December is usually a quiet month in U.S. real estate, but the December 2026 data shows a market that is behaving very differently. HousingWire and Altos Research reveal that December has effectively become an early preview of the coming year.

For foreign nationals and U.S. expats looking to invest, these six charts highlight a market that is stabilising, rebalancing and offering conditions far more favourable than what we saw during the volatility of the last several years.

Here’s what the December housing trends actually reveal — and why they matter for America Mortgages clients.

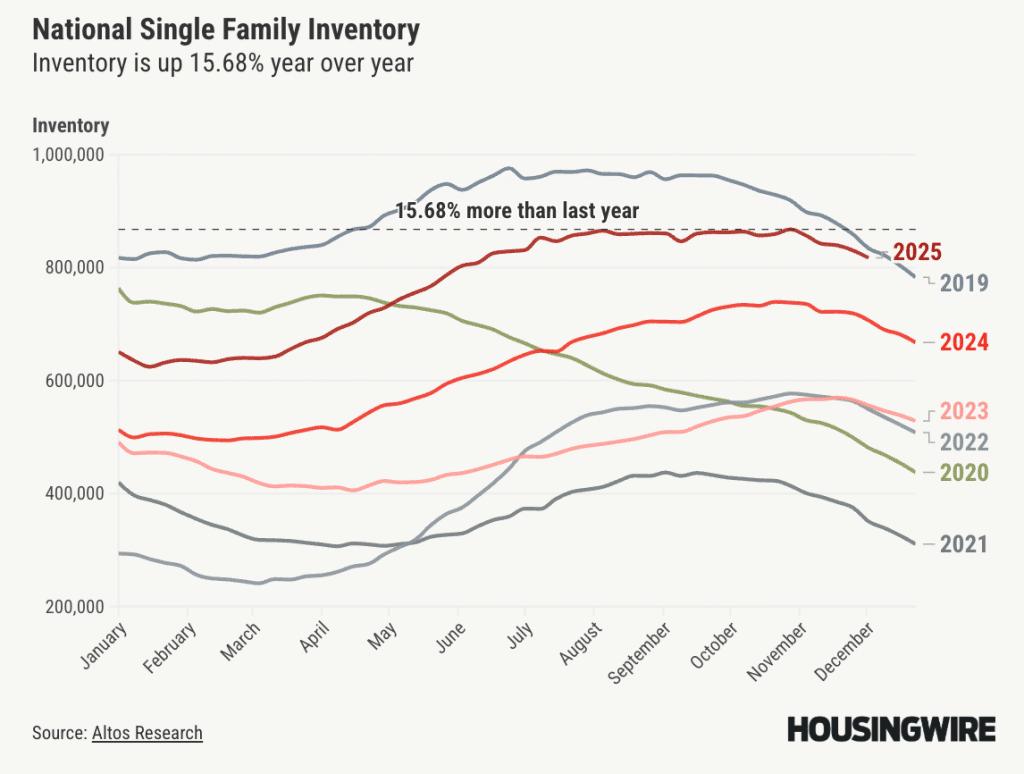

1. National Single-Family Inventory Is Recovering

This shows one of the most important improvements in today’s housing environment: inventory is up 15.68% year over year. After years of ultra-tight supply, the market is finally loosening. Higher inventory levels give international buyers considerably more choice, stronger negotiating leverage and the ability to make decisions without the pressure of immediate competition. For those purchasing from abroad, where due diligence often takes more time, this renewed breathing room is particularly valuable.

