From rising rents to record-low housing supply, real estate is now front and center in the U.S. economy. While policymakers are working on long-term strategies to ease the pressure, international investors are already taking action as they recognize that the window to enter the U.S. property market is wide open.

Housing Supply Is Still Far Behind Demand

According to the National Association of Realtors, the U.S. housing market is currently short by about 5.5 million homes. In May 2025, the median home price in the U.S. reached $407,600, up nearly 6% from the year before. During the same period, new home sales surged by more than 14%, according to the U.S. Census Bureau. These figures reflect that demand remains strong. However, for many renters, homeownership remains out of reach.

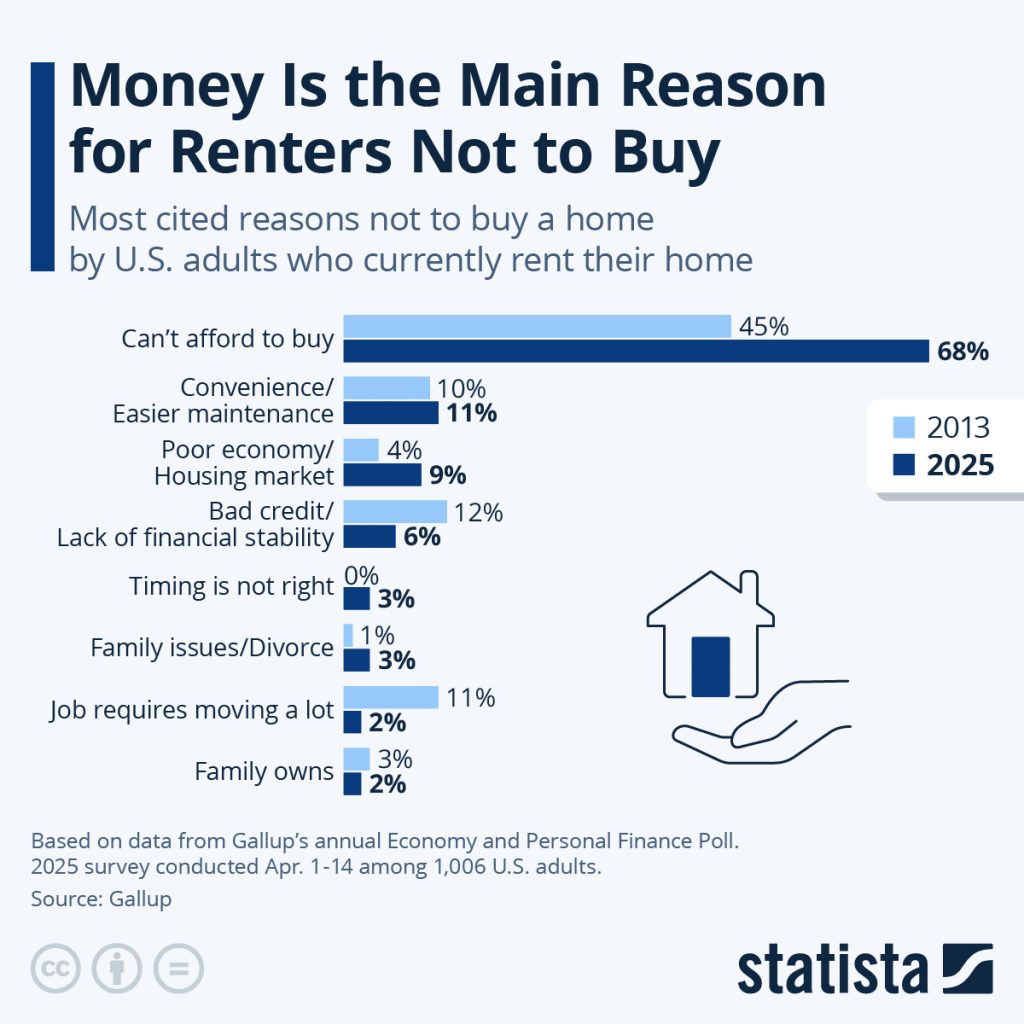

A recent survey shows that affordability is still the top barrier preventing renters from buying, as shown in the chart below.

With demand far outpacing supply, prices remain strong in key rental markets including Florida, Texas, North Carolina, and Georgia.

Policy Momentum Is Building

In response to the housing shortage, state and city leaders are proposing new strategies to unlock more housing supply and improve affordability. These range from expanding buildable land to modernizing zoning and financing rules.

Some proposals include large-scale new home construction targets, the conversion of underused land into housing, and revised borrowing criteria that could make it easier for more people to access financing. While still in early stages, these ideas point to a growing push to resolve structural housing challenges, which could open new doors for investors.

Rental Demand Remains High

Vacancy rates for single-family rentals are near 1.6% nationally, according to Rentometer and RentCafe reports. In fast-growing cities like Charlotte, Orlando, and Dallas, rental demand is strong and rents continue to rise as inventory struggles to keep up.

At America Mortgages, we continue to see strong demand from foreign nationals and U.S. expats financing homes for rental income or long-term growth. Many are choosing to secure property now, ahead of increased competition.

What About Mortgage Rates?

Some investors are locking in today’s prices and planning to refinance later if the Federal Reserve moves ahead with expected rate cuts this year. This approach allows them to enter the market without trying to perfectly time interest rate changes.

Why International Buyers Are Moving Now

- Currently the U.S. has a 5.5 million home shortage, keeping prices and rents elevated with little to no relief in the near future.

- Politicians are prioritizing housing with serious proposals that may unlock new development and financing paths increasing property values.

- Rents continue to rise, especially in landlord-friendly states.

- Global investors are taking advantage of mortgage solutions available for non-resident buyers without U.S. credit or income.

America Is Becoming a Nation of Renters — Here’s Why That’s Great News for Property Investors

Rental demand has exploded. Vacancy rates in many markets are at historic lows while rents continue to climb.

For landlords and real estate investors, the message is clear: this is a golden era for owning rental property. With limited housing supply, strong rental yields, and rising long-term appreciation, investing in U.S. real estate, especially in landlord-friendly states, offers a rare combination of income and growth.

Whether you’re a U.S. expat or a foreign national, this is the time to act.

America Mortgages specializes in financing U.S. property for foreign nationals and U.S. expats. With up to 80% loan-to-value, 30-year fixed rates (regardless of the age of the borrower), and no U.S. credit or income required, we make it easy to invest in U.S. real estate, no matter where you live.

Contact us today to get started! Visit www.americamortgages.com, call +1 (845) 583-0830 to speak with a loan officer, or schedule a call with a U.S. mortgage specialist here.