Making a case for U.S. Residential Property Investment

“It’s not Apples to Apples”

As you may recall, last week, we looked at the affordability between popular U.S. investment destinations compared to major cities in the world. We argued that the U.S. offered the best “entry price” for real estate investments on absolute terms and when adjusted for affordability.

This week in Part 2 of our Deep Dive Series, we look at the Relative Income Potential of the popular U.S. investment destinations compared to major cities in the world.

Investing in residential properties or buying-to-let is a form of a business, and as a business owner, making a profit is of priority. A common metric that we use to measure the profitability of a real estate investment is rental yield. Net rental yield measures the profit you generate each year from your investment as a percentage of its value.

Same as what we did last week, we shall compare data sets from 2 sample groups:

1. Major global cities:

| Toronto | Vancouver | London | Sydney | Melbourne |

| Shanghai | Beijing | Hong Kong | Singapore | |

2. Top U.S. residential real estate investment destinations:

| New York, NY | Miami, FL | Orlando, FL | Ft Lauderdale, FL | Ft Worth, TX |

| San Antonio, TX | Austin, TX | Dallas, TX | Houston, TX | Seattle, WA |

| Chicago, IL | Los Angeles, CA | San Fran, CA | San Jose, CA | Atlanta, GA |

| Portland, OR | Las Vegas, NV | |||

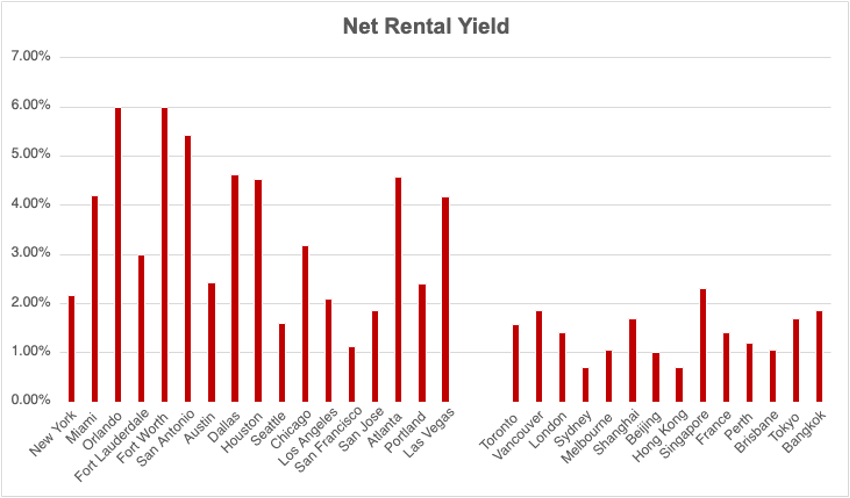

On average, the net rental yield of popular U.S. real estate investment destinations is 3.49%, much higher than that of other global cities – 1.39%. This means that on average, for a property that costs USD 500 000, you can earn approximately USD 17,450 if this property is in the U.S. and only USD 6,950 if this property is in other global cities. This is after accounting for property taxes. We see that investing in the U.S. can earn you 2.5 times the income you will earn in other cities!

In the following chart, you will see the disparity in the profit flow more clearly.

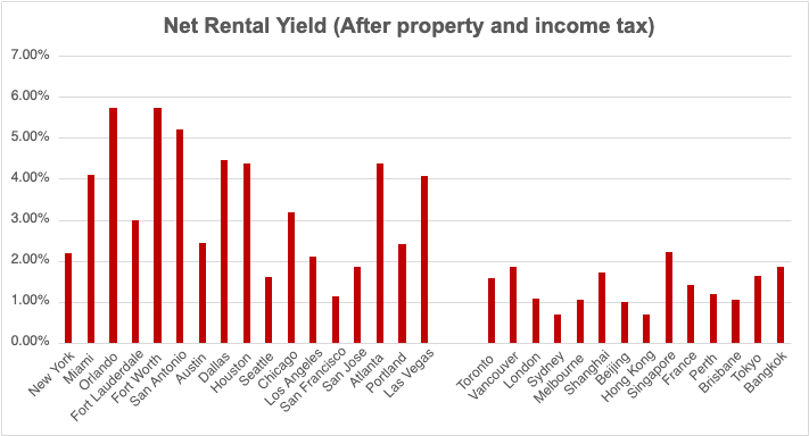

Now, if we look at the net rental yield that takes into account both local property and rental income tax as part of the costs, we can see that the results are similar. U.S. destinations, on average, have a much higher yield than other global cities (3.40% vs. 1.36%).

Note: Even after considering income tax, investing in the U.S. can still earn you 2.5 times the income you will earn in other cities.