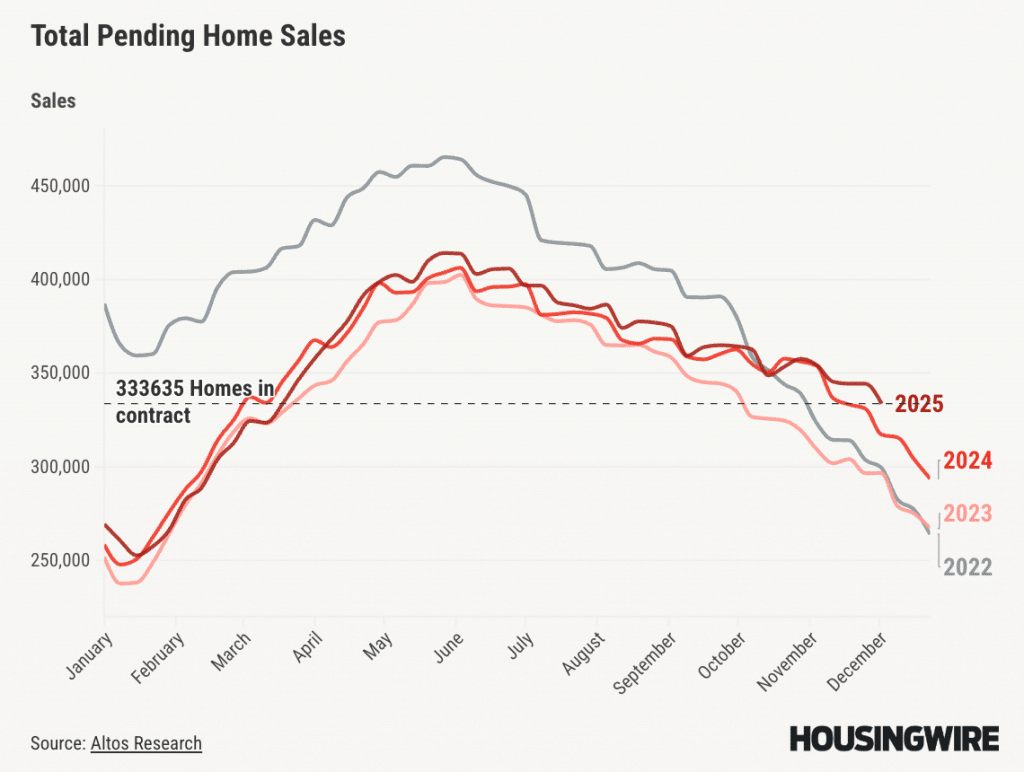

2. Pending Home Sales Show Buyers Are Returning

Pending sales reached 333,635 homes in contract, a number that exceeds activity seen in 2023 and 2022. Even with higher interest rates, buyers are stepping back into the market earlier and with more confidence. This signals that demand is building beneath the surface and is likely to accelerate as affordability improves. For real estate investors, this trend suggests that early 2026 may be the calm before a much more competitive spring.

