Building a real estate portfolio in the United States is easier than you’d think. As we all know, growing a real estate portfolio is an excellent way to provide long-term passive income and generational wealth building. For U.S. expats and non-residents, investing in the American property market might seem daunting, especially when you’re unsure about your mortgage options or even if there is an option to get leverage as a non-resident investor.

With strategic planning and an understanding of key principles, it’s possible to start real estate investing with less money and gradually expand a portfolio. This guide will explore practical strategies, the 1% rule, and how America Mortgages can assist U.S. expats and foreign nationals in financing their real estate portfolio.

How to Start Real Estate Investing in the USA with Less Money

For U.S. expats and non-residents looking to begin their real estate journey with leverage, there are several entry points to explore:

Understanding the 1% Rule in Real Estate Investing

The 1% rule is a fundamental principle used by real estate investors to evaluate the potential profitability of a property. According to this rule, the monthly rental income should be at least 1% of the property’s total acquisition cost. For instance, if a property costs $200,000, the monthly rental income should be $2,000 or more to meet the 1% rule.

Adhering to the 1% rule ensures that the property generates sufficient cash flow to cover expenses such as mortgage payments, property management, and maintenance while leaving room for a positive return on investment (ROI).

Determining a Good Cash Flow on an Investment Property

When it comes to investing in U.S. real estate, the location of the property is a critical factor that significantly impacts the cash flow potential. A good cash flow on an investment property refers to the surplus income generated after covering all operating expenses. Positive cash flow is essential for long-term sustainability and building a strong real estate portfolio. To calculate cash flow, deduct monthly expenses (mortgage, property taxes, insurance, maintenance, etc.) from the rental income.

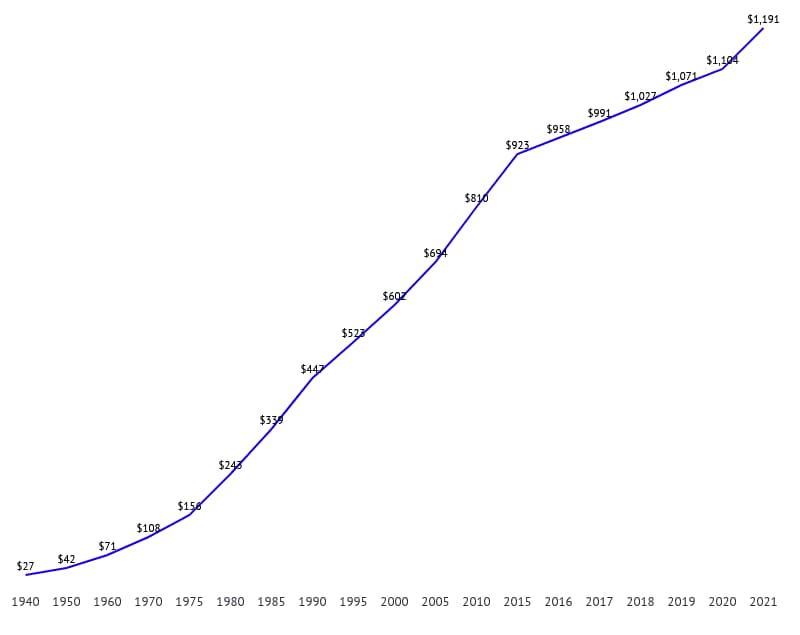

According to iPropertyManagement, rental prices have soared by an average of 8.85% annually since 1980. As of May 2023, here are the top 10 hottest U.S. rental markets, offering attractive opportunities for investors looking for profitable real estate prospects.

Median Monthly Rent Nationwide Since 1940, Selected Years

A positive cash flow indicates that the property generates more income than it costs to maintain, providing a buffer for unexpected expenses and contributing to the investor’s overall financial stability.

The Ideal Cash Allocation in a Real Estate Portfolio

While building a real estate portfolio with minimal cash outlay, investors should carefully consider the allocation of their funds. It is generally advisable to keep a portion of the portfolio in cash or liquid assets to handle any emergencies, vacancies, or unexpected repairs.

The exact percentage to hold in cash may vary depending on an investor’s risk tolerance and investment strategy. However, keeping around 10-20% of the portfolio in cash is a common approach to ensure stability and flexibility in managing the portfolio.

America Mortgages U.S. Portfolio Financing

Investors living overseas interested in purchasing multiple investment properties face challenges with multiple lenders and varying rates for each property. America Mortgages’ AM Portfolio+ loan program provides a solution with unique portfolio loans, offering long-term financing at fixed rates, either “Principal + Interest” or “Interest-only payments.” This flexibility simplifies the process, allowing one mortgage and payment as your portfolio grows.

AM Portfolio+ Lending Terms:

- Loan to Values:

- U.S. Citizens: Up to 75%

- Foreign Nationals: Up to 65%

- 1 Loan over multiple different properties – meaning one loan payment monthly and one underwriting process.

- Rates are fixed for up to 30 years, allowing investors to plan for a constant rate and payment over the lifetime of the loan. There is no need to restructure the loan during the 30 years unless your plan is to extract equity in the future or lower the rate if interest rates improve.

- Flexible prepayment penalties – Most people agree that we are at or near the high for interest rates in the near term, and eventually, they will start to come back down. Flexible prepayment penalties allow you to plan a potential refinance sooner if you feel rates will come down in the near term or longer out if you think it will take a few more years for rates to decline.

AM Portfolio+ Lending requirements:

- Properties must be owned by a U.S. entity. America Mortgages Concierge can assist you in setting up a U.S. entity to hold the properties

- Properties must be cash flow positive – generally 1.25 : 1 – meaning the property is bringing in $1.25 in rental income for each $1 in loan payments

- Minimum property value: $75,000 per property

- Minimum loan amount: $250,000

Portfolio loans are a great way to quickly jumpstart or increase your real estate holdings in the U.S. As with most other items, buying in bulk can often result in lower prices per property or embedded equity in the portfolio versus buying the same homes individually.

Build a U.S. real estate portfolio with minimal cash outlay—achievable and rewarding for U.S. expats and non-residents. Explore financing options, understand the 1% rule, focus on positive cash flow, and maintain an appropriate cash reserve.

Ready to start? Contact us at [email protected] and seize opportunities in the thriving U.S. property market. Visit www.americamortgages.com for more information.