You should be!

As we know, The Wolverine is the school mascot of the University of Michigan, the publisher of the widely referenced monthly Consumer Sentiment Index.

This index in early August reached the lowest level since 2011!!

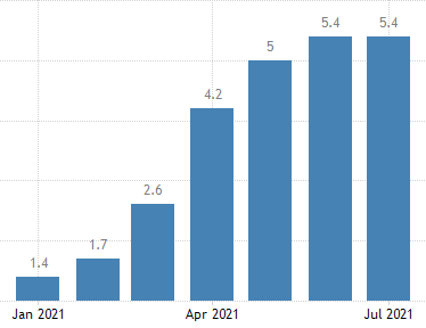

Consumer Sentiment Index

Why is this happening?

This “Stunning Deterioration”, as Bloomberg puts it, is a strong reflection of how inflation and the Delta Variant are worrying consumers. As seen from last week’s article, fast-rising rents are taking up an extremely large portion of peoples’ disposable incomes and it is a very real issue. The prices of goods and services (measured by CPI) are also at record high, and we all know it is only going to go higher.

U.S. Consumer Price Inflation Rate

Rising prices are bad news for low-income individuals and fixed-incomers because it erodes their purchasing power. Hence, it is not surprising that their sentiments lean on the negative side. The rising number of Delta variant cases and several states (California, New York) reinstating mask mandates have dashed peoples’ hopes that the pandemic will end soon and has triggered negative emotional reactions which further dragged down the Consumer Sentiment Index.

Why should we pay attention to the fall in this index?

This index is indicative of how people are viewing the future environment and, specifically their confidence. Lower consumer confidence has serious negative implication on the economy. Lower confidence could also create a negative feedback loop – businesses will look at a fall in consumer spending and delay investments. Consumers will look at delayed investments and have even more negative assessments about the economy.

Given how consumer spending is almost 70% of aggregate demand in the U.S., a fall in it will undoubtedly erase all the economic recovery gains made in the past few months (Just look at Australia as an example).

All in all, lower confidence could mean reversing back into the economic recession, which we were in the majority of last year. Except, this time, it could be much worse. Given how high inflation is currently, if the U.S. economy plunges, we could be entering an era of stagflation (high inflation, high unemployment). The 2020s could very likely be the new 1980s…

In conclusion, despite the ‘summer of joy’ we’ve enjoyed so far, this index signals a potential ‘winter of discontent’ ahead.