Myth Buster – The common misconception that the U.S. tax regime makes investing difficult and not feasible is unfounded. Even adjusting for taxes, U.S. residential real estate is superior investment.

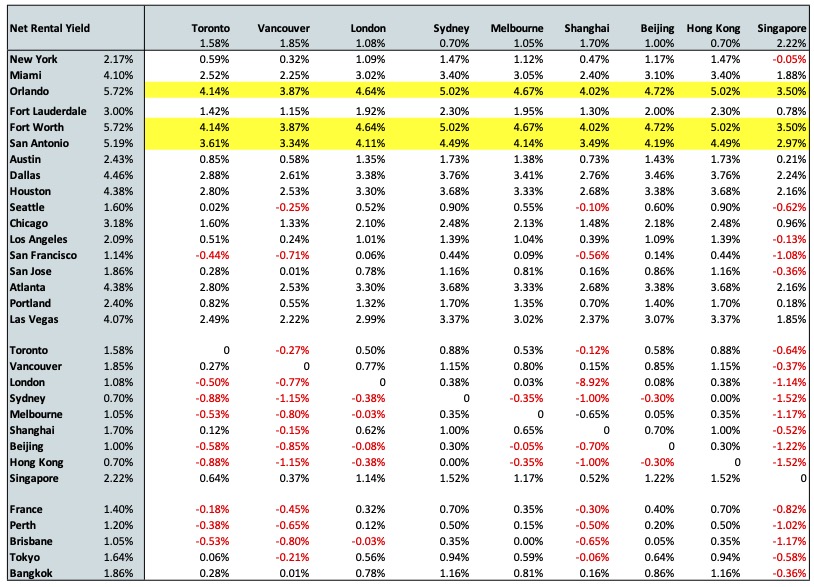

To further strengthen our point that the income potential of U.S. cities is much higher than other global cities, including your home cities, take a look at the table below. If you live in the cities stated in the row, you should definitely not buy-to-let in the cities highlighted in red as the income potential in those cities is worse than your home. Instead, it would be best to invest in the cities highlighted in yellow, where yield is much higher.

Net Rental Yield differences between Major Global Cities and U.S. Residential Real Estate Investment Destinations

Let someone else pay for your mortgage.

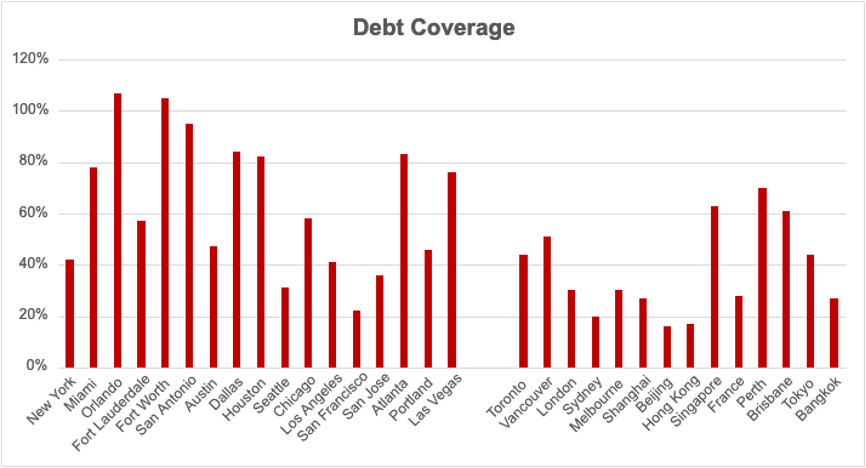

To make things better, in some U.S. cities, you can even pay off a sizeable portion of your mortgage loan with your post-tax rental income. Using the AM debt coverage ratio, we see that in cities such as Orlando and Fort Worth, without considering other maintenance costs of your home, your annual post-tax rental income can cover all of your annual mortgage payment (with some to spare). This is rare in other global cities. In Hong Kong, annual post-tax rental income can only cover 17% of the yearly mortgage payment.

The following diagram shows the debt coverage ratio comparison (the higher, the better).

Solely based on net rental yield, you should always consider Orlando, Fort Worth, San Antonio, and almost never San Francisco. It is interesting to see some overlap with last week’s affordability rankings, where Fort Worth and San Antonio were at the top and San Francisco at the bottom.

Just like affordability, rental yield is also just another aspect of property investment. It is important to consider other factors too – growth potential of the city, capital gains, future price appreciations – which we will discuss in our next report.

To summarize, we see that U.S. real estate properties are outperforming other major global cities in terms of affordability and income potential.

Next week, we will get an even bigger picture by understanding the factors that drive property value growth and why these factors will affect U.S. real estate investments more than other major global cities. You won’t want to miss out!

Stay tuned for next week’s continuation of our Deep Dive series. Email Us