Foreign buyers purchased $56 billion worth of U.S. existing homes from April 2024 to March 2025, a 33.2% increase compared to the previous year, according to the National Association of REALTORS® (NAR). This also represents a 44% increase in the number of properties purchased, totaling 78,100, marking the first year-over-year increase since 2017.

But it is not just the total spend that tells the story. It is where the money is going.

According to The Real Deal, Miami continues to be the top choice for international buyers, capturing 8.7% of all foreign demand. Its combination of tax advantages, sunshine, and investment-grade rental yields keeps it at the front of the pack.

However, the real trend is diversification.

In the first half of 2025, New York City saw its volume of international buyers double year over year. That growth is being led by buyers from Asia, the Middle East, and Latin America, who are snapping up trophy homes and long-term investment properties in legacy neighborhoods.

Meanwhile, the Bay Area is back in focus. After a slowdown during the pandemic, overseas buyers are returning to San Francisco and Silicon Valley. Proximity to top universities, tech companies, and high appreciation potential is drawing global capital back in.

And there is more.

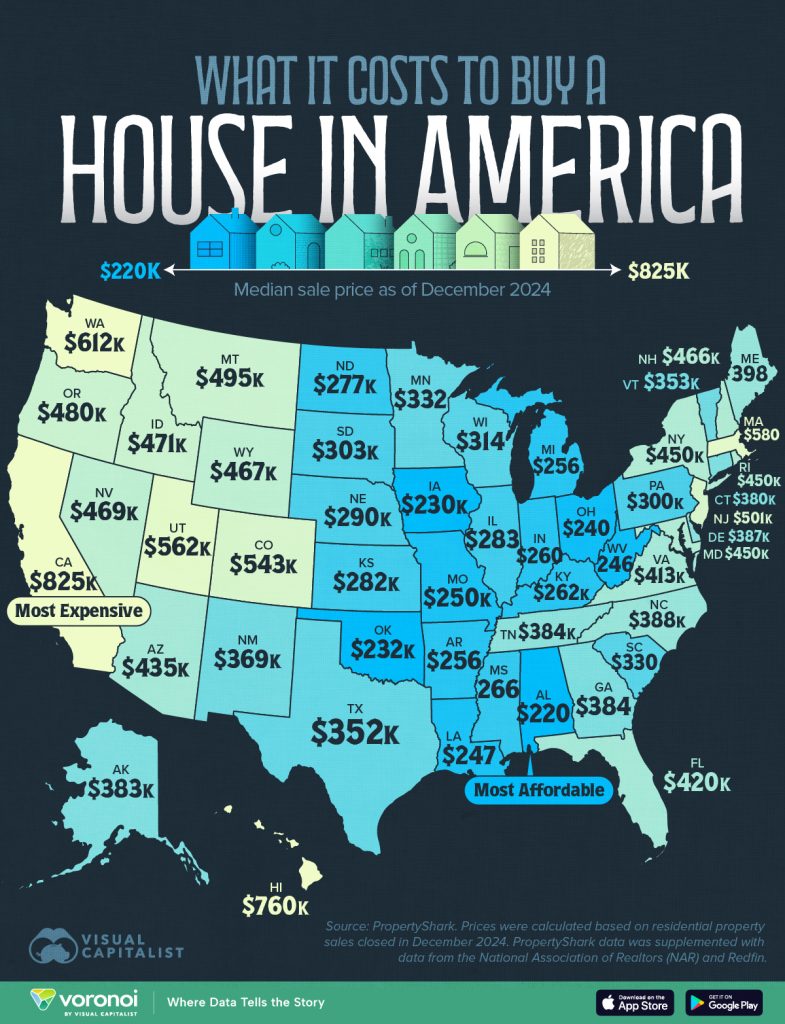

Texas cities like Austin, San Antonio, and Dallas are quickly becoming global favorites. International investors are looking for affordability, strong rental income, and stable long-term returns in fast-growing Sun Belt metros.

At America Mortgages, we are seeing it all firsthand.

From high-net-worth investors in Singapore, London and Dubai, to first-time buyers in Zurich and Hong Kong, these clients are not just buying holiday homes, they are buying investment properties around the U.S., building portfolios with strategy and speed.

