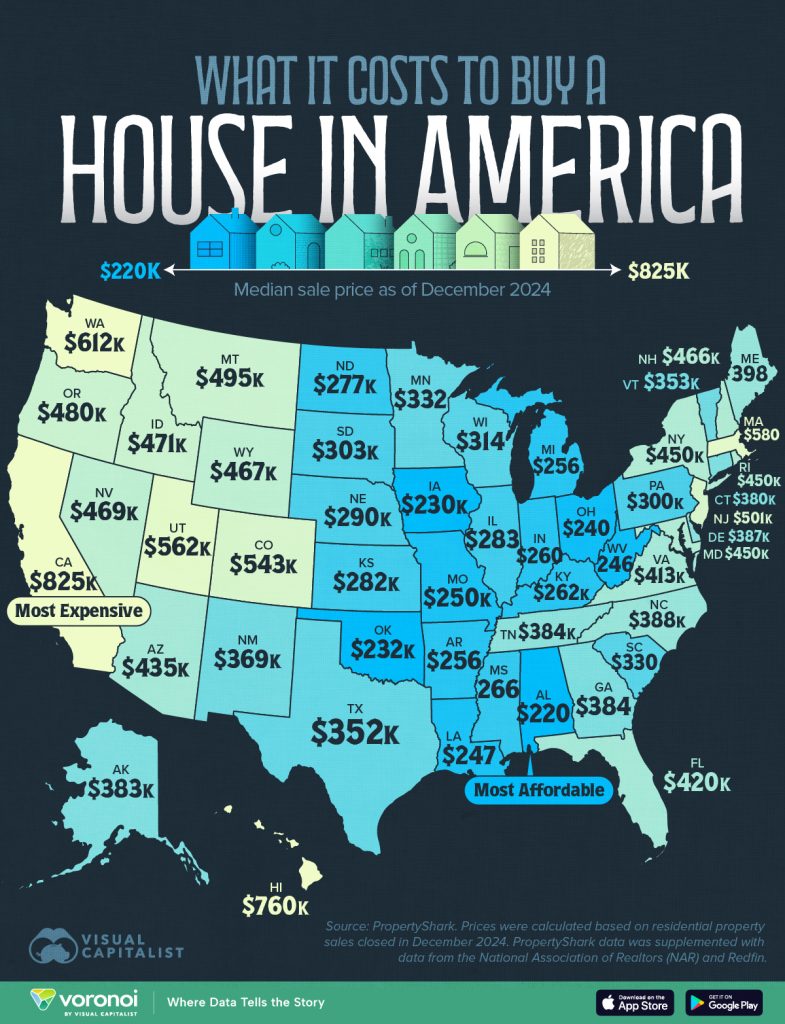

A Map of U.S. Home Prices

The latest data mapping median home prices across all 50 states shows just how diverse the American property market is. While the national median is around $385,000, the gap between states is striking. Coastal markets such as California, Hawaii, and Massachusetts lead with prices well above the national average, while states in the Midwest and South offer significantly lower entry points.

For overseas real estate investors, these differences create unique opportunities. Affordable states can be a starting point for building a portfolio, while higher-priced states often offer stronger long-term appreciation potential. Selecting the right location is key to maximising returns.

Warren Buffett’s Real Estate Wisdom

More than a decade ago, Warren Buffett said that if he could, he would buy a few hundred thousand single-family homes while prices were low, lock in a 30-year mortgage, and rent them out. His point was simple. When you can secure a property at a good price and finance it with long-term fixed debt, the combination of rental income and appreciation can be extremely powerful.

Fast forward to today and while the market has changed, the principle still applies. Mortgage rates are higher and home prices have climbed since the post-2008 lows. This means finding distressed bargains requires more patience and strategy. However, with the right financing in place, investors can still secure high-potential properties, particularly in markets that have yet to reach their peak.

New Ways to Invest

While Buffett was talking about buying homes outright, today’s investors have more options. Some are entering the market through fractional ownership platforms that allow buyers to invest in shares of rental properties with a low minimum commitment. Others are building portfolios in emerging or affordable states that offer better yields and appreciation potential. In all cases, having access to financing tailored to non-residents is the key to moving quickly when the right opportunity appears.

Making U.S. Real Estate Possible for Non-Residents

At America Mortgages, providing U.S. mortgage loans to non-U.S. residents, both expats and foreign investors, is not a side business. It is all we do. As a direct lender and super broker, we have the ability to find not just any loan, but the loan that matches your specific needs and requirements.

When you work with America Mortgages, you benefit from:

- No U.S. credit score required

- Foreign income accepted for qualification

- Financing up to 75–80% LTV

- No U.S. residency or visa needed

- Loans available for investment, vacation, or primary homes

- Fast closings, sometimes in as little as 30 days

The U.S. real estate market remains one of the most stable, scalable, and secure investment options globally. With the right financing, it is accessible to you. America Mortgages makes it possible.

Contact: [email protected]

Website: www.americamortgages.com

Speak to a U.S. Loan Expert 24 hours a day / 7 days a week: +1 845-583-0830

Need help getting started? Use their 24/7 online booking tool to schedule a free, no-obligation consultation with a licensed U.S. mortgage advisor.