Many investors believe that paying cash for property is the safest route. While it’s true that owning a home outright provides strong cash flow, it actually limits your growth. The wealthiest real estate investors take a different approach. They use leverage to multiply both income and equity, turning one opportunity into many. This strategy is especially effective for foreign nationals and U.S. expats investing in American real estate, as the entry can be low and the leverage is high.

Here’s how:

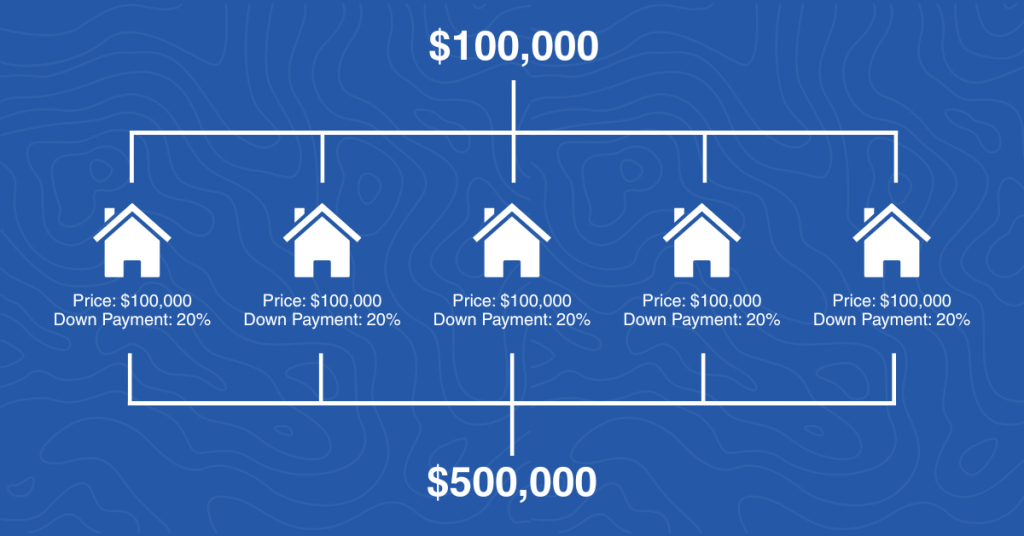

Use $100K to Buy ONE Property in Cash or FIVE with Smart Leverage?

Let’s say you have $100K to invest. You could buy one $100K property outright. Rent it for $1,500 a month. After expenses, you might walk away with $1,000 in monthly net income. That’s a 12% return, which isn’t bad… or is it?

But there’s another option.

You could split that $100K into five down payments of $20K each and finance five $100K properties. After covering mortgage payments (around $664 per property), you’d still earn roughly $350 per home in net cash flow. That’s $1,750 total, which is $750 more per month than the all-cash option.

And you now own five appreciating assets instead of just one.

Higher Cash Flow, Higher ROI

When you spread your capital across multiple properties, you increase your cash-on-cash return. Instead of earning 12% on one home, you’re potentially earning over 20% across five.

According to SparkRental’s 2025 investor survey, leveraged real estate investors consistently outperformed all-cash buyers in both income and long-term appreciation.

Equity Builds Faster When You Scale

Real estate appreciation compounds when you own more properties.

If one $100K property grows to $150K over 5 to 10 years, that’s a potential $50K or more equity gain. But if all five of your $100K properties appreciate by the same amount, you now have $250K or more in new equity, all from your original $100K investment.

This is how the wealthy multiply wealth through real estate.

Refinance, Reinvest, Repeat

Once your properties appreciate, you can do a cash-out refinance and borrow against the new value. If you maintain the same loan-to-value ratio, you can access that capital tax-free. The IRS treats it as a loan, not income.

You now have the capital to buy another property, without using another dollar.

But What About Today’s Mortgage Rates?

It’s a fair question. Mortgage rates are currently hovering around 6.8% (Freddie Mac, June 2025) with about a .50-.875% premium for foreign national investors. But that’s only one part of the picture.

Inflation has averaged 7 to 8% since 2022, according to the U.S. Bureau of Labor Statistics. That means the real cost of borrowing is actually lower. In other words, your debt is getting cheaper while your asset continues to grow.

Real Example: One Property, $77K Net Cash Flow

In 2020, one of our clients purchased a short-term rental for $430,000 using just $86,000 as a down payment. After setup and furniture costs, the property was listed on Airbnb.

By 2022, it generated $143,140 in revenue. After mortgage payments, cleaning, and operating costs, the net cash flow was $77,235.

That same year, the home was appraised for $645,000. The client did a cash-out refinance, pulled $170,000 in equity, and used it to buy another home.

They now own nine short-term rentals, generating over $2 million a year.

Why This Works for Foreign Nationals and Expats

This strategy isn’t just for U.S.-based investors. With no restrictions on the maximum LTV, America Mortgages can offer up to 80% LTV on one or a hundred homes. That’s the power of leverage and why building a U.S. real estate portfolio far surpasses any other real estate market in the world.

At America Mortgages, we’ve helped thousands of global investors finance U.S. real estate with no U.S. credit, no tax returns, and with foreign-earned income. With the right mortgage structure, you can access the same strategy to scale your portfolio, even from abroad.

Bottom Line

Cash flow is great. But equity and leverage are what build long-term wealth. The best investors know how to combine all three.

If you’re ready to grow your U.S. real estate portfolio and want guidance from a team that understands global investors, reach out to us.

Let’s make your $100K work like $500K

Frequently Asked Questions

Q1: Why shouldn’t I pay cash for U.S. property?

A: Paying cash limits growth. Using leverage allows you to buy multiple properties, increase cash flow, and build equity faster.

Q2: How does leverage increase returns?

A: By spreading your capital across several financed properties, you can earn higher monthly income and own multiple appreciating assets instead of just one.

Q3: Can foreign nationals and expats use this strategy?

A: Yes. America Mortgages offers up to 80% LTV, no U.S. credit or tax returns required, and foreign income can qualify you for financing.

Q4: What is cash-out refinancing and how does it help?

A: After properties appreciate, you can refinance to borrow against their equity tax-free. This capital can be reinvested to buy more properties and grow your portfolio.

Q5: Does this strategy work despite current mortgage rates?A: Yes. Even with rates around 6.8%, inflation and property appreciation mean the real cost of borrowing is lower, making leverage highly effective for long-term wealth.