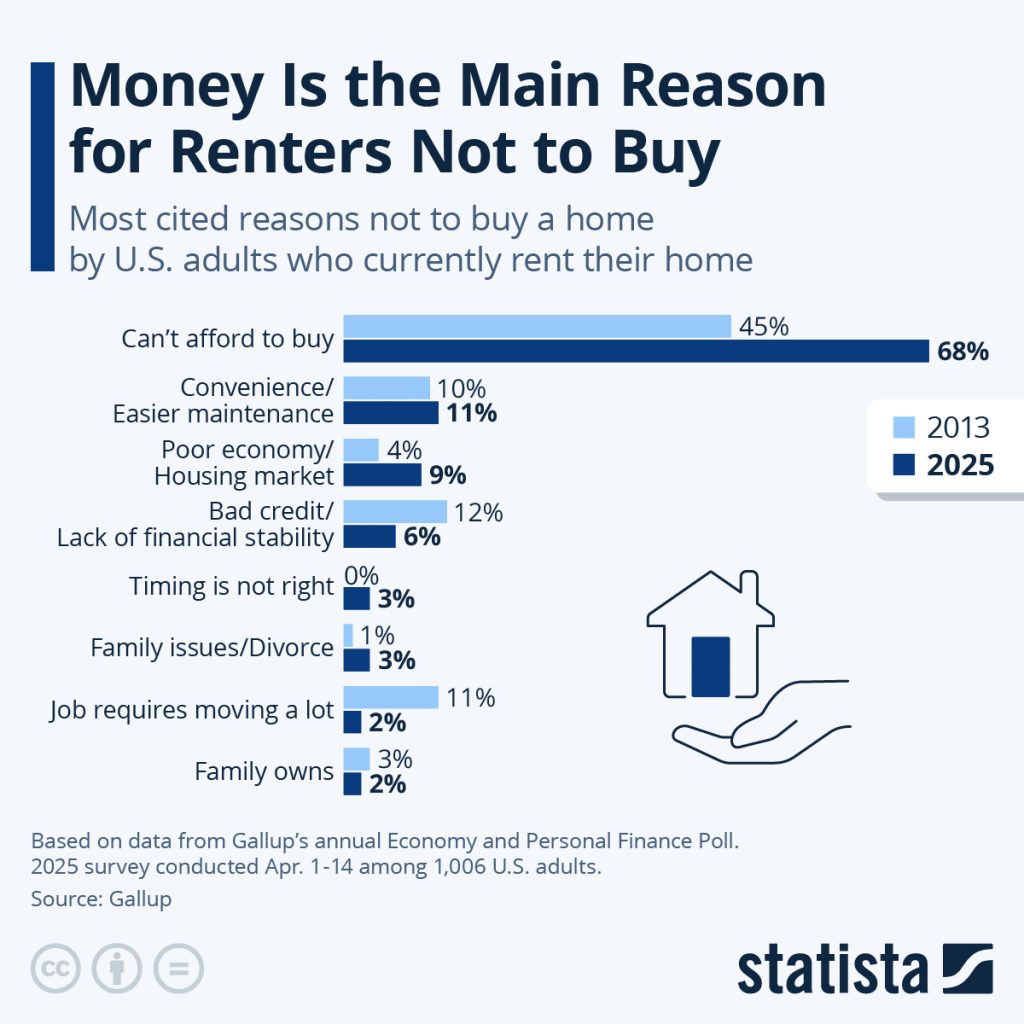

The one thing that holds most buyers back? Financing.

That is where we come in.

We make U.S. real estate possible for non-residents.

At America Mortgages, providing U.S. mortgage loans to non U.S. residents, both expats and foreign investors, isn’t a “side job” for us. It’s all we do. As a direct lender and super broker, we have the ability not to find “just a loan” but a loan that is specific to your needs and your requirements. Our loan programs feature;

