Why U.S. Expats and Green Card Holders Can Still Buy Property Without U.S. Income or Credit

Many U.S. Expats and Green Card holders assume they cannot buy real estate in the U.S. because they no longer earn American income or maintain a domestic credit score. In reality, both groups often qualify through programs designed specifically for Americans living overseas. These programs evaluate foreign income, international assets, and global banking history, allowing borrowers to finance a second home or prepare for future relocation. For a complete breakdown of expat documentation and eligibility, see the Guide to U.S. mortgages for U.S. Expats.

Traditional banks rarely accommodate overseas borrowers because they cannot interpret foreign financial documents. America Mortgages solves this by underwriting using international verification systems and expat-specific criteria. Many programs for U.S. Expats and Green Card holders do not require a U.S. credit score or even a credit score from your home country. Instead, alternatives such as banking references or strong asset history are accepted. For a clear comparison of how Americans overseas qualify differently, see How expats easily secure a U.S. mortgage.

How Americans Overseas Qualify Using Foreign Income and 2-Month Bank Statements

Foreign income can be used to qualify for second homes, holiday homes, and personal-use properties for both U.S. Expats and Green Card holders. These loans rely on salary slips, employer letters, and two months of bank statements, not six months or year-long histories. This structure allows U.S. Expats and Green Card holders to purchase a home for personal use or long-term relocation without needing U.S. tax returns or domestic deposits.

For investment properties, the rules differ. Investment loans do not use foreign income. Instead, they rely on DSCR (Debt Service Coverage Ratio), asset-based underwriting, or rental-cash-flow evaluation. This allows U.S. Expats to purchase investment units without proving employment income at all. For expats buying their first U.S. property, support options are outlined here: Down payment help for first-time expat buyers.

Why 2025–2026 Is an Ideal Window for U.S Expats and Green Card Holders Re-Entering the Market