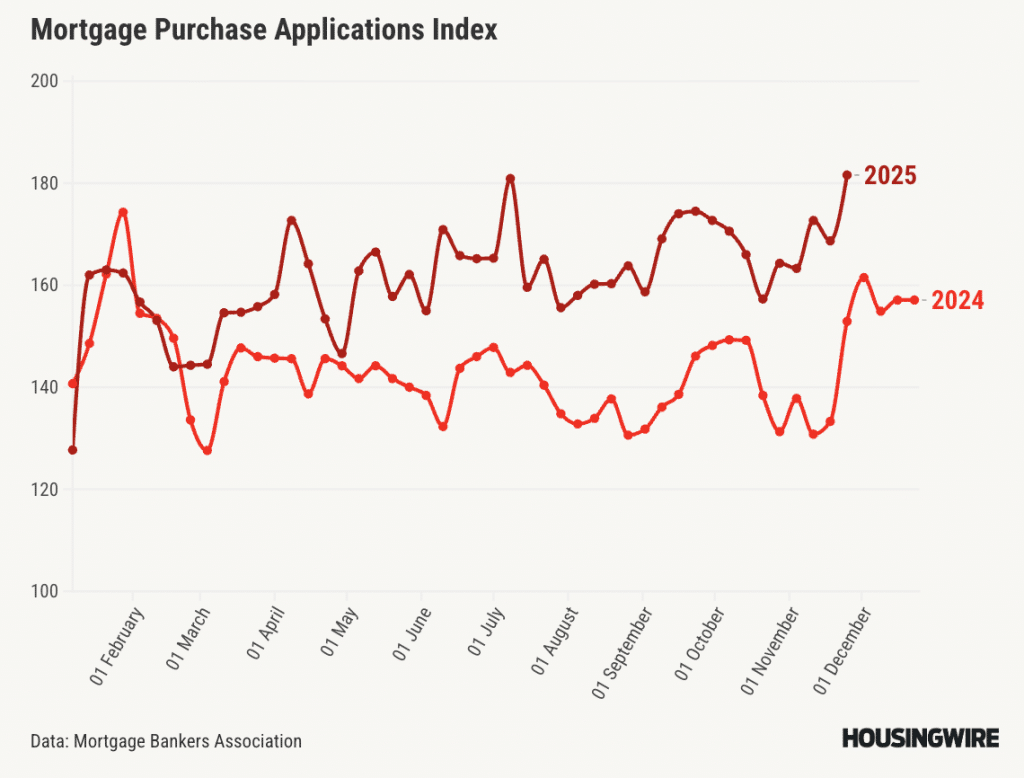

3. Purchase Applications Are Climbing Ahead of Peak Season

Mortgage Bankers Association data shows a consistent increase in purchase applications throughout 2025 compared to 2024. Applications are one of the earliest indicators of forward demand, and this rise suggests that buyers are preparing for purchases sooner than expected. For buyers, this early upswing highlights the advantage of being proactive. With America Mortgages’ expat and foreign-national loan programs — which do not require U.S. credit, W-2 income, or domestic tax returns — overseas borrowers can move just as quickly as local buyers and position themselves ahead of the competition before activity intensifies.

4. Mortgage Rates Have Finally Stabilised

One of the most encouraging shifts is in rate stability. After several years of unpredictable spikes, mortgage rates in 2024 and 2025 have moved into a stable, flatter range. This allows buyers to plan long-term financing with much greater confidence. For investors who often rely on fixed-rate products to lock in predictable monthly payments, this environment reduces uncertainty and encourages decisive action.