- No U.S. credit score required

- Foreign income accepted

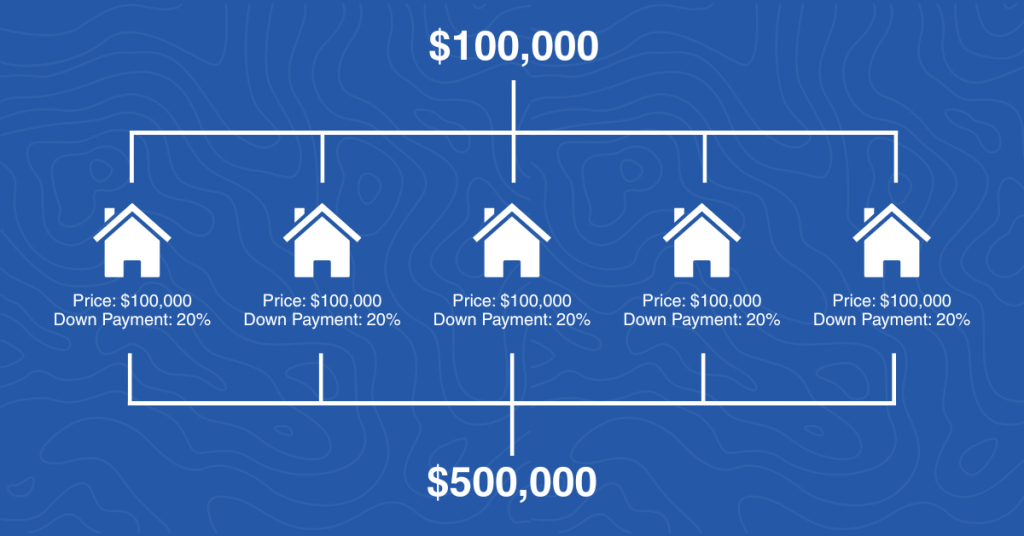

- Up to 80% loan-to-value

- Over 150 loan programs designed for non-U.S. citizens

- Fixed rates up to 30 years

- Loan amounts as low as $150k

- DSCR – investment property mortgagee loans that require no personal income to qualify

- 30-year fixed rates regardless of the age of the borrower

- 10-year fixed interest-only loans

- No W2 required for U.S. expats and foreign income accepted

- Mortgage loans in ALL 50 U.S. states

The U.S. real estate market remains one of the most stable, scalable, and secure investment options globally. And with the right financing, it is accessible to you.

Want to know how much you can borrow and where you can buy?

Let’s build your U.S. strategy.

Contact: [email protected]

Website: www.americamortgages.com

Speak to a U.S. Loan Expert 24 hours a day / 7 days a week: +1 845-583-0830

Need help getting started? Use our 24/7 online booking tool to schedule a free, no-obligation consultation with a U.S. mortgage advisor. https://www.americamortgages.com/home-mortgage-for-foreign-national-form/

Para Cuando Leas Esto, Otro Inversor Extranjero Ya Habrá Comprado una Casa en EE. UU.

Los compradores extranjeros adquirieron propiedades residenciales existentes en Estados Unidos por un valor de 56 mil millones de dólares entre abril de 2024 y marzo de 2025, lo que representa un aumento del 33.2% en comparación con el año anterior, según la National Association of REALTORS® (NAR). Esto también equivale a un aumento del 44% en el número de propiedades compradas, alcanzando un total de 78,100, marcando el primer aumento interanual desde 2017.

Pero no se trata solo del gasto total. Lo importante es dónde se está invirtiendo ese dinero.

Según The Real Deal, Miami sigue siendo la principal opción para compradores internacionales, capturando el 8.7% de toda la demanda extranjera. Su combinación de ventajas fiscales, clima soleado y rentabilidades atractivas la mantiene como líder del mercado.

Sin embargo, la tendencia real es la diversificación.

En la primera mitad de 2025, la ciudad de Nueva York duplicó el volumen de compradores internacionales en comparación con el año anterior. Este crecimiento está siendo impulsado por compradores de Asia, Medio Oriente y América Latina, quienes están adquiriendo propiedades emblemáticas y de inversión a largo plazo en vecindarios tradicionales.

Mientras tanto, el Área de la Bahía vuelve a estar en el foco. Tras una desaceleración durante la pandemia, los compradores extranjeros están regresando a San Francisco y Silicon Valley. La cercanía a universidades de prestigio, empresas tecnológicas y un alto potencial de apreciación está atrayendo nuevamente capital global.

Y hay más.

Ciudades de Texas como Austin, San Antonio y Dallas se están convirtiendo rápidamente en favoritas a nivel internacional. Los inversores buscan accesibilidad, fuertes ingresos por alquiler y retornos estables a largo plazo en las áreas de más rápido crecimiento del Sun Belt.

En America Mortgages, lo estamos viendo todo de primera mano.

Desde inversores de alto patrimonio en Singapur, Londres y Dubái, hasta compradores primerizos en Zúrich y Hong Kong, estos clientes no están comprando solo casas vacacionales, sino propiedades de inversión por todo EE. UU., construyendo carteras con estrategia y rapidez.

¿El principal obstáculo para la mayoría de los compradores? El financiamiento.

Ahí es donde entramos nosotros.

Hacemos posible invertir en bienes raíces en EE. UU. para no residentes.

En America Mortgages, otorgar préstamos hipotecarios en EE. UU. a no residentes estadounidenses, ya sean expatriados o inversores extranjeros, no es algo secundario. Es todo lo que hacemos. Como prestamista directo y super broker, no solo buscamos “un préstamo”, sino el préstamo adecuado para tus necesidades y requisitos. Nuestros programas de préstamo ofrecen:

- No se requiere historial crediticio en EE. UU.

