeah. I will turn the camera off though, so you’re not looking at the floor, but all good.

01:03:14

Speaker 2

Okay, let me go to the next question. Hold on, let me go to it. Let me go to a mortgage question. While Thomas is recouping himself here.

01:03:24

Speaker 1

I’m, I’m still good with it. Just had to turn the camera off.

01:03:28

Speaker 2

Okay. All right, next question. What happens to taxes when I sell my US Property, do I have to pay capital gains tax?

01:03:38

Speaker 1

Yeah, this is the ultimate reason why, you know, the other than cash flow positive, tax flow negative, the other rules is never sell US rentals real estate. You will pay, you will pay capital gains tax at 15 depending upon value, can even go up to the about 20%. Now with the net investment tax issue to this and you get subject to remember that depreciation that’s coming in at about 4% per year comes back to you at income when you sell the property with this. So yes, it’s possible to do that. But if you’ve owned a property for say 25 years, we have a lot of People who do that do this, almost everything you paid for the property originally comes back to you as income.

01:04:22

Speaker 1

With this, generally you are far and ahead to refinance the property, take all the cash you want out of the property, do whatever else you want to, and continue to own the property and, or do a Section 1031 exchange where you buy the property, you sell that property, you identify another property and there’s no tax whatsoever when you do what’s called a like kind exchange with this. So smart planning should prevent you from having to go in and do that.

01:04:54

Speaker 2

Yeah, and I, I agree with you. I think when it comes to US Real estate investing, obviously listen to the experts, listen to us, that again only focus on, you know, clients just like yourselves. And, and also, you know, with Thomas, I think if you follow the expert advice, you’re going to have an absolutely amazing experience owning U.S. Real estate. Next question. Will owning a U.S. Property in an LLC lower my taxes? Thomas?

01:05:26

Speaker 1

It’s possible, but the benefits, the benefits of an LLC are generally not tax savings. They’re other than possibly estate tax. You know, if you pass away with it, most of the time it’s a liability issue of making sure your tenants cannot potentially go after any assets you have anywhere. To us now if your assets are generally outside the United States, the US Court can’t attach them anyway with this, although there are exceptions to just about everything with this. But most of the time the LLC is really done as a way to isolate liability, not a tax savings in.

01:06:03

Speaker 2

The U.S. Okay, next question. And this would be for me, I’m a self, I’m self employed in Dubai. What documents do I need to get started with a mortgage in the U.S. Well, if you’re buying a property as an investment property with no intention of living in it, then it’s quite a simple process. You need to do the loan application, which is done on a portal. Very simple. You’re just answering questions and the application is filling in the information as you go. You’re going to provide your passport, you’re going to provide two months of bank statements. Foreign bank statements are perfectly fine. What we want to see on those bank statements is that you have the down payment and you can cover any costs that are associated with the purchase. And really that is it.

01:06:54

Speaker 2

Once we have that, we’ll run it through our underwriting, which obviously is quite simple, and we’ll issue a pre approval letter. Next question. Can I apply for a mortgage jointly with my spouse? If only one of us has income yeah. And well, there’s two ways you can go. One, you can apply for the mortgage with your spouse if you choose or you can just have the spouse on title either. If you’re buying it as an individual and not in an entity, then you can, you could be the mortgage, the person on the mortgage and then your wife could also be on the title of the property with you. If you’re using an llc, then you can both be members of that llc.

01:07:41

Speaker 2

If there are, there is a certain percentage threshold which is, you know, needs to be required when it comes to the mortgage. But the short answer is absolutely yes. So there’s another question which is in the other chat but it says very informative call. What about short term rentals? Intending to buy a property in the US to periodically stay there but rent it on a short term basis. What I would do on that is we do have programs for like Airbnb. I would contact one of the loan officers and discuss exactly what you’re looking to do, how much time you’re willing to spend on it and then we can structure a loan around that requirement within the chat group or within the Q and A.

01:08:31

Speaker 2

And on the chat there actually is a link that you can schedule a call with one of the loan officers 247 or you can speak to one of Thomas’s team and as Thomas had said, because you’re a client of America Mortgages and he has a free consultation for one hour which I believe Thomas is probably at least a couple hundred dollar value. So.

01:08:53

Speaker 1

Yeah, yeah. The one thing about that is if you do use a rental property for more than two weeks a year for personal use with this, you lose the depreciation cycle on this. So personal use can adjust how you deal with a rental property. To us it’s not the most onerous thing in the world times especially if you’re going to use it in a nice area like Orlando, Florida to this you can go spend several months and let the rental property pay for itself the rest of the year with. And that’s what a lot of people do in a vacation spot. They’ll go own the property to this, use it for several months but it’s not quite as tax efficient as it would be otherwise.

01:09:33

Speaker 2

Fantastic. Okay Thomas, I think that is all the questions. I want to thank you again always for joining us for the webinar. We really appreciate it. I don’t know if you have any final sign off words.

01:09:46

Speaker 1

Yeah, I mean I apologize for my camera falling to this. You know, give us a call if you’ve got question tax questions about, you know, rental property in the United States. You know, it’s, I’m an advocate over this. As I’ve gotten longer and this is a career with it you really can build wealth. I mean a friend of mine many years ago said buy a lot when you’re young with it. What he meant was not buy a lot of things, but buy a piece of property a lot somewhere to this and that will appreciate considerably to this.

01:10:20

Speaker 1

I have a small piece of property I bought for my oldest daughter in Florida many years ago and it is now appreciated tremendously with this rental property allow is even better because you can keep the income flowing and stuff, but you can make a lot of money and rent real estate and rental real estate. Man, United States. Yeah, excellent.

01:10:43

Speaker 2

Well, I, I, I want to thank everybody as always for joining our webinars. This, there will be a recording of this sent out. So if you have missed something, it takes about a week to go through the production with our team, but it’ll be sent out to everybody that has signed up or has joined the webinar or people that maybe couldn’t have made it. We have maybe a hundred webinars that are on our website. So if you have any questions on u. S Real estate related, you can go to our YouTube page and you’ll be able to follow that on, you know, an ongoing basis as the webinars come out. The next webinar and for that person that had asked about finding a property in the US Will be with one of our partners called New zip, which will be a property matching service.

01:11:32

Speaker 2

So with that said again, thank you everybody. We really appreciate your business and your time on this webinar today and we look forward to seeing you on the next webinar. Thomas, thank you again. Thank you very much everybody. Good day or good night.

01:11:57

Speaker 1

It.

Disclaimer: This transcript is AI-generated, so kindly pardon any transcription or grammatical errors that may be present.