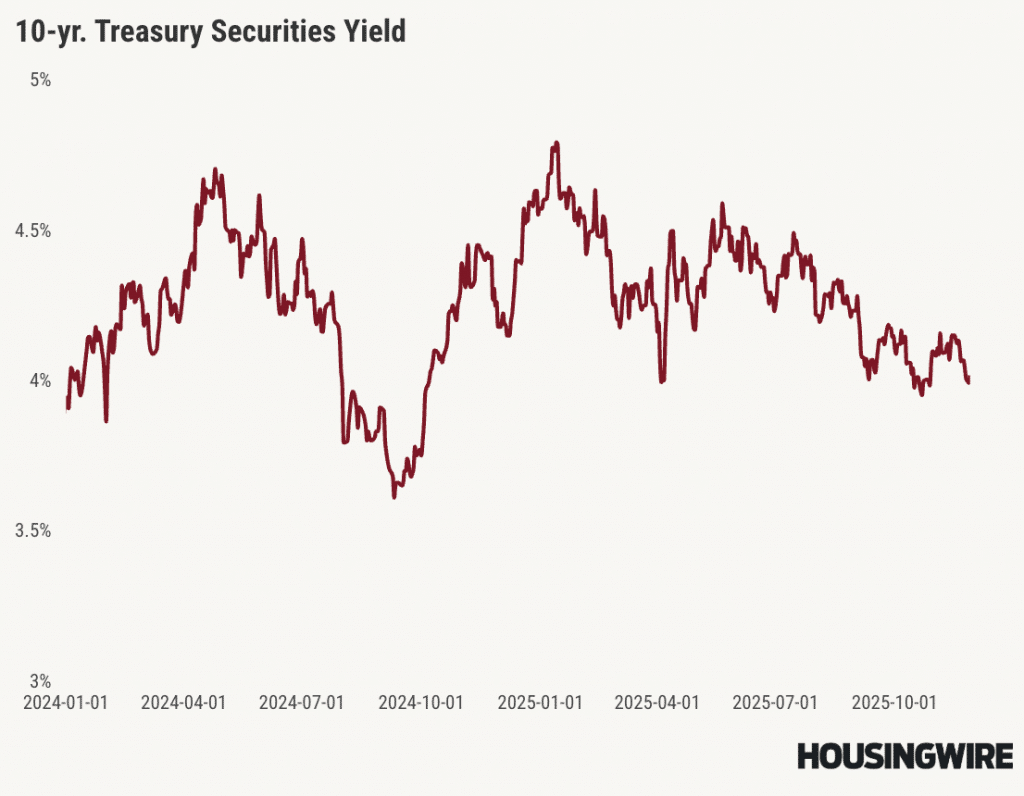

5. Treasury Yields Suggest Further Rate Relief May Be Ahead

Because mortgage rates are heavily influenced by the 10-year Treasury yield, this chart provides an important signal. The yield saw periods of volatility in early 2024 but began cooling and drifting downward in late 2025. If this pattern continues, borrowing costs may ease further in 2026. For international buyers, entering the market before any major increase in competition — and potentially refinancing later if rates drop — can be a highly favourable strategy.