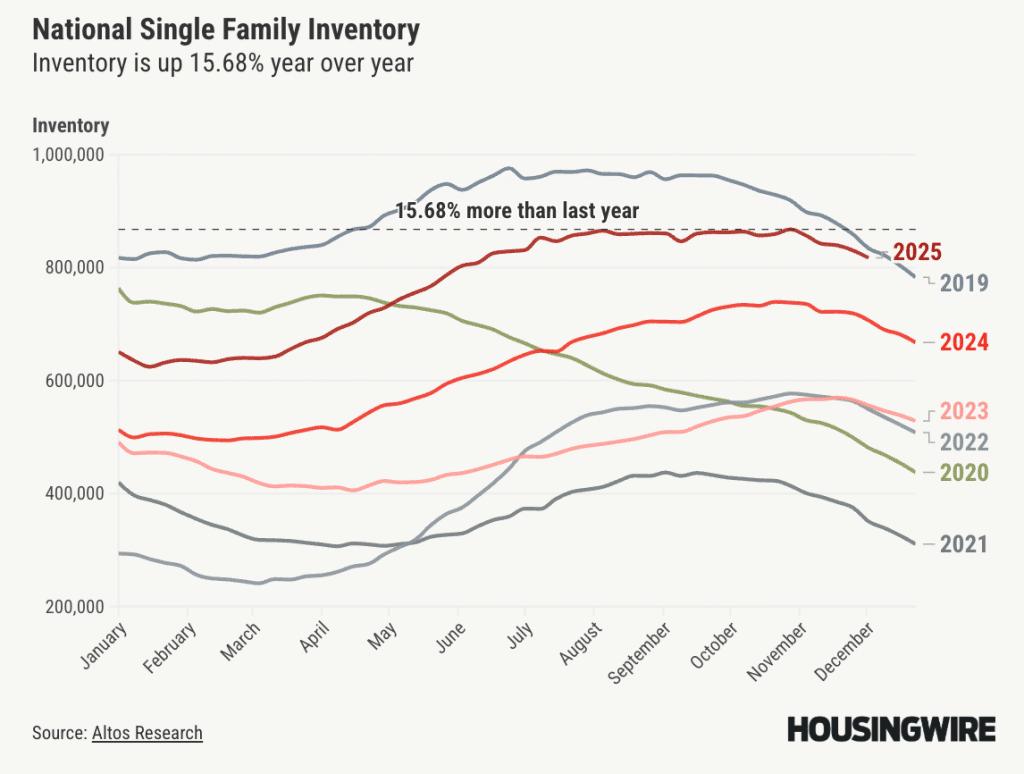

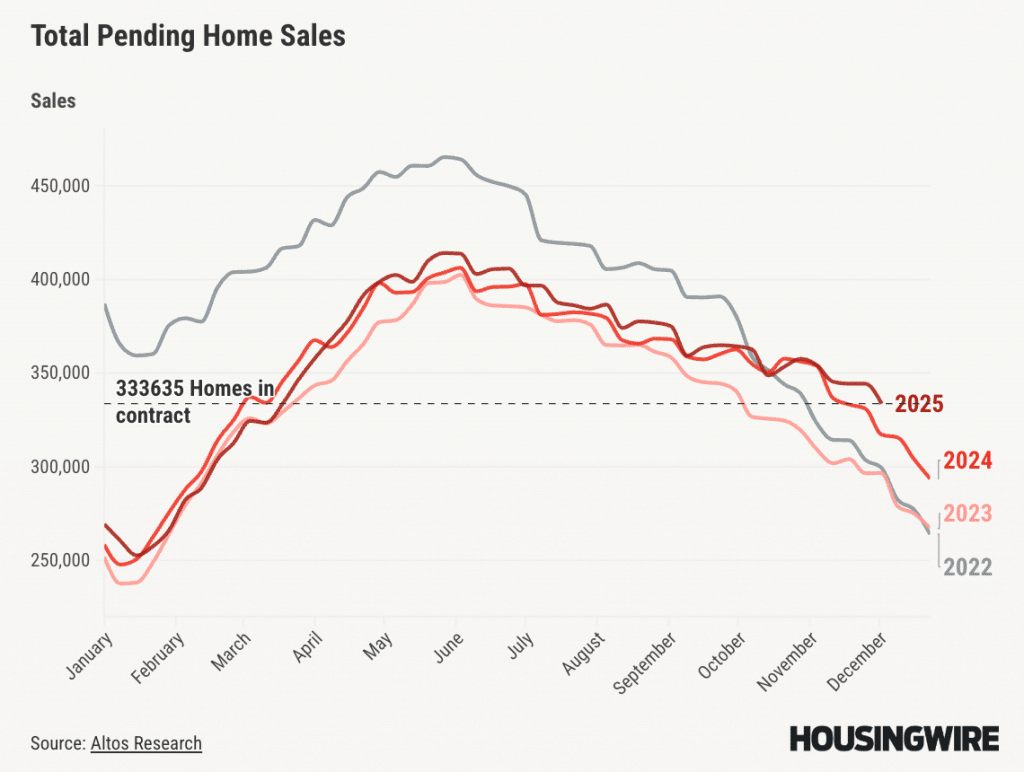

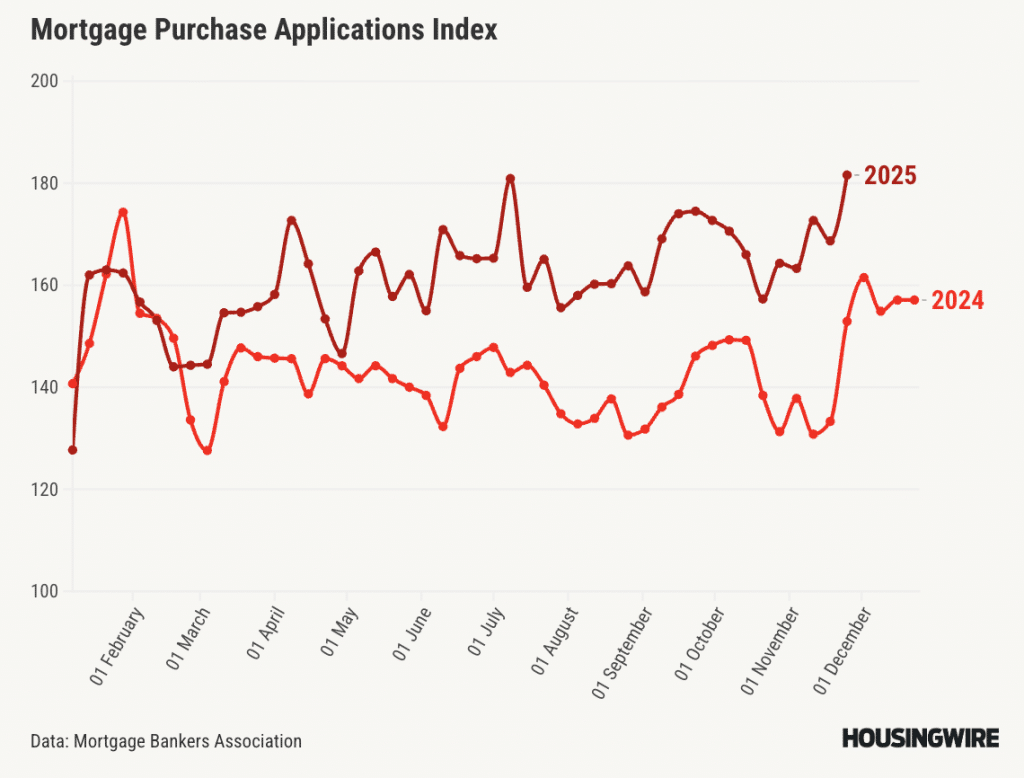

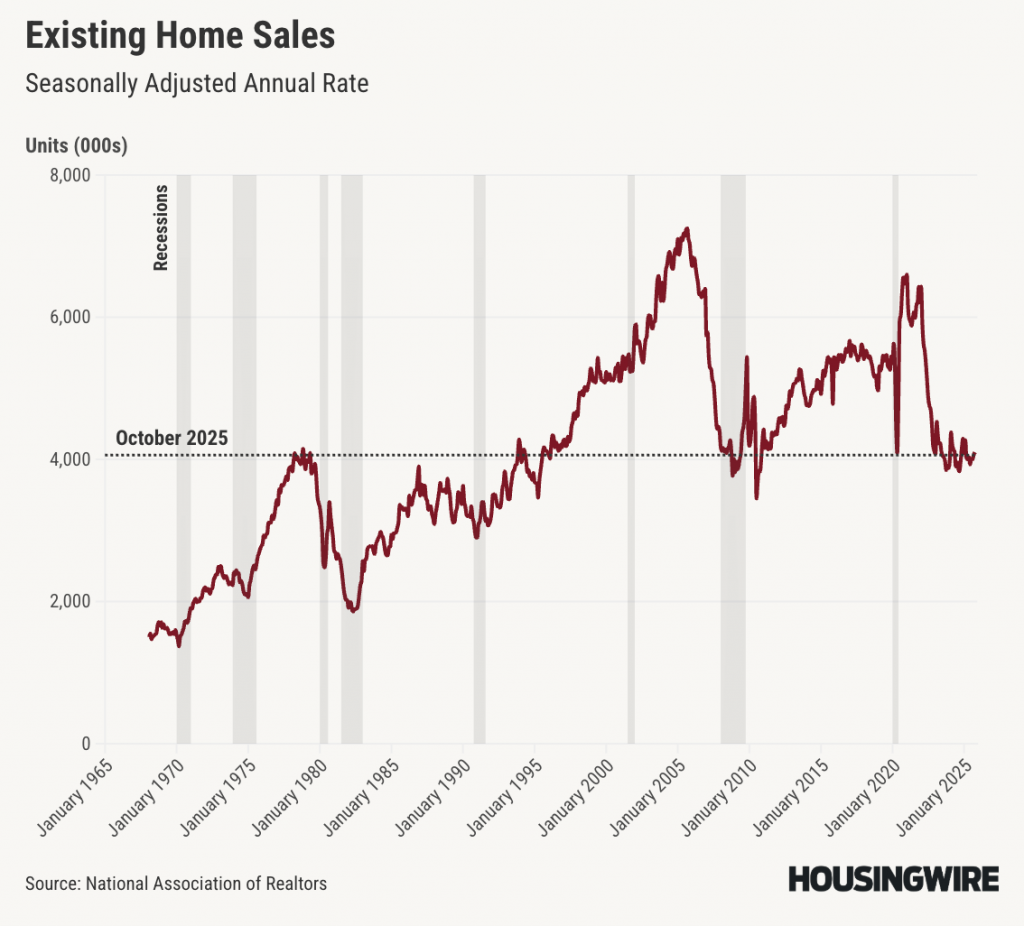

Market data shows stabilizing prices across multiple U.S. metros, creating a strategic moment for U.S. Expats and Green Card holders to re-enter the market. The U.S. Real Estate Market Outlook 2026 highlights moderating price pressure, improved supply, and buyer activity shifting after years of volatility. These trends make it easier for expats to secure property while competition is still manageable.