- Se acepta ingreso extranjero

- Hasta el 80% de préstamo sobre el valor de la propiedad (LTV)

- Más de 150 programas hipotecarios diseñados para no ciudadanos estadounidenses

- Tasas fijas de hasta 30 años

- Préstamos desde $150,000 USD

- DSCR – Préstamos para propiedades de inversión sin necesidad de comprobar ingreso personal

- Tasas fijas a 30 años sin importar la edad del prestatario

- Préstamos a interés solo fijo por 10 años

- No se requiere W2 para expatriados estadounidenses y se acepta ingreso extranjero

- Préstamos hipotecarios en los 50 estados de EE. UU.

El mercado inmobiliario estadounidense sigue siendo una de las opciones de inversión más estables, escalables y seguras del mundo. Y con el financiamiento adecuado, puede estar al alcance de tu mano.

¿Quieres saber cuánto puedes pedir prestado y dónde puedes comprar?

Construyamos tu estrategia en EE. UU.

Contacto: [email protected]

Sitio web: www.americamortgages.com

Habla con un experto hipotecario en EE. UU. 24/7: +1 845-583-0830

¿Necesitas ayuda para comenzar? Utiliza nuestra herramienta de reserva en línea disponible 24/7 para agendar una consulta gratuita y sin compromiso con un asesor hipotecario en EE. UU.:

https://www.americamortgages.com/home-mortgage-for-foreign-national-form/

等你读到这篇文章时,又有一位外国投资者买下了一套美国房产

根据全美房地产经纪人协会(NAR)的数据,从2024年4月到2025年3月,外国买家购买了价值560亿美元的美国现有住宅,比前一年增长了33.2%。购买的房产总数也增加了44%,达到78,100套,这是自2017年以来首次出现同比增长。

但不仅仅是总金额值得关注,关键是这些资金流向了哪里。

据《The Real Deal》报道,迈阿密继续稳居国际买家的首选,吸引了**8.7%**的外国需求。得益于其税收优势、阳光气候和具有投资价值的租金收益,迈阿密始终位于榜首。

不过,真正的趋势是多元化。

2025年上半年,纽约市的国际买家数量同比翻了一倍。亚洲、中东和拉丁美洲的买家正带动这股增长潮,他们正在传统社区抢购豪宅和长期投资型房产。

与此同时,湾区也重新回到聚光灯下。在疫情期间经历了一段低迷后,海外买家开始回归旧金山和硅谷。这里靠近顶尖大学、科技公司,具备极高的升值潜力,正吸引全球资本回流。

而这还不是全部。

德克萨斯州的奥斯汀、圣安东尼奥和达拉斯等城市,正迅速成为全球投资者的新宠。这些国际买家正在寻找价格可承受、租金回报强劲、长期收益稳定的增长型城市,尤其是在快速发展的“太阳地带”。

在 America Mortgages,我们正亲眼见证这一切。

从新加坡、伦敦和迪拜的高净值投资者,到苏黎世和香港的首次购房者,这些客户购买的可不仅仅是度假屋,他们正在美国各地购买投资型房产,用策略与速度建立自己的投资组合。

那么,阻碍大多数买家的最大障碍是什么?融资。

这正是我们擅长的领域。

我们帮助非美国居民实现投资美国房地产的可能。

在 America Mortgages,专为非美国居民(包括外籍人士和外国投资者)提供美国房贷,不是我们的副业,而是我们专注的全部。作为直接放贷人兼超级贷款中介,我们不仅为您“找到一个贷款”,而是匹配最适合您需求的贷款产品。

我们的贷款计划包括:

- 无需美国信用评分

- 接受海外收入

- 最高可贷房产价值的80%(LTV)

- 150多种专为非美国公民设计的贷款方案

- 最长期限为30年的固定利率贷款

- 最低贷款金额为15万美元

- DSCR投资房贷款 – 无需提供个人收入即可获批

- 无论借款人年龄多大,均可申请30年固定利率贷款

- 10年期固定利率只还利息贷款

- 美国外籍人士无需提供W2表格,接受海外收入

- 覆盖美国所有50个州的房贷服务

美国房地产市场依旧是全球最稳定、可扩展、最安全的投资渠道之一。只要有合适的融资,您也能轻松进入这个市场。

想知道您可以贷多少?可以在哪些地方购房?

让我们一起制定您的美国投资策略。

联系方式: [email protected]

官网: www.americamortgages.com

全天候联系美国贷款专家:+1 845-583-0830

准备开始了吗?使用我们的 24/7 在线预约工具,立即安排与美国房贷顾问的免费无义务咨询:

https://www.americamortgages.com/home-mortgage-for-foreign-national-form/