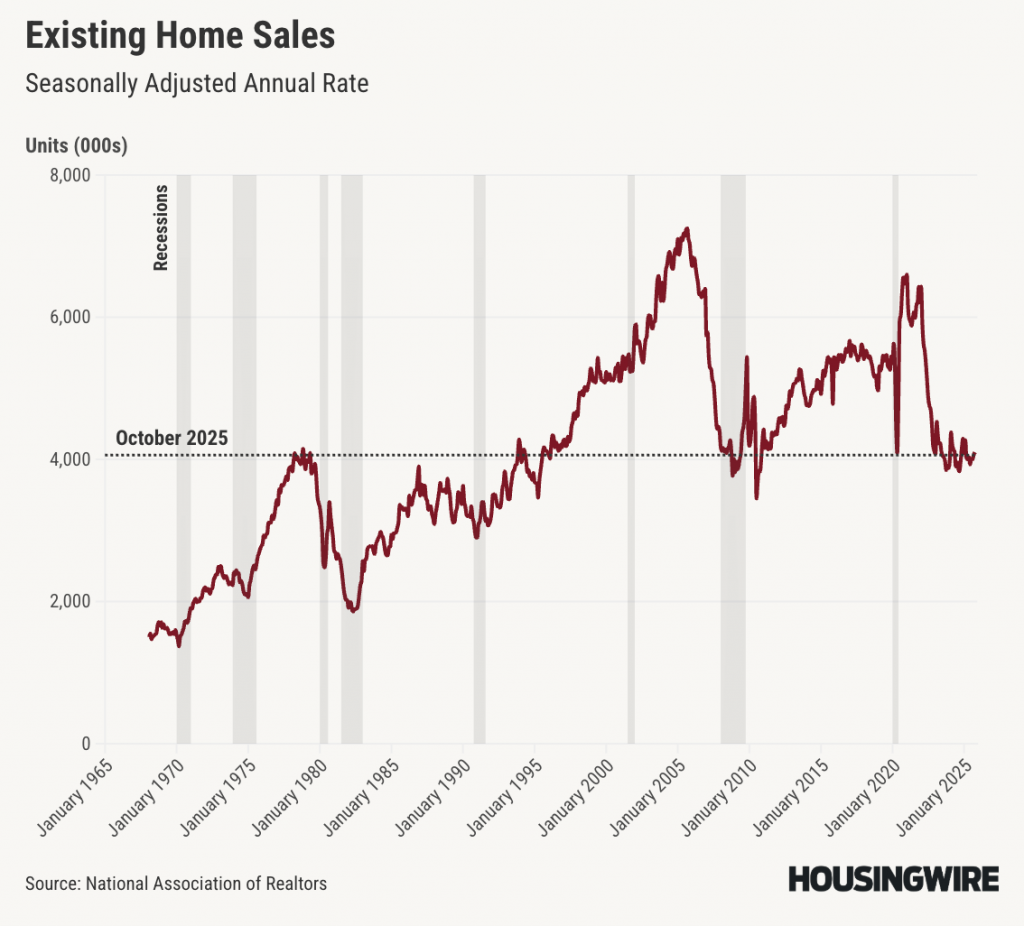

6. Long-Term Existing Home Sales Show Pent-Up Demand

The final chart offers valuable historical context. Existing home sales sit near multi-decade lows, a level typically associated with recessionary periods or moments of major affordability strain. Historically, such lows are followed by significant rebounds once conditions improve. This suggests that the market is not weak — it is paused. When affordability and supply continue improving, demand is likely to return quickly and forcefully.

What This Means for America Mortgages Clients

Taken together, these trends show a U.S. housing market in transition. Inventory is improving, demand is reawakening and rates are settling into a predictable range. For foreign nationals and U.S. expats clients of America Mortgages, this creates a rare early-cycle opportunity to buy before the spring market intensifies. Buyers who move now can secure better pricing, better positioning and better financing terms before competition builds.

How America Mortgages Helps You Act Before the Window Closes

If you’re living outside the U.S. but waiting for the right moment to buy property, the market signals suggest that time may be now. This is one of the rare times when the charts line up signaling the time to strike.

At America Mortgages, we specialise in helping foreign nationals and U.S. expats secure full-term U.S. mortgage financing without the barriers of traditional banks.

You don’t need a U.S. credit score, U.S. residency, or American tax returns.

Our underwriting is designed around your international financial profile, making U.S. homeownership accessible no matter where you live or earn.

Key Highlights

- No U.S. credit score required

- Foreign income, assets, and international documentation accepted

- Up to 80% loan-to-value depending on country and borrower profile

- Access to 150+ loan programs designed for non-U.S.-resident borrowers

- 30-year fixed rates, regardless of borrower age

- Minimum loan amounts starting from US$150,000

- DSCR investment property loans requiring no personal income to qualify

- 10-year fixed interest-only loan options for investors

- No W-2s or U.S. tax returns required for U.S. expats

- Mortgages available in all 50 U.S. states

- Remote closings supported worldwide

- Loan officers working in 12 different countries in your time zone and speaking your language

- Residential, commercial, asset backed bridge loans – all available

Whether you’re purchasing an investment property, refinancing an existing loan, or unlocking equity from your U.S. home, our global lending team ensures a fast, seamless experience built around the unique needs of international borrowers.

This is how America Mortgages empowers buyers abroad to move quickly — before competition rises and the window of opportunity narrows.

Bottom Line

The December data offers a clear signal: the U.S. housing market is stabilising, strengthening and preparing for a potential resurgence. Buyers who act early, before the first wave of spring competition, will be best positioned to take advantage of this rare opportunity of timing.

Ready to explore your options? Our team of America Mortgages specialists is here to guide you, no matter where in the world you’re based.

If a U.S. purchase is on your horizon, this is the ideal moment to start planning. We work with you from the mortgage, to the property, to the tax planning to the holding structure … all under one roof.

We’ll help you build a clear financing strategy so you’re prepared before market conditions shift.

Speak with a U.S. mortgage expert anytime, 24 hours a day, 7 days a week: +1 845-583-0830

Prefer to book online? Use our 24/7 scheduling tool to arrange a free, no-obligation consultation with a U.S. mortgage advisor at your convenience.