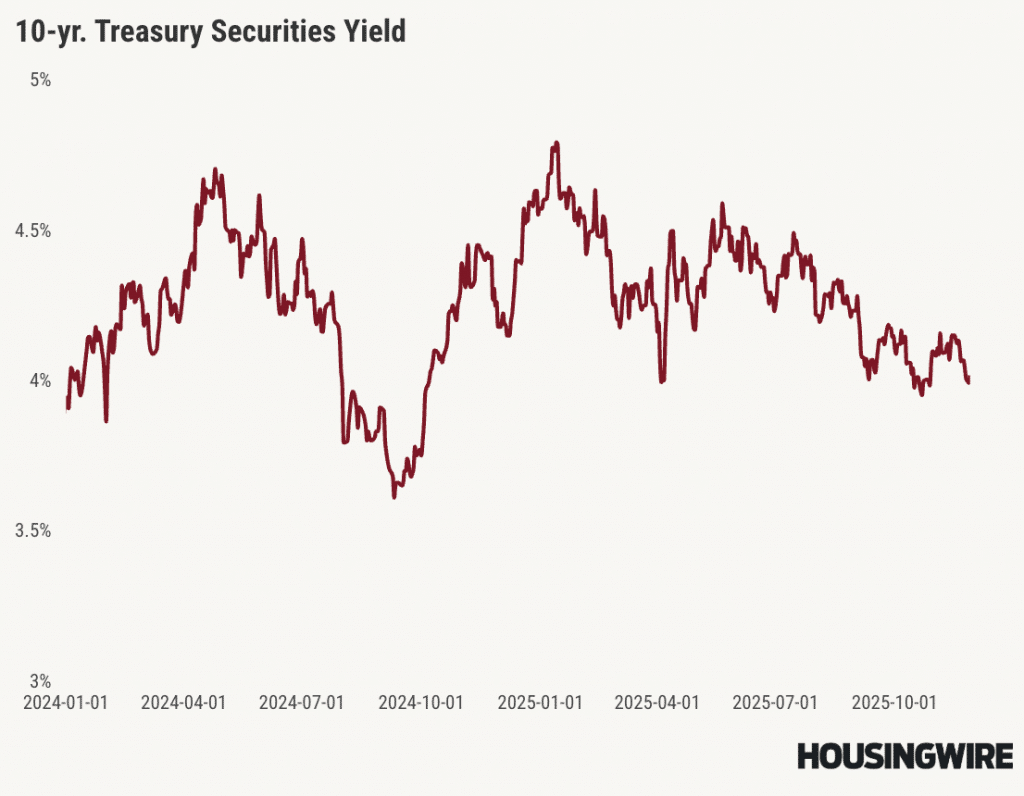

In addition, expats are monitoring potential policy shifts, including the proposed 50-year mortgage model, which could reduce payment burdens for long-term buyers. Interest rate momentum explained in Trump vs The Fed may also create a short opportunity where rates steady before new demand returns. External sources such as CNBC and Forbes Real Estate confirm rising interest from overseas buyers when rates stabilize.

Where U.S. Expats and Green Card Holders Are Buying and Why High-Demand Markets Still Perform

U.S. Expats and Green Card holders often purchase homes for future relocation, lifestyle planning, or for family members studying in the U.S. Popular second-home markets include suburban metros with strong schools, warm-weather destinations, and stable, mid-tier cities that offer long-term appreciation. For investment-minded expats, financing depends on DSCR or asset-based lending rather than income, making it accessible even for entrepreneurs or consultants abroad.

Luxury real estate remains a significant driver of expat demand due to resilient pricing, limited supply, and favorable currency moments. A stronger foreign currency versus the U.S. dollar can reduce effective purchase costs, improving long-term returns. For market behavior across luxury segments, review U.S. Luxury Property Investments.

How Americans Overseas Can Time Their Purchase Using Currency and Market Cycles

One strategic advantage U.S. Expats often overlook is currency timing. When the U.S. dollar weakens relative to your local currency, your down payment and long-term mortgage cost can effectively decrease. Some borrowers transfer funds in stages, while others align their purchase timeline with favorable exchange cycles to maximize value.

These currency movements pair closely with broader U.S. market shifts. Trends outlined in the 2026 market outlook suggest that stabilization may give expats a window to secure property before larger pools of buyers re-enter the market. This makes timing both a financial and strategic opportunity.

Second Home or Investment? Choosing the Right Mortgage Path as U.S. Expats and Green Card Holders

Choosing the right structure depends on your purpose. Second homes allow U.S. Expats and Green Card holders to qualify with foreign income, making them ideal for future relocation or family use. These properties can later become rentals, offering flexibility over time. Investment properties, by contrast, are underwritten using DSCR or asset-based formulas, making them independent of employment income.

Expats and Green Card holders planning for long-term residence may benefit from fixed-rate structures, while investors may focus on cash-flow potential and market demand. Future affordability tools, such as the proposed 50-year mortgage program, explained here: Why smart buyers are locking in early may further help expats choose options aligned with long-term goals.

Conclusion: Buying U.S. Real Estate From Overseas Is More Achievable Than Most Expect

U.S. Expats can buy second homes or investment properties without U.S. income, domestic credit, or local tax returns when using expat-focused mortgage programs. America Mortgages evaluates foreign income for second homes and uses DSCR or asset-based underwriting for investments, allowing borrowers to qualify from almost any country. With remote processing, flexible documentation, and expat-tailored mortgage solutions, financing a home in the U.S. is simpler than expected.

If you’re ready to explore options, America Mortgages can prequalify you from anywhere in the world.

Frequently Asked Questions

Q1. Can U.S. Expats qualify for a U.S. mortgage using only foreign income?

A: Yes, but only for second homes or personal-use properties. Investment properties use DSCR or asset-based qualification instead.

Q2. Do I need a U.S. credit score or home-country credit report?

A: No. Many America Mortgages programs do not require credit from the U.S. or your home country. Banking references or asset history are often accepted.

Q3. How many months of bank statements are required?

A: America Mortgages typically requires two months of bank statements for qualifying U.S. Expats